See why 4thWay now accepts ethical ads.

Why Wellesley & Co. is Safe Even During a Crash

I wanted to know just what kind of disaster lenders like you and me could survive when we lend our money through property peer-to-peer lending company Wellesley & Co.* so I put it to a severe test with big property price falls and lots of borrowers failing to repay.

Wellesley's record so far

But, first, a re-cap on Wellesley's record in normal times.

Wellesley & Co. is a P2P lending company that specialises in short-term property loans, such as developer and bridging loans.

Bridging loans providers can easily go out of business if they get over-confident and don't keep their discipline when selecting borrowers to lend to.

Wellesley, however, has built up a very credible record. It has matched individual lenders' money in 133 loans and none of the loans so far have resulted in bad debts. Plus, there are also no loans that are being paid late.

So we lenders have not had to take advantage of Wellesley's bad-debt provision fund, which is set aside to cover losses that aren't recovered when Wellesley is forced to sell the properties it has taken from the borrowers in security.

The big question is: can this P2P lending company still keep you safe if property prices fall and many property developers go under? Is Wellesley being that disciplined? Or will its bad-debt provision fund be easily overwhelmed?

I put this to a simple, but severe test.

Here's the severe crash scenario

Let's say property prices start collapsing and a bad economy means lots of borrowers become unable to repay.

Here's what I tested:

- 10% of Wellesley's outstanding loans go bad. Remember, this is a big jump from the record of zero bad debts in 133 loans that Wellesley has accumulated so far.

- None of the borrowers are able to recover or repay anything at all, so that Wellesley has to repossess and sell all the properties.

- Prices fall 20% before the properties are sold.

- Wellesley is unable to sell immediately, so there is an average delay of six months in getting your money back. During this time you earn no interest on the loans that have gone bad.

- Because these are particularly distressed sales, Wellesley can't get the market value; it has to accept another 10% less.

- The cost of chasing the bad debts, taking possession of the properties and selling them come to a shocking 10%.

- To cap it off, Wellesley over-valued many properties, so on average the original property valuations were 5% too high.

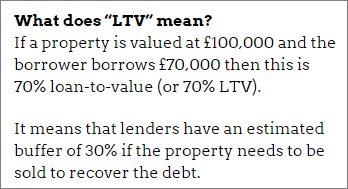

The average original LTV (see explanatory box, right) was 64%, which is Wellesley's average LTV. Half the loans that went bad were over 64% and half under.

The average original LTV (see explanatory box, right) was 64%, which is Wellesley's average LTV. Half the loans that went bad were over 64% and half under.

When you put all that together, property sales will only recover 55% of their original value, but we lenders lent 64%, so the property sales do not recover all the money we're owed.

Individual lenders survive the disaster

The astounding news is that, in this situation, we individual lenders still don't lose any money.

Wellesley & Co. does. Banks and some other companies that lend through Wellesley do, too. But individual lenders like you and me lose nothing.

In my stress test scenario, when Wellesley sells the properties it has repossessed for us, it is still close to £2 million short.

But only around £700,000 of that belongs to us individual lenders (the rest belongs to banks and Wellesley, which also lends through Wellesley alongside us).

We individual lenders are covered by Wellesley & Co's bad-debt provision fund, which has over £900,000 in it, so we easily get our money back.

If that wasn't enough, Wellesley lends 5% of its own money in every loan and it has stated that it will take the first loss before it even calls on the bad-debt provision fund. This means hundreds of thousands of pounds would come out of Wellesley's pocket before the provision fund is needed.

So even during the extreme scenario I have tested, we individual lenders would be just fine!

It's important to realise that, although I tested a very dire situation, we don't know just how severe a crisis might get. Could the costs of recovery rise even more? Or property prices fall even further? It's certainly possible. But you still have another buffer to burn through before you lose your initial loan: the interest you earn.

Some potential negative effects

- We might have to wait a while for our money back.

- If we want to exit early at this time, we probably won't be able to leave the bad loans.

- If lots of people are frightened and want to exit even the good loans then it will be impossible for everyone to get out at the same time; you need lots other lenders who want to take over your loans.

- If you're coming towards the end of your fixed period that you wanted to lend in, you might not be able to get all your money back as soon as you expected.

- And we could potentially not receive all the interest we expected on the loans that went bad; it would be up to Wellesley to decide whether to pay that to us through the bad-debt provision fund. Even so, in my example above, this would likely only shave a few fractions of a percentage point off the interest we earn.

The bad-debt provision fund is “discretionary”

Wellesley's bad-debt provision fund is a slightly weaker guarantee than some other reserve funds, because it is at Wellesley's discretion, which means it decides whether to pay out and how much is in it.

However, I've seen no reason to be concerned at this stage. Wellesley & Co.* keeps affirming its strong intention to see to it that our money is protected.

In addition, I think that the company could expect to be in serious trouble with the regulator if it used its “discretion” not to pay out. It's business would be over. No one would trust it again. Assuming it cares about having an ongoing P2P concern, that will have an impact on its decision.

Wellesley's bonds are another story

Note that the risks for Wellesley's bonds could be higher, since you're not lending directly to many other borrowers, but to Wellesley alone. We wrote about that in Wellesley P2P ISA Bond is Not P2P Lending.

Read about some stress tests at other P2P lending companies

How Funding Circle Lenders Will Survive a Terrible Economy.

Landbay Survives Severe Property Price Crash Test.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Wellesley & Co., and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.