See why 4thWay now accepts ethical ads.

Wellesley & Co. Lenders Now Diversify Across 100 Loans

All individual lenders on Wellesley & Co. are now spreading their risks across 100 different loans. The number will likely rise as Wellesley continues to grow.

Wellesley has just reached 100 outstanding loans. The property P2P lending company automatically splits all lenders' money across all loans. It readjusts the split every Friday as loans are paid off and new ones begin.

At Wellesley's rapid pace of growth, we can expect lenders' money to be spread across far more loans by the end of 2015. Wellesley has already approved £34 million of loans to start in the next 30 days, even though it estimates that it only accepts about 10% of loan applications.

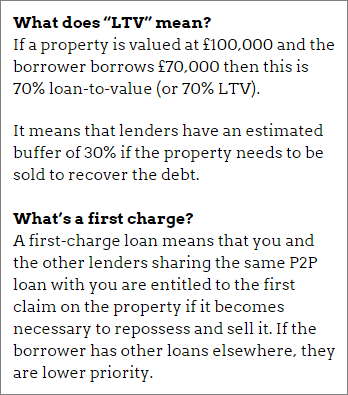

Loans on Wellesley are typically very large,  averaging more than £1 million each. Each loan takes a first charge and it generally has a low LTV, with the average LTV being 64% according to the last figures available. (See sidebox for explanation of LTV and first charge.)

averaging more than £1 million each. Each loan takes a first charge and it generally has a low LTV, with the average LTV being 64% according to the last figures available. (See sidebox for explanation of LTV and first charge.)

What this means for lenders like you and us

If you put all your money into just one loan – with any P2P lending company – the risks to you are greater if something goes wrong.

Wellesley has one of the lowest (best) 4thWay® Risk Ratings, so we think the risk of losing money is low, but having your money spread across lots of loans reduces the chances of facing a serious misfortune.

If one loan goes bad, or even several, it will probably have a minimal impact on you. Indeed, our stress test of Wellesley showed you would avoid all losses even if 10% of borrowers were unable to pay a penny during a terrible UK economy. Read Why Wellesley & Co. is Safe Even During a Crash.

Greater diversification across 100 loans adds an extra layer of protection.

The 4thWay® Risk Ratings were devised by experienced investors and a debt specialist from one of the major accountancy firms. The score is calculated using objective criteria that can be measured and improved over time, although no risk-scoring system is perfect. Read more about the 4thWay® Risk Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Wellesley & Co., and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.