See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

How One Lender Is Losing Money – A Lesson In P2P Lending Diversification

This guide page is to:

- Describe to you just how incredibly powerful it is to spread your money across lots of high-quality loans.

- Offer guidance on how much diversification you need.

- Give you tips on how to go about doing that and how to lower the risks even further.

How not to do P2P lending

Here's a true story. A lender put £1,000 into Funding Circle, which, at that time, was offering P2P loans to small businesses. These loans were not secured against real property (which is no longer so common in P2P), so the risk of losing a good chunk of your loan when a borrower suffers problems was quite high.

He complained to The Guardian that he had so far made £115 interest after costs, but had outstanding bad debts of £128.

The bulk of the bad debt came from a single loan. The lender had put a whopping 10% of his £1,000 into that loan.

Luckily for any lender going through that, the situation is likely to be temporary. Firstly, you would continue to make interest on your remaining good loans for years to come.

Secondly, Funding Circle said at the time that it expected to recover enough of the bad debt on his large bad loan within a few months to put him back into profit.

Indeed, it is typical for many kinds of lending that some loans go bad early on. That might worry amateur lenders, but, provided the P2P lending site knows what it's doing, recoveries and interest earned over the following months and years is expected to make up for that.

But that's not what you should be learning from this story in The Guardian:

What's important about this story is that you make it far easier to lose money if you just lend in a few loans. Putting 10% of your money in just one loan to a small business borrower is simply too risky and misses the point of money lending.

On the flipside, if you spread across lots of quality loans, it is very difficult to lose money. More on that in a moment.

Let's put it this way: if you had money in an account at a very small bank, and that bank lent 10% of all deposits by its account holders to one borrower, would you be happy with your bank about the risks it was taking?

Of course not. A few bad loans and then a recession, and you might have to face a run on your bank. That could be pretty nerve-wracking for savers.

The same standards apply to ourselves as individual lenders.

The absolutely extraordinary protection you get from spreading your money around

Very loosely speaking indeed: if you lend in an ordinary personal loan to just one single individual borrower, right at the moment a very severe recession kicks off, you might have around a 10% chance of losing 3/4 or more of your money.

It seems to us that not many people want to have a 10% chance of losing most of their money. That sort of risk is not what P2P lending is about.

However, the maths changes completely in our favour when we lend to many borrowers:

Indeed, it's now more realistic to say you have a 10% chance of losing 10%-20% of your money. Any interest you earn on the good loans over the years will help offset that.

That is a lot better. Your stock-market investments during a severe recession have a far, far higher chance of doing worse than those loans. Which is appropriate, since the stock-market is generally higher-risk, higher-reward than money lending.

It gets better

Those odds might still not be good enough for you. Prime borrowers are supposed to be low risk and paying relatively low interest compared to, say, lending to property developers.

You might want to reduce the risk further. And so you double down: lend to 200 of the same quality borrowers instead of 100.

Doing this, the risk of losing more than 13% of your money during a severe recession, before interest, falls to 0.1%. That's a lot better.

We're making some fierce assumptions in calculating all these odds, so the chances of losing that much money are probably even lower. This example is simply an extremely bad scenario for you to work with. After all, investors (including those of us doing P2P lending) should invest with a “large margin of safety”. (See 4thWay's 10 Principles Of Investing.)

Property lending is now the norm

And yet I so far have still just given you examples that are not reflective of the greater safeguards that you can now expect in P2P lending. The vast majority of providers have real property – real estate – backing each loan. Properties are valued and the amount the borrower can take out is usually a lot less than that valuation. This greatly lowers the risk in each loan and often means you can lend in fewer loans with the same level of safety.

Don't get me wrong, you should still be looking to lend in many loans through each of the P2P lending providers you spread across. But you're no longer talking about hundreds of loans through each provider. “Dozens” is normally going to be closer to the mark.

How many loans do you need to lend in?

The founder of one of the P2P lending company's said that, to him, P2P lending is not about protecting against 1-in-100-year recessions. Yet that's his opinion, because these kinds of extreme events are precisely what 4thWay likes to plan for and it incorporates that into its 4thWay PLUS Ratings and 4thWay Risk Scores.

Ultimately, it's up to you how much risk you want to take on.

But doing some rough, but tough, sums, based on 4thWay's standards, we can loosely categorise loans for you like this, assuming there's a severe recession and major property crash. Here we go:

| 4thWay Risk Score | No. of loans required | Rough estimated results through a recession |

| Secured loans with Risk Score of up to 5 | 30 | 0.1% chance of 10% loss |

| Unsecured loans with Risk Score of up to 5 | 200 | 0.1% chance of 10% loss |

| Unsecured loans with Risk Score of 6 or 7 | 300 | 1% chance of 20% loss |

4thWay Risk Scores are based on a very-tough-bordering-on-mean version of the international “Basel” stress tests that banks are required to do on their own loans, and factor in the type of lending, bad-debt performance, reserve funds and other factors.

The table above goes up to a risk score of 7/10, since that's the limit to risk that we think most lenders would consider appropriate. Higher 4thWay Risk Scores represent risks that we calculate are at stock-market levels, and are therefore probably not suitable for most lenders.

You might be willing to take more risk and that's perfectly acceptable, but you need to decide in advance what's acceptable to you and stick to it, especially during times when other amateurs and experts around you lose their minds. That happens an awful lot in investing.

It's quite simple really: if in doubt, don't get greedy. Stick to your lines in the sand and be proud that you're thinking for yourself instead of being another sheep.

Just to stress that, despite the skills, data and knowledge behind 4thWay, the number of loans that are estimated in that table is not some kind of guarantee, not least because each P2P lending company is different.

5 ways to diversify even further

All the above assumes you just put your money into one P2P lending site just as a severe recession crashes down on you.

However, to diversify, improve your returns and lower your risks an awful lot further, you can use these five additional, solid techniques:

- Drip your money in over many months to spread across more borrowers.

- Re-lend your money consistently, including before and after a recession.

- Select lower-risk borrowers.

- Lend to different types of borrowers through multiple P2P lending accounts.

- Use other types of investments and savings products as well.

Where to get started in spreading your risk

To get started in spreading your money across lots of loans:

- Look for P2P lending sites that offer at least some automatic diversification. You can see which P2P lending sites offer automatic diversification by looking at the “Description” column in our comparison tables.

- Bear in mind that some P2P lending sites will only spread your money around enough when you lend thousands of pounds.

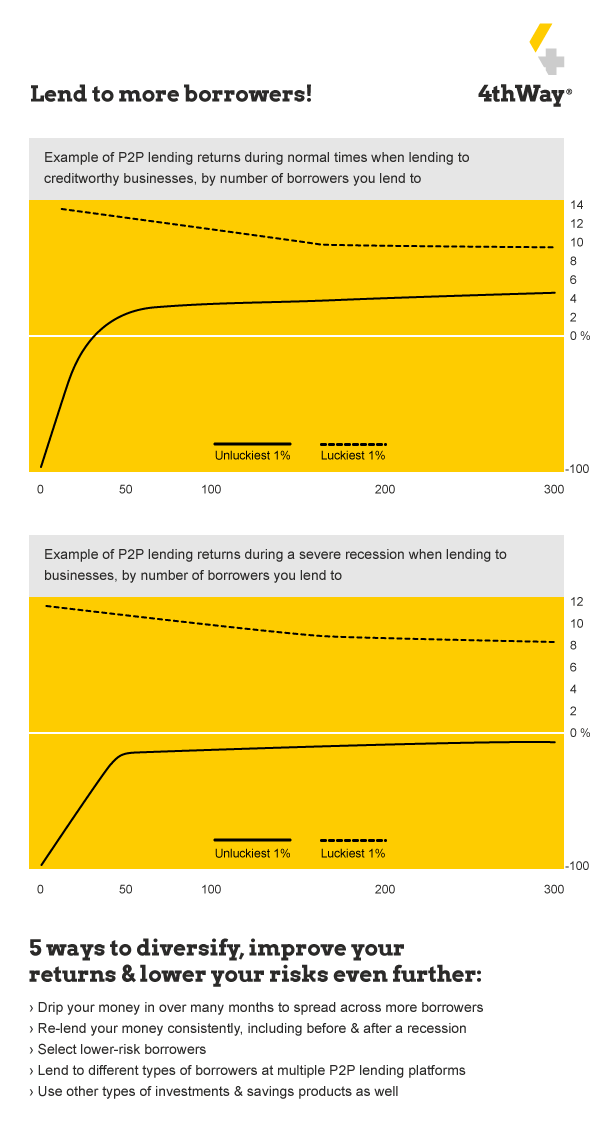

Finally, here's a chart, not based on a real P2P lending site, that shows the kind of spread of results you might expect. It is based on lending to typical unsecured business borrowers. Higher-risk lending would have a wider spread of results. Lower-risk lending a smaller spread, with less chance of negative results.

This was part ten of our ten-page P2P lending guide

Read part nine: The IFISA (P2P ISA) Guide.

See the contents of the whole guide.

See the 4thWay Risk Scores in our comparison tables.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.