To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Safest P2P Lending Interest Rates Over Christmas

The P2P lending companies pitching themselves as lowest risk and easy-to-use all have the best records – with no lenders losing any money.

These companies all have bad-debt provision funds: that's a pot of money in reserve to pay you back in case a borrower stops paying.

They also either focus on very high-quality borrowers or they take property as security for the loan, while checking that the loan is for far less than the estimated value of the property.

All of them spread your money across many borrowers and take other steps to keep the risks right down. They have the best 4thWay® Risk Ratings of just 10-13 points out of 50, marking them as low risk investments by our latest mathematical calculations.

Despite their great records, they're paying far more interest than you can expect from the best savings accounts:

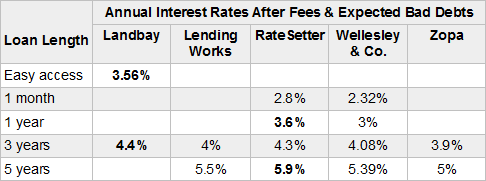

Interest rates from the P2P lending companies with the safest records

All the interest rates assume that you re-lend any interest and loan repayments you receive. Wellesley's and Landbay's rates look different on their websites because they calculate them in different ways. We convert them all to the same calculation to make it easier to see how they really compare.

The best rates

Notice that Landbay‘s easy-access account pays better than the two available monthly accounts and practically the same as the best annual account. Landbay also has the best rate over three years.

Landbay does mortgages to high-quality buy-to-let borrowers and ensures the loans are for far less than the property valuation.

RateSetter, which mostly does consumer loans to “super-prime” borrowers, takes the best one-year and five-year deals, at 3.6% and 5.9% respectively. As usual, this is well above the best savings account rates.

RateSetter has the longest zero losses record of all these P2P lending companies, having started with its (now very fat) bad-debt provision back in 2010.

Zopa, the oldest P2P lending company in the world and the one that started it all, used to pass all losses on to us lenders, but it has had zero losses since it created a large bad-debt provision fund in 2013.

Lending Works wins no awards for highest rates, but it is the only P2P lending company with both a bad-debt provision fund and insurance against losses when borrowers can't pay due to accident, loss of employment or redundancy.

Minimum lending amounts

All these companies allow you to lend as little as £10, although Landbay asks for an initial deposit of £100.

Early exit

As usual in P2P lending, you can get your money back early but doing so is not guaranteed, since you're reliant on another lender or lenders being available to take over your loans.

You might also get back less than you expected when leaving early, especially if interest rates have risen since you lent your money out. The reason being that the new lender expects to get today's new, higher rates, so you need to compensate for that.

Re-lending repayments

You can expect to earn less than shown, because these rates assume you're able to re-lend any repayments immediately. While you can normally re-lend within days, or even hours, you can't assume you'll earn interest continuously. All these companies have simple options to re-lend your money automatically at the latest rates.

What you earn will also differ depending on the interest rates that you can get when you re-lend any repayments and interest you receive. The exception is Wellesley, the bridging loans and short-term developer loans specialist that focuses on lending far less than a property is worth. Wellesley pays you interest from day one and keeps paying even when your money is not being lent out.

The 4thWay® Risk Ratings were devised by experienced investors and a debt specialist from one of the major accountancy firms. The score is calculated using objective criteria that can be measured and improved over time. No risk-scoring system is perfect, not least because rely on accurate and timely data from the P2P lending companies and the P2P lending industry is relatively new, so there is less information to base a score on. Read more about the 4thWay® Risk Ratings.

Commission: we receive commission from all the above mentioned companies for publishing their calculated 4thWay® Risk Ratings and our editorially independent 4thWay® Insight Reports, which are our own proprietary research products to help individual lenders like you make good investment decisions. We do not take commission for including P2P lending companies in our free comparison tables. All P2P lending companies will be included over the next few weeks. Learn How we earn money fairly with your help.