See why 4thWay now accepts ethical ads.

Wellesley & Co. Increases Interest Rates

This article was updated on 2 May, to explain an additional interest rate change made by Wellesley on that day.

Property P2P lending website Wellesley & Co. has increased interest rates on all its deals as of today, 1 May. Except for one deal which went down slightly on 2 May.

The P2P lending website, which has one of the lowest (best) 4thWay® Risk Ratings of just 12*, has also dropped its one-year deal and brought back its 18-month product instead.

Wellesley sets interest rates itself – not us individual lenders – and it only changes them irregularly. This is just the fifth time it has changed rates since it began in late 2013.

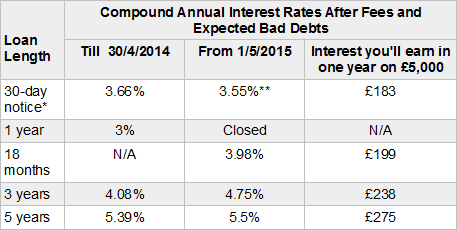

Wellesley & Co. interest rates

*Wellesley calls this the Easy Access account, but it takes 30 days for you to get your money. **This rate was changed on 2 May 2015.

The annual interest rates above show what you'll get paid at the end of the deal – or every month in the case of the 30-day notice account. You can choose to be paid monthly interest instead, for which you get very similar rates.

Wellesley & Co. continues to pay a large premium to savings accounts, as you'd hope and expect. See Safest Peer-to-Peer vs Savings Accounts for the latest interest rate comparison, and for a brief overview of how the risks compare.

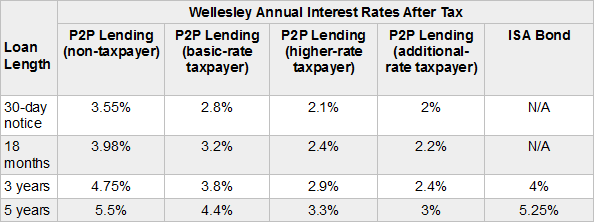

Here are the interest rates we lenders receive after we pay our taxes:

Wellesley & Co. rates after tax

Those interest rates are still competitive

Wellesley & Co. currently offers the highest monthly interest rate in the P2P lending market.

Its three-year and five-year rates are pretty competitive.

No other P2P lending website offers an 18-month account that we can compare it to.

The best comparable savings account currently pays around half as much as Wellesley.

The best tax-free savings account (cash ISA) – also pay around half. This means that higher-rate and additional rate taxpayers could be roughly as well off with a cash ISA, because we pay income tax on our peer-to-peer lending. (Unless you wrap up your lending in a P2P pension.)

More on 30-day notice

Wellesley & Co. is the only peer-to-peer lending company offering a monthly rate rate that does not require that you keep re-lending your money after the month is over. It will instead keep paying you interest until you give 30 days' notice to withdraw your money.

There is a potential risk that your money will get trapped in for longer if lots of lenders want to exit Wellesley at the same time, although we can probably expect 30-day lenders to be given priority.

Wellesley's ISA Bond rates

You can see Wellesley ISA bond rates in the table above. These are from the Wellesley & Co. Listed Bond, which you can put in an ISA to make tax free.

The rates here have also gone up. The three-year deal now pays 4%, up from 3.8%. The five-year deal pays 5.25%, up from 4.7%.

This bond is technically known as a “retail bond”. This is not like the savings bonds that banks offer you. The risks in Wellesley & Co's retail bond are higher than in its regular P2P lending accounts, as Neil explained in Wellesley P2P ISA Bond is Not P2P Lending.

Why Wellesley shows different interest rates

Wellesley & Co. is one of the few P2P lending websites to tell you what you can expect to earn using “simple” interest rates on its website. Most others use “compounded” interest rates, which better reflect what you're likely to earn.

Throughout the 4thWay® website, we change Wellesley's interest rates to compounding so that you can better compare like with like and so it more accurately shows you what you'll earn.

For example, the five-year deal now pays 6.32% in “simple” terms (as shown on the Wellesley website), but compounded it pays 5.5% (as shown on 4thWay®).

*Wellesley's 4thWay® Risk Rating

RateSetter has the lowest 4thWay® Risk Rating of 10 out of 50, meaning it is probably only just short of being as safe as savings accounts.

Wellesley is virtually the same at 12 out of 50. Theoretically, the maximum score is considerably higher than 50, but we haven't risk-rated all of the riskier P2P lending websites yet. We're still awaiting details from Landbay to be able to calculate its own 4thWay® Risk Rating.

Although Wellesley aims to be at the lower risk end, bad debts could reduce or eliminate any interest you earn and you could make a loss. Read about Wellesley in Get Started With the Safest Peer-to-Peer Lending Websites.

4thWay® Risk Ratings: no risk-rating system is ever perfect and they cannot consider all factors and future events. Read more about the 4thWay® Risk Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Wellesley & Co. and RateSetter, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.