See why 4thWay now accepts ethical ads.

Zopa Review – An Analyst’s Review Of Zopa For Investors

This is an analytical Zopa review for lenders (otherwise known as investors). You can also visit our peer-to-peer lending comparison tables or IFISA tables to see how Zopa compares.

4thWay's Zopa Review

4thWay's Zopa Review

Zopa has closed its P2P lending operation to focus on its bank

Zopa has closed its P2P lending operation to focus on its bank. The reasons it gives are a great excuse not to upset existing lenders, but they're not the real reasons. Read The Real Reason Zopa Is Closing Its P2P Arm.

4thWay's specialists don't anticipate any problems for existing lenders. Loans will wind down smoothly until they are fully repaid.

Still want to read the Zopa Review?

We're keeping the last version of the Zopa Review alive below for a while, in case you're still interested in reading it. Although its relevance is obviously now very limited!

The oldest peer-to-peer lending website shows its maturity in its results.

What Zopa does

Zopa does UK personal loans to creditworthy individuals, repaid within five years. It targets returns for lenders of 3.2% to 3.7%, after bad debts.

When did Zopa start?

It started in 2005, making it the oldest peer-to-peer lending website in the world. Zopa total loans has reached £5 billion by the beginning of 2021.

What interesting or unique points does Zopa have?

Zopa has the longest and deepest set of loans in peer-to-peer lending in the UK. This is extremely useful. For the specific types of loans that Zopa does, it makes it much easier for the peer-to-peer lending platform to approve new loans and set interest rates when it can look at how similar borrowers have done in the past.

While the stock market has seen five down years since this peer-to-peer lending platform started (and this year, 2021, not necessarily going to be any better), Zopa has had an excellent record of positive returns every single year for its lenders – through the Great Recession right up to the present. It remains a reasonable choice for any peer-to-peer lending portfolio.

Zopa review: how does Zopa work?

Pictures speak louder than words:

4thWay's Zopa review infographic: click to expand to see How does Zopa work?

Zopa during COVID-19

It's now around a year since the pandemic started, but, Zopa has not provided a new, detailed break down of all its loans throughout the entire period, making it impossible for 4thWay to independently assess its recent performance. Zopa also hasn't provided substantive commentary on its results during the pandemic. We currently have nothing new to go on.

Past results aside, we know Zopa's taken very strong steps to reduce the risks on new loans during this time. Both its lending accounts have tightened lending criteria to ensure the borrowers are lower rate, lower risk. This will impact lending rates, but not as much as higher bad debts would.

Zopa review: how good are its loans?

In normal times, Zopa accepts a wide range of borrowers, from super prime down to borrowers that have a much more mediocre financial position – but all borrowers need to show a good track record of repaying their debts. The latest information we had is that it accepts around 20% of applications, at least during normal times, which is in line with the major banks.

Its lending standards are sensible: borrowers have to have a good credit history, a record of repaying debt and the ability to afford the loan.

Its acceptance rate will be lower at present, and the borrowers skewing even more to the prime end, while the risks are higher due to the economic fallout of lockdowns.

Zopa will have learned a lot in pricing the rate of loans appropriately and data provided to us shows that it does an excellent job. Bad debts rise with the interest rates in a smooth fashion. That's one of many signs garnered from the detailed data provided to 4thWay that show Zopa* has developed a very good understanding of its borrowers.

Recovery of bad debt is never a big feature in personal loans like these. Yet it's reassuring that the bad debt outstanding has been sharply in line with 4thWay's models, which are based on results from similar banks.

How much experience do Zopa's key people have?

In 2021, Zopa has one of the largest and most widely-skilled teams in the peer-to-peer lending industry, including former bankers, underwriters, credit-risk experts and data analysts. I can find no weak spots.

Zopa review: lending processes

Zopa has demonstrated that it has highly satisfactory and thorough processes in analysing and approving loans, as you would expect from this team.

How good are Zopa's interest rates, bad debts and margin of safety?

Zopa usually pays between 2% and 19% to lenders on each individual loan in its Zopa Core lending account. Due to minor data omissions from Zopa, it's possible only to closely estimate the average lending rate before bad debt, which has been approximately 8.63% in Zopa Core loans.

During Zopa's pandemic measures, the highest lending rates in Zopa Core, as well as the average lending rate before bad debt, will be lower, but we have no data from Zopa. We know that the target return after bad debts is currently 3.2% in Zopa Core.

Zopa usually pays lenders up to 34% on some loans in its Zopa Plus account, with the average rate up until the pandemic being around11.73%.

The target Zopa Plus return after bad debt is currently 3.7%.

While in 2021 Zopa is no longer exciting or among the most generous when it comes to the interest you expect to earn, the latest information we had is that both the Zopa Core and Zopa Plus target interest rates remain absolutely reasonable. The vast majority of lenders could expect to have positive returns in the future, as they have in the past. However, the proviso is that Zopa's performance has not deteriorated since the start of the pandemic, when we last had data.

Using 4thWay's strict version of the international standard banking Basel stress tests, it seems likely that most lenders will continue to make money even through a severe downturn similar to 2008-2009.

Has Zopa provided enough information to assess the risks?

Although we're overdue fresh interviews with Zopa, it has previously allowed direct access to some of its team.

It has provided a great deal of information to us, but no longer submits complete historical data on a regular basis to show the performance of every single loan.

4thWay receives enough information to assess enough of the risks – but quite sporadically, making it harder to assess the past performance, conservatively forecast future risks in recessions, and also see the spread of results that lenders might expect.

Is Zopa profitable?

Zopa's peer-to-peer lending operation was profitable in 2017. It was again loss-making from 2018, when you discount the impact of one-off events. Its wider group continued to lose money to the end of 2020, and 2021 is the same – especially as it invests in building a brand new bank to compete with the high street.

However, the Zopa Group successfully raised another £140 million from investors last year and the group has minimal debts. Its future looks highly resilient, as smaller and newer P2P lending sites now face greater barriers to entry.

Is Zopa a good investment?

Overall, there are no major weak points.

At present, two things give me pause: a lack of data and information during the pandemic is the first. The second is whether it's clear to lenders that the target returns Zopa advertises, and the average returns achieved by lenders, are not the results that everyone can expect.

Your results depend on the batch of loans that Zopa assigns to you, and a small proportion of lenders are likely to lose money even in non-pandemic years. You need to be willing to lend for years to ensure positive returns in the end.

What is Zopa's minimum lending amount and how many loans can I lend in?

The Zopa* minimum investment is £1,000 and your money will be spread across at least 100 borrowers. Based on the risk of bad luck occurring within an individual's Zopa portfolio of loans, this is a little less diversification than I would like to see for these kinds of loans to contain the risks.

Lenders can diversify more by lending more, staggering lending over several months, by re-lending the repayments, or by lending new money every month. The more of those you do, the better.

Does Zopa have an IFISA?

Zopa's lending accounts are available as IFISAs.

What more do I need to know?

In case you've not read one of our Zopa reviews for a long time, you might have missed that Zopa no longer has a reserve fund to cover expected bad debts.

Lenders rely exclusively on spreading their money widely across lots of loans – which is always the main defence when lending in personal loans, whether or not there's a reserve fund.

You can lower the risks even further if you commit to lend for at least three years. You need to earn enough interest to offset some losses that might occur early on.

Lenders have usually got their money back within days when they sold their loans early. But it should be clear to you that you'll only be able to quickly get your money back by selling your loans before the borrower has repaid them if there are lenders who want to buy loans. More than that, you should even expect that sometimes you will not be able to sell quickly.

It's best to accept in advance that the natural horizon for these investments is to keep them until the borrowers have repaid.

Zopa Review: their best-rated product

Towards the end of last year, we took the unfortunately necessary step of stopping ratings for Zopa, so it has now 4thWay PLUS-rated lending accounts.

Zopa is too sporadic in providing a full picture showing the record of every loan its approved. We're unable to conduct all the research and checks on data voracity that we do today.

If we consistently receive data, we have more opportunity to spot errors, inconsistencies or data manipulation, and we can do better models of the loans. Regular data submissions are therefore a basic requirement that all P2P lending companies must comply with in order to maintain a 4thWay PLUS Rating.

Read about the 4thWay PLUS Ratings.

Full Zopa review: starting with Zopa news

Turning to what's new in 2021 since our previous Zopa review:

Rates have continued to fall

Lending with Zopa many years ago, you would have received more money and sometimes you would have done so with protection from a reserve fund.

Anyone who was lending through Zopa many years ago might now be disappointed to be earning less interest than they did in the old days, as rates have gradually, steadily, come down for many years.

However, it's natural for interest rates to start off too generous for lenders, because lenders demand a greater return for taking a chance on the unknown. As a peer-to-peer lending website grows, the spread between risk and reward narrows to a more sustainable, and more natural level. Zopa's have now done so and remain satisfactory for the risks involved, albeit no longer very exciting.

Target lending rates have also continued to fall during the pandemic, which is to be expected.

Zopa bank and its existing peer-to-peer lending operation

Zopa launched a new bank in summer: Zopa Bank. I currently have no reason to believe that this will impact the quality of the loans in its peer-to-peer lending business, unless in a positive way. I see this as a neutral development in terms of the risk-reward balance.

Why use Zopa?

Investors who lend through peer-to-peer lending websites should consider Zopa as one of the strong contenders. And it's one of the only viable options if you want to include some personal loans lending in your mix of investments.

Straightforward loans to creditworthy borrowers are very different to other types of lending – and other types of investments. A wide spread of different investments protects you from taking too big a hit if one part of the economy suffers a shock, so this is an easy way to add more variety to your savings and investments.

Zopa* would fit in a balanced or low-risk portfolio of P2P lending investments.

How long should I lend for at Zopa?

For reasons that will become clear by the end of my Zopa review, at least three years. It's especially good to re-lend your money during the period. Lending through a downturn rather than selling in a panic during it is also likely to lead to better results.

Zopa's 4thWay PLUS Ratings and 4thWay Risk Scores

As noted above, Zopa's lending accounts no longer receive ratings, because we don't receive detailed data regularly enough.

However, if it did, it's still likely that both Zopa Core and Zopa Plus would get the top 3/3 4thWay PLUS Rating. That includes the IFISA versions of Zopa's accounts. This means that, according to the international-standard bank tests we do on the performance of all Zopa's historical loans, 4thWay expects the average lender to be profitable if you lend and diversify for years, even through a severe recession similar to 2008.

Zopa's 4thWay Risk Score would probably be 5/10 for Zopa Core and 6/10 for Zopa Plus. The lower, the better.

5/10 means that we conservatively forecast average lender losses before interest earned of 5%-10% over the full life of a batch of loans, if you start lending in them at the start of a severe recession similar to 2008. Interest earned every year will offset those losses.

6/10 means that we forecast 10% to 15% losses before interest through a severe recession over all the years that the loans are repaid.

Bear in mind those are not annual losses, but the total losses over many years. On the flip side, interest you earn before, during and after the recession is earned monthly, and the rates are annual.

How much should I lend at Zopa?

The more you lend, the more loans you can expect to be spread across, further reducing your risk of losses through bad luck. Yet you still need to limit the amount of money you put in any investment, so how much makes sense at Zopa?

The risk of losses is well below the risk of losing money on the stock market over a similar period of time. Indeed, a drop of 15-25% in the space of just one year is not especially surprising when investing in shares.

But other peer-to-peer lending websites and IFISA providers have lower risks. For Zopa*, I therefore think a sensible amount to lend would be 10%-15% of your total investing pot. This is unchanged since my last Zopa review.

If you haven't done peer-to-peer lending before, you're restricted to just 10% of your spare funds in your first year, so that you can better learn how it works.

What returns have lenders had in the past?

Zopa lenders have been given the bulk of the profits, when you deduct all the costs Zopa has in finding borrowers and running their operations on your behalf, as well as deducting the bad debts.

Lenders' returns after bad debts from all Zopa's accounts have averaged between 4% and 7% every year since Zopa began in 2005. This is steadier even than the high-street banks, which have fine-tuned their personal loans lending over many decades. According to Liberum, the banks made less than 4% on six occasions between 2005 and 2015.

This is likely to change in 2021, due to the pandemic, where average returns will drop below 4%.

Zopa review 2021: how variable are lenders' results?

Zopa's advice to lend and re-lend your money for three years or more is smart, as it lowers your risks.

That said, historically your chances of having positive results have been extremely good, even if you just lend money once and then let borrowers gradually repay it to you over time.

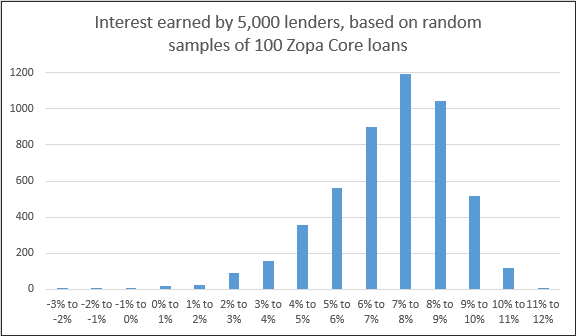

The following graph shows the actual spread of results based on 5,000 random samples of 100 Zopa Core loans. Note this is all the interest earned over the life of the loans, not the annual interest rate (which will be lower):

4thWay Zopa Review graph: showing vast majority of Zopa Core lenders have earned positive returns. Source: 4thWay

Interest shown is the interest rate earned over the life of the loan (average 28 months) against the starting loan amount. It assumes that lenders lend until the loans are fully repaid by the borrowers or written off. Lenders who sell earlier might suffer worse results.

You can see from this graph that, even here, when lenders ignore Zopa's advice to re-lend, hardly anyone has lost money. Zopa recently reported that less than 1% have lost money over all. Most of this small minority could easily recover with a little more patience and time.

Expected lending rates after bad debts have been coming down over the past year or two, especially with the pandemic, so expect this graph to shift a little bit more to the left.

Zopa itself suggests that 95% of its lenders will get within about 1.5 percentage points of the target rate.

Zopa review: a look at its more recent results

The results shown in the above graph are from seasoned loans, meaning loans that have either been repaid or that were taken out years ago. It therefore shows how Zopa* has previously performed when lenders give it enough time to pay out interest and chase bad debts.

The economy slightly worsened in 2019 and got a lot worse in 2020. Since 2021 has just started and Zopa not providing up-to-date data on last year, we can look at 2018 and 2019 as the most recent years.

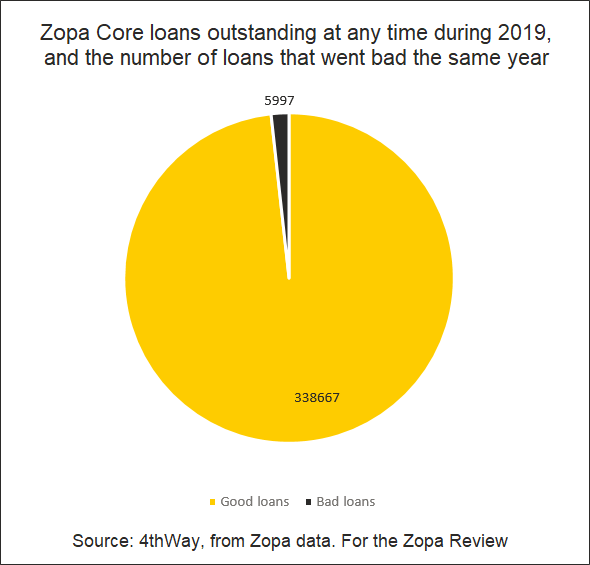

Using a calculation used by many banks in what's called their “pillar 3 disclosures” we look at how many loans turn bad in a year compared to how many loans were outstanding at any point during that same year.

In this regard, Zopa Core is performing highly satisfactorily. Just 17 out of every 1,000 loans turned bad in 2019. This is better than our benchmark high-street banks. 2020 and 2021 will surely be worse for Zopa lenders, due to the pandemic. As it will be for the banks, too. Bear in mind that this is already taken into account in Zopa's target lending rates.

4thWay's Zopa Review pie chart: showing Zopa Core bad debts. Source: 4thWay.

Before Zopa launched Zopa Core, it was preceded by Zopa Classic and other accounts. If we take all the loans in Zopa's history that would ever have qualified for Zopa Core, the worst year was 2018, which was only a little worse than 2019.

The majority of the increase over the years is related to Zopa maturing as a business. While a peer-to-peer lending platform is small, agile and growing fast, it's easier to charge higher rates to quality borrowers, because you can still be extra choosy of your borrowers.

On top of that, the figures are flattered by a rapid growth in the number of loans, many of which will not have had enough time to turn bad by the end of the year.

Zopa is now nearing full maturity in this sense. So it's good to see the bad-debt numbers are in line with the best of the banking world.

What results can Zopa lenders expect in future?

For the first time, Zopa is now forecasting that the average lender will receive less than 4% in both its Zopa Core and Zopa Plus accounts. Indeed, for Zopa Core, its projecting 3.2%.

Zopa's most recent forecast of annualised bad debts of 2% for Zopa Core, which fits neatly with its recent performance and seems realistic. However, this is a pre-pandemic forecast. The next year or two will certainly see higher annualised bad debt.

Zopa* had also been forecasting annualised bad debts of 3.4% for Zopa Plus, or 1.4 percentage points more than Zopa Core. Zopa Plus, with its helping of higher-rate, higher-risk loans, was paying around three percentage points more interest before losses only a short time ago. Now it's expecting results to be much closer to Zopa Core, as more of its lower credit-rating borrowers suffer in these difficult times. The typical expected rate for a “middle” lender is now 3.7%.

Zopa review: how easy is it to lend?

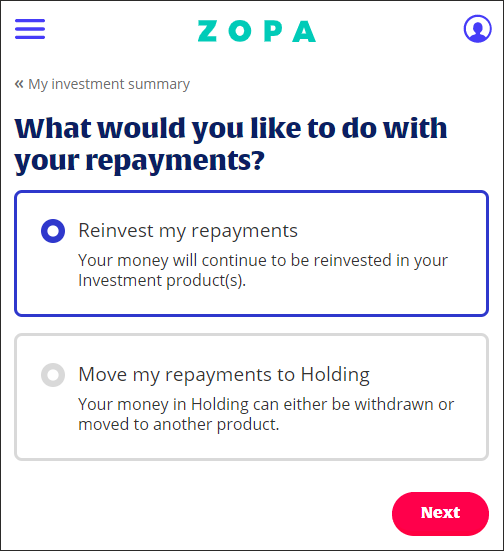

Zopa keeps it very simple. You select an account to lend through, and pay money in. You can then decide whether to re-lend all the repayments and interest received from the borrower, if you want, at the click of a button:

Image shows how simple it is to use the Zopa website. When deciding whether to re-lend money received from your borrowers automatically, you need just click a button.

In one section of the previous version of this Zopa review, it indicated that you could choose to re-lend just the loan repayments, while taking the interest as cash for yourself. This was incorrect. You either receive both repayments and interest paid to your Zopa account as cash, or you re-lend both.

Is Zopa good compared to savings accounts and cash ISAs?

| Comparison | Top account | Zopa Core | Zopa Plus |

| Savings | 5.00%

(Post Office) |

3.2%

(+-4.55%) |

3.7%

(+-4.55%) |

| Cash ISAs | 4.60%

(Castle Trust Bank) |

3.2%

(+-4.25%) |

3.7%

(+-4.25%) |

Zopa's target rate on its Zopa Core account beats savings accounts by +-4.55% and cash ISAs by +-4.25%. The difference is greater if you would only be interested in savings accounts or cash ISAs from big brands.

Zopa Plus is paying +-4.55% and +-4.25% above the top savings account and cash ISA respectively. Again, the spread is greater with the biggest brands.

For comparison, I looked at the three-year savings accounts and cash ISAs, which I think is the most suitable equivalent.

To find the best savings accounts I looked to the Moneysavingexpert's Top Savings Accounts page.

For cash ISAs, I found the best account on the Top Cash ISAs page.

Is Zopa good compared to the stock market?

Zopa* has offered lenders a better risk-adjusted return than the stock market. (“Risk-adjusted” means taking the risk into account as well as the rewards. The typical measure used is called the Sharpe ratio.)

The risk of suffering substantial losses is considerably lower in peer-to-peer lending, but the reward is also likely to be a little lower than the stock market in the long run – although in the short run anything can happen to the stock market.

Zopa's performance is at least as good as high-street banks, which have earned better risk-adjusted returns than the stock market, according to Liberum.

Zopa is a good investment, although it's down to lenders to decide whether the expected interest whets your appetite as part of your P2P lending portfolio.

Which lending account is best?

In a previous Zopa review, I favoured Zopa Core, because there was a slight lack of information about Zopa Plus. This missing information has now been remedied enough, so that we no longer need to be quite as conservative when stress-testing the potential results of Zopa Plus in a severe recession.

So now, there is no clear winner. Zopa is very good at measuring the risks, grading borrowers and pricing interest rates, which means the risk and reward rises smoothly from Core to Plus. My own preference is for lower risk, so I choose Zopa Core, but rationally Zopa Plus is just as good.

Zopa lending review: lending tactics

Zopa does all the work for you when you lend, automatically allocating loan parts to you. So, apart from taking steps to spread your money across more loans, there's nothing you can do to increase your rewards or lower your risks at Zopa.

How can I use the Zopa website?

At 4thWay, we get a lot of access to peer-to-peer lending platforms, so we can see when information provided publicly is representative of what we have learned through other means. In this latest update to my Zopa review, I thought it would be useful for you to take a look at some of the pages on the Zopa* website that I think contain the most useful information:

Basic info about the accounts and borrower grades

On Zopa's Peer-to-peer investment page, you might take the time to read through the top sections as a refresher, but most of it is explained independently in this Zopa review.

Instead, scroll down to the “Who you invest in” section of that page. It tells you something about the borrowers. (The information on the borrowers there is a bit limited, but you get more additional information on the Zopa's Who we lend to page.)

Below the Who you invest in section, you'll see more information about the different borrower grades that go into each of Zopa's accounts, such as the expected bad debts and interest rates at each grade. There is a useful FAQ section at the end of the page.

Zopa's statistics

Zopa's Historical performance page is its main statistics page. It's a bit unwieldy, but if you take the time to go through the statistics you get a reasonable view for yourself of Zopa's very steady performance. Further down you can see that it has also historically forecast bad debts accurately (figures verified by 4thWay). The most you can hope for is that forecasts are reasonably accurate, which is not easy to do. Zopa has surpassed expectations here and so this is another sign that it understands its borrowers very well.

Zopa's disaster scenario page

Zopa's What happens if…? page helps to get it into your mind that investing has risks. It shows you what your losses might be if the economy turns progressively worse.

However, it doesn't help you understand how likely those situations are, and the graphs on that page do project right down to some extraordinarily cataclysmic scenarios, that might only impact a minority of lenders in extreme circumstances.

4thWay's PLUS Ratings helps you better understand the probabilities, and Zopa's accounts have the top PLUS Rating.

If you happen to be a banker reading that Zopa page, you should realise that Zopa is not using the traditional definition of “default rate”, meaning the proportion of loans by number of loans that ever turn bad. It actually is showing the annualised credit-loss rate. In other words, the graphs are showing, hypothetically, the proportion of debt that is written off each year.

Zopa's key people

Some P2P lending sites are prone to exaggerating the training and experience of their staff. However, the two pages about its key people are very representative of the reality at Zopa, complete with their substantial banking and risk experience:

Zopa's Get to know the leadership page.

Zopa's Get to know the board page.

Zopa review: how much are Zopa's lending fees?

Just like most peer-to-peer lending platforms (and indeed like most investment products), Zopa* doesn't charge a direct, clear investing fee. Instead, all the lending costs are buried in the spread between what borrowers pay and what lenders receive before bad debts.

That spread is technically charged to borrowers in an undisclosed “loan-servicing fee”. But it costs lenders, because lending returns are reduced by the same amount.

But I have made rough estimates of the cost of lending in the past, which I have updated again for this Zopa review. Based on Zopa revenue taken from its filed at Companies House, and other data, Zopa's total lending costs are likely to be in the range of 2.6%-3.1%.

This fee is low for personal loans peer-to-peer lending, although Zopa does not have a reserve fund that it needs to pay any revenue into. Its fee is competitive and Zopa is clearly passing the bulk of the rewards on to lenders.

Read more about this subject in There’s No Such Thing as “No Lender Fee”.

Early exit costs

If you do feel the need to sell your loans early, and won't wait till the borrower repays naturally, it costs 1% of the loans sold. You will only be charged at the point that Zopa manages to sell your loans to another lender. Most of the time this is quick, but it won't always be.

You might also have to compensate anyone buying your loan parts. For example, if you were earning a target rate of 4.5% and the new lender starts lending when Zopa target rates have risen to 4.6%, you'll need to pay a small fraction of your loans to the new lender to make up for it. Most of the time, this situation does not occur.

Is Zopa covered by the FSCS?

Like all peer-to-peer lending platforms and IFISA providers, the money you are lending is not covered by the Financial Services Compensation Scheme. If you lose money, no-one is going to compensate you.

However, like many P2P lending websites, Zopa* does have a segregated account for unlent money at a high-street bank: Royal Bank of Scotland. When any of your money is not being lent and is held in that account, it is covered under the bank's FSCS, in the event the bank goes out of business.

Any money you have in in the Royal Bank of Scotland, including in cash at Zopa, is covered under the same limit.

Read more about FSCS in peer-to-peer lending in Which P2P Lending Sites Offer FSCS Protection?

What if Zopa goes bust?

All investments listed on 4thWay are peer-to-peer lending operations, which means that borrowers still owe you in the event that the P2P lending website goes out of business. But some are more reassuringly straightforward than others, in terms of how this is legally arranged.

Zopa's lending contracts are “plain vanilla”, in that they operate under the standard P2P lending laws. The main one is called article 36H of the Regulated Activities Order, which means that lenders are lending directly to the end borrowers.

There are other ways to legally bring about that same condition, but when it's plain vanilla it means its straightforward and we can therefore be highly confident that there is no legal issue about who gets the money when borrowers repay after the event Zopa goes bust.

It's also reassuring that Zopa* has a very simple corporate structure, with a group (parent) company and one main subsidiary of note, which houses its P2P lending operations.

Investing in Zopa

Instead of investing by lending money through Zopa, what about investing by buying shares in Zopa the business itself? As in, investing in Zopa, not its loans? This question has come up with us before.

But, unfortunately, Zopa is not a public listed company. And it's grown too big to sell shares through crowdfunding websites. Until it decides to be listed on the stock market, it's not likely you'll be able to become a part-owner of Zopa by owning shares in it. If it ever does, I'll be sure that I or one of my other colleagues with training or experience in share analysis gives you our candid opinions in future Zopa reviews.

Summary of the investing tips in this Zopa review

- Lend for at least three years to lower risks.

- Spread your initial lending amount over several months to lower the risks.

- Lend additional money regularly to reduce risks.

- Re-lend the loan repayments and interest to lower risks.

- Split your lending between Zopa Core and Zopa Plus to spread your money more widely.

- Use Zopa* as just one of several peer-to-peer lending websites in a portfolio, with no more than 10%-15% of your total investing pot in it.

Conclusion to the Zopa review

Interest rates are not exciting and lenders can expect some variability between their results. But this is one of the most competent and learned platforms available. Excellent at assessing rates and risk, and highly experienced in all aspects of their operations. It adds some useful diversification into a different kind of investment: personal loans. It would only look silly in your investing portfolio if you are going all out for high-risk, high-reward.

Lenders like Zopa

There's only really one other pure personal loans peer-to-peer lending/IFISA provider of note, and that is Lending Works. Read the 4thWay Lending Works Review. For more on Zopa and its competitors, read Personal Loans Peer-To-Peer Lending: It's Underrated!

Thank you for reading the 4thWay Zopa review!

See more reviews in Guides, reviews and tips.

There’s No Such Thing as “No Lender Fee”.

Which P2P Lending Sites Offer FSCS Protection?

Personal Peer-To-Peer Lending: It's Underrated!

Zopa review: key details of its Zopa Plus Account

4thWay PLUS Rating

3 PLUSes is best. What does the 4thWay PLUS Rating tell you about the risks and rewards?

Interest rate after bad debt

Here we show the P2P lending site's own estimate (or 4thWay's if theirs are not appropriate)

4thWay Risk Score

Lower Risk Scores are better. How is this different to the 4thWay PLUS Rating?

Description

£5.0 bn in personal loans since 2005, with auto-lend, auto-diversification & early exit. Available in an IFISA

Minimum lending amount

Exit fees - if you sell loans before borrowers fully repay

Early exit is not guaranteed. Usually, other lenders need to buy your loans

Do you get all your money back if you exit early?

Loan size compared to security value

Reserve fund size as % of outstanding loans

Company/directors lend alongside you/first loss

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Lending Works and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.