See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

4thWay P2P And Direct Lending Index: December 2025

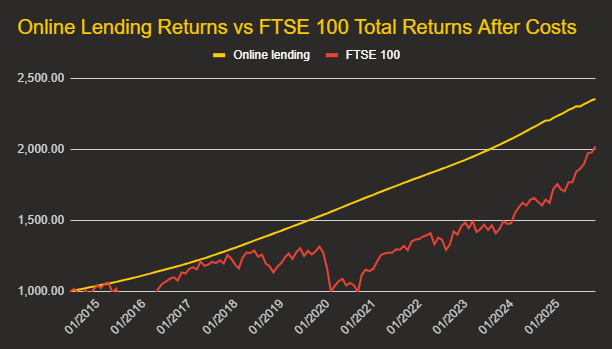

In 2025, while P2P and online lending made “just” 6.77% after costs and write-offs, the stock market returned a huge 24.5%(1) for investors, after estimated investing costs.

Plus, the 4thWay P2P And Direct Lending Index (PADL) now has two new constituents – Somo and CapitalStackers. These fill a gap in coverage so that the index now better reflects the wider market. Their data has been retroactively added.

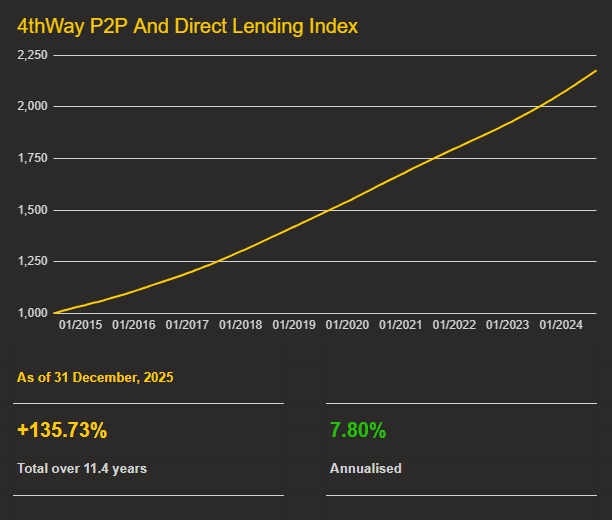

Annualised lending returns after costs and losses have averaged 7.80%, with no losing months. The graph above is not smoothed, but shows actual results over time.

Over the medium and long run, lending returns at 7.80% pa have massively outpaced the stock market's 6.32% pa.

Put another way, £10,000 became £23,573 in online lending, versus £20,242 for the stock market.

Key numbers

Stability: number of calendar years with positive returns

P2P and online direct lending: 11/11.

Stock market: 8/11.

Calendar year head-to-head matchup: which performed best?

P2P and online direct lending: won 5/11 calendar years.

Stock market: won 6/11 calendar years.

Longest losing streak

P2P and online direct lending: 0.0 years. (Not even a single month has been losing overall.)

Stock market: 6.3 years(2).

Years losing to inflation(3)

P2P and online direct lending: 1/11 years.

Stock market: 4/11 years.

Comparison of Volatility with the Stock Market

Primary constituents

The table below shows the types of lending available today and the rates currently available for investors who start lending today, before any bad debts.

| Provider/ model |

Description | Current lending rates |

| CapitalRise*/ DL(4) |

Prime development lending with negligible capital losses | 10.51% |

| CapitalStackers*/ P2P(4) |

Mezzanine and stretch development lending | 13.49% |

| CrowdProperty/ P2P |

Mostly development lending | 8.96% |

| Loanpad*/ P2P |

Bridging and development lending under 56% LTV, no losses | 5.80% |

| Proplend*/ P2P |

Commercial property lending with investment income, negligible losses | 7.98% |

| Somo*/ DL |

Bridging lending, mostly second charge, no capital losses | 9.69% |

Find out more about these and other providers in the comparison tables.

New constituents creating better balance to the index

With over half a billion pounds represented in the 4thWay PADL Index, it covers a large part of the market.

Even so, there was previously a gap in representation of the wider market that has now been closed retroactively with two new constituents.

Somo* does a lot more second-charge bridging lending than first charge, putting investors second in the queue to recover their money in return for higher interest rates. It also tiers some first-charge loans for investors by splitting those loans into two tranches, paying better rates to the more junior tranches.

With £90 million in money on loan through Somo, this helps the index better reflect the blend of senior and junior lending that exists in this investment space.

CapitalStackers* adds £16 million in mezzanine and stretch finance, which is the most junior form of property development lending. Previously, this type of lending was not represented in the 4thWay PADL Index, but it is now well reflected.

4thWay PADL Index methodology and inclusion criteria

The 4thWay P2P And Direct Lending Index (PADL) starts from the end of July 2014 and shows actual returns after costs and credit losses.

All online direct lending, including peer-to-peer lending, is eligible for inclusion in the 4thWay PADL Index, provided the data supplied to 4thWay is verifiable and meets high standards.

Using detailed data from the lending platforms, 4thWay takes the way many bond indices are calculated as a minimum standard.

Bond indices typically take the loan amount, rate and term, and extrapolate the amount made by investors based on generating a schedule, while marking down bad debt as it is written off or charged off.

4thWay’s methodology improves on that by using intra-loan events, such as additional default interest paid out to investors and actual cash flows where possible.

Further reading

1. All stock-market comparison figures are based on data on the FTSE 100 total returns index (i.e. including dividends) from Curvo and Investing.com, after estimated wrapper and fund costs, fees and expenses of 1%, which is conservative compared to most share investors’ frictional costs.

2. FTSE 100 total returns after costs saw share investors with a smaller investment pot on 31 October 2020 than they had at the end of July 2014.

3. Inflation is based on what is widely considered to be the most accurate measure: the CPIH index.

4. “P2P” means the platform model is based on article 36H P2P agreements. “DL” means the platform operates using one of several other direct lending models, or models that effect the same for investors. All models effectively mean that the end borrower borrows from the end investor, substantially reducing the risk of losses to investors if an investment platform closes down, switches business model or goes insolvent.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from CapitalRise, CapitalStackers, Loanpad, Proplend and Somo, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or when you make an investment, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.