See why 4thWay now accepts ethical ads.

How To Protect Your Lending From The Personal Loans Bubble

First I'll tell you about the lending bubble, then I'll share my views about how much it affects us as individual lenders, and then I'll say what action we can take now.

The growing personal loans debt pile

Financial advisers, debt charities and the Bank of England have all raised concerns about personal borrowing in the UK, the total of which has now breached £200 billion.

This lending includes ordinary loans to individuals, car loans, payday loans, credit cards, overdrafts and store cards, but not mortgages.

Personal debt has recently increased faster than at any time since 2005, according to the Financial Times.

This larger debt pile has been a lot longer in the making than that. Of those debts that are picked up by the Office for National Statistics or the Bank of England, personal borrowing is up 60% over-and-above inflation, since 1994. If we add on the unreported lending the total increase would probably be higher.

Debt charity StepChange told The Guardian “We are seeing more and more households struggling just to make basic ends meet.”

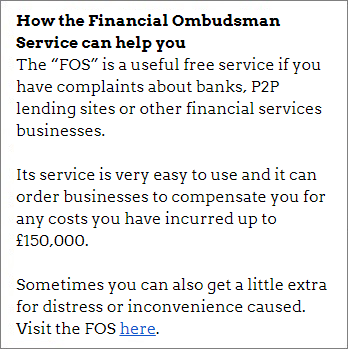

The Financial Ombudsman Service reported that complaints about payday loans are now nine times higher than two years ago.

The Financial Ombudsman Service reported that complaints about payday loans are now nine times higher than two years ago.

Data from the Insolvency Service shows that bankruptcy and similar events rose rapidly after the start of the Great Recession from 107,000 in 2007 to 135,000 in 2010.

They fell just as fast after 2010 down to 80,000 in 2015, but then went back up to 90,000 in 2016, with more brankruptcies likely in 2017.

Mark Carney, the governor of the Bank of England, called personal borrowing one of the “pockets of risk”.

He suggested, after a recent good run with low bad debts, some banks might have got too relaxed about who they approve for a loan.

Under his authority, the central bank has now started to put tougher controls in place for the likes of Barclays, HSBC and Lloyds.

How this affects personal loans P2P lending today

Buried in ominous words from Martyn James, a spokesperson for the online complaints service Resolver, was a hidden message that will guide those lending through personal loans P2P lending sites to a solution.

Quoted in The Guardian, James said:

“There is a large amount of credit out there and a large [number] of people who are trying different types of credit as a way to keep afloat.”

That sounds bad and of course it really is very unpleasant for many households struggling with debts.

But the point for individuals lending their money through P2P is that it is a specific type of borrower who is struggling. Unsurprisingly, it's the ones who have multiple loans, credit cards and store cards, who are shifting their debts around but unable to clear them.

It's possible that some high-street banks have been continuing to approve many of them for loans. The Bank of England is doing what it can to prevent those banks getting any crazier.

Just like the banks, you and I have the choice of whether to lend to these people or whether to avoid them. Thankfully, P2P lending sites have focused mostly at the low-risk end, which particularly lowers the risks of lending during bubbles.

Three step-strategy to defend our lending from disaster

So here's how to go about it defending yourself from bad debts to struggling borrowers:

1. Look for great records at the P2P lending sites

In short, the first thing you're looking for P2P lending sites with a long history and low bad debts.

To that end, 4thWay's experts do tests of all the individual loans approved by P2P lending sites using the same methods that banks are required to do. But we do a much stricter version.

For starters, 4thWay's tests presume that individual lenders like you and me will have the misfortune of lending at the start of a recession that is as bad or quite possibly worse than 2008.

These test results are summarised in the 4thWay PLUS Ratings, a score out of five with 5/5 being the best. If a P2P lending site has any PLUS Rating at all, it means the results of our tests show that most lenders will still make money during a major recession, due to the interest the lenders can earn right now, the quality of the borrowers, and other defences put in place by the P2P lending site.

You can see which P2P lending sites have 4thWay PLUS Ratings in our comparison tables.

Zopa and Lending Works* are the two pure personal loans P2P lending sites that have earned 4thWay PLUS Ratings.

You can read 4thWay's Zopa Quick Expert Review and Lending Works Quick Expert Review. You could also read last week's article on Zopa: Big Lending Update On zopa, RateSetter And Funding Circle.

2. Check if P2P lending sites are taking evasive action

With signs that more borrowers are having trouble and that some banks are no longer being as sensible as they should in approving loans, you want to see that personal loans P2P lending sites are being more cautious and disciplined.

So take a look at what the P2P lending sites are telling you about how strict they're being.

For a relatively small site like Lending Works, it has less to worry about, because it can still be very selective of its borrowers.

But Zopa is large, so it is easily affected by more struggling borrowers. Therefore it is reassuring that it is saying all the right things: it has been cutting back on lending to borrowers at the higher-risk side that it usually lends to.

This is an important message to hear it say publicly, because it means it is not giving into short-term goals, such as hitting revenue or profit targets set by shareholders or directors. Thats's good discipline. 4thWay will likely be able to see over the coming months from the data Zopa provides if it is doing what it says it is.

For those of you who like getting into the details, keep an eye out for a variety of signs that a personal loans P2P lending site is being loose, or looser, in selecting borrowers, approving loans or setting interest rates. And you can look at whether bad debts and late payments are rising rapidly – especially when compared to the nearest competitors.

You can usually find some of this information in the statistics pages on their websites. (Zopa's are here and here, and Lending Works' are here and here.) That information, and more, is also updated as much as possible in 4thWay's detailed comparison tables (which you reach by checking the boxes next to the P2P lending opportunities in the comparison table and then clicking “Get more details” at the top of the page).

We also let our newsletter subscribers know if there's any change that we believe they need to be alerted to.

3. Don't invest without absolute confidence

Finally, principle one of 4thWay's 10 P2P Investing Principles is:

If there's any doubt about lending at all, the answer's “No”. Only lend when you are supremely confident you understand all the risks.

What's important is that if you are not confident you stop lending and exit immediately, if you are doing so right now. You don't wait for a recession to start, or for loans to start going bad more quickly, before you get out.

The reason is that if you're not genuinely confident, I bet you will do anything to leave when suddenly a load of other people who weren't really confident in their loans are panicking around you. And, by panicking with them, you will find it's impossible to get out quickly, because too many lenders are selling loans and not enough are willing to buy. Or you will find that to get out you have to accept 90p or 80p in the pound to sell your loans, potentially making an instant loss.

Why do I bet you this? Because unprepared investors do this sort of behaviour with every kind of investment. P2P lending will not be the only ever exception.

Arm yourself with knowledge and confidence before you lend.

As always, spread your risks across lots of different types of P2P lending sites, not just personal loans ones.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Lending Works and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.