See why 4thWay now accepts ethical ads.

Landbay: The Lowest Cost P2P Lending Company

Landbay has today revealed a few of its key statistics that help us to better understand the low-risk, BTL property P2P lending company.

We can now see the average size of the BTL mortgages we're lending in through Landbay, rental coverage and now, at last, the size of its bad-debt provision fund. Plus, it has revealed its true cost to lenders.

How much Landbay costs lenders

We now have enough information to estimate how much Landbay costs lenders. Most P2P lending websites don't make it so easy. They even claim it doesn't cost you anything, which is never true. (Read There's No Such Thing As “No Lender Fee”.)

By 4thWay's estimates, the total cost to lenders for Landbay is no more than 1.85 percentage points. This means if borrowers are paying an average APR of around 5.7% (including arrangement fees) and lenders are receiving an average 3.95% then the difference are your total costs.

This is the lowest-cost P2P lending company we have come across as we build our comparison database to cover all companies. Low costs means lower risk, since you're getting more of the rewards for the risks you're taking.

How big is Landbay's provision fund?

In addition to finding out that it is the lowest-cost P2P lending company, we now know that Landbay's bad-debt provision fund is 1% of the size of the outstanding loans.

This is the smallest bad-debt provision fund, but it is also possibly the least necessary one, due to Landbay's focus on what could well be the safest type of loan and borrower among all the P2P lending companies with provision funds.

Assuming it continues to grows its loanbook at an accelerating pace for a while, it means it could be paying between a quarter and three-quarters of its total fees into the bad-debt provision fund for some years.

Highly safe lending through Landbay

We now know there are currently, there are 19 outstanding buy-to-let mortgages with an average value of £146,000, or £2.8 million in total. Landbay expects to double its loans by the end of next month.

Half of the loans by value are in London and another 30% are in the south east of England.

On average, the mortgage payments are 188% covered by rent that the landlords are already receiving. The minimum cover that Landbay accepts is 125%, or 135% for new landlords.

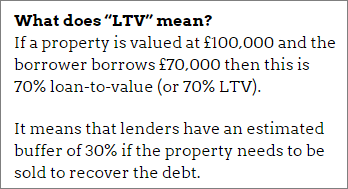

Buy-to-let properties from successful landlords with great income coverage provide great security for lenders. In addition, the average loan-to-value at Landbay is a low 67%.

at Landbay is a low 67%.

This is not the lowest average LTV among all P2P lending companies, but it is very low considering it is combined with safer borrowers and safer types of property loans than, say, bridging loans and developer loans.

Landbay will not lend more than 80% of the estimated value of the property.

Read more: Landbay Survives Severe Property Crash Stress Test.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Landbay, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.