See why 4thWay now accepts ethical ads.

Why I’m not worried about Wellesley’s P2PFA exit

My colleague, Matthew Howard, wrote just a few moments ago about Wellesley leaving the Peer-to-Peer Finance Association (P2PFA). It seems quite possible that the company left due to differences over its savings bond.

On the one hand, Wellesley & Co. is a peer-to-peer lender, matching borrowers and lenders.

On the other hand, it has a much more ordinary savings bond. This bond is more like traditional banking, in that Wellesley takes your deposits, lends the money itself, collects higher interest from borrowers, and pays you a fixed, pre-agreed savings rate from the proceeds. It also uses your deposits to expand its business. So the savings bond is a business loan from savers to Wellesley.

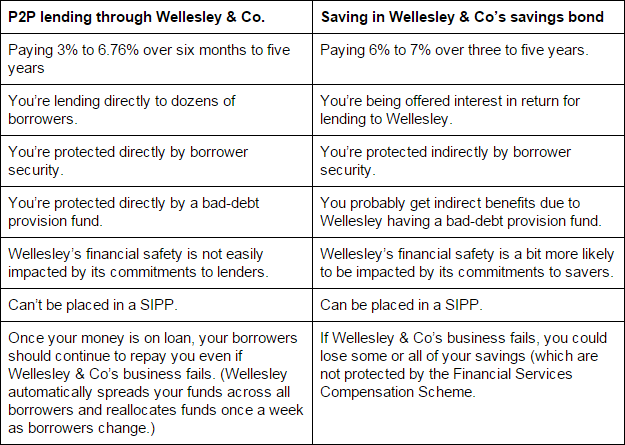

Here's my take on the key differences between its P2P lending and its savings bond:

Eased out on a technicality?

Wellesley clearly sets out the risks of both P2P lending and its savings bond on its website and in the key documentation, and it explains how it uses the money it borrows from its savings bond customers.

The problem appears to be that P2PFA rules state: “Members should not borrow or raise funds through their own platform.” Perhaps I'm missing something, but, if this is the reason Wellesley was chucked out or resigned, it seems to be on a technicality. Wellesley is not borrowing through its peer-to-peer lending platform, but it is borrowing through its website.

I think it's worth noting that there is nothing in P2PFA rules to stop any P2P lending company setting up a savings bond off their websites, and then using the money for expansion and for lending just as Wellesely has done.

It's the savers who have more to worry about

Take a look at the last line in the table above. Reading that, it seems to us that those lending through Wellesley have little to worry about from the savings bonds. Indeed, those using the savings bonds are probably taking more risk, because they have no safety net if Wellesley goes out of business and their savings are not diversified across lots of borrowers; instead, their sole borrower is Wellesley. Perhaps that's why savings bond customers are also being paid higher rates by Wellesley.

The pros and cons for Wellesley's P2P lenders

The money Wellesley gets from its savings bonds is potentially faintly useful to lenders like you and me, as the money is being used to expand and get more and more borrowers into its P2P marketplace.

I can also see one small possible cause of higher risk arising for lenders, due to the savings bond.

All P2P lending companies will, at times, face pressure to loosen their lending criteria and allow more borrowers and to offer them higher grades of credit. Indeed, this has already happened, just a little bit, at some of these companies, as they have tried to cope with demand from lenders like you, me, and even financial institutions and the government.

Any P2P lending company that has debts of its own has another factor to deal with that might put pressure on it to weaken its standards. The same applies whether the debts are through a savings bond on its website or off its website, or through a loan or other form of debt.

But even massive P2P lending company Funding Circle is borrowing money to expand more quickly. And we have seen no evidence that we have to worry about rapid-grower Wellesley more than the rest – although we shall be keeping our eyes out for any worry signs from any of the P2P lending companies, and we'll shall report all such signs to you immediately.

Georgie Courtney from Wellesley told me:

“We have a portion of every loan that we make which we retain and we are consistently monitoring the expected draw downs and incoming funds to control the balance. With our retained capital at risk and our Provision Fund we are able to pay interest from the moment funds are committed.

“The aim and the system that we have in place is to manage the process to ensure that we have the correct balance throughout to meet interest payments and loan draw downs. The process is mapped out in detail and runs in conjunction with the Wellesley business model and functions.”

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Wellesley & Co. and Funding Circle, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.