See why 4thWay now accepts ethical ads.

Why Assetz, LendInvest & Wellesley Have Countless Subsidiaries

The founders and directors of LendInvest, Wellesley & Co. and Assetz Capital have over two dozen limited companies between them either as part of their P2P lending operations or as companies very closely related to them.

Why? More specifically, is this an extra risk that we lenders need to be careful of?

While I was investigating this, I identified six reasons why these companies choose to create an extra “Limited”.

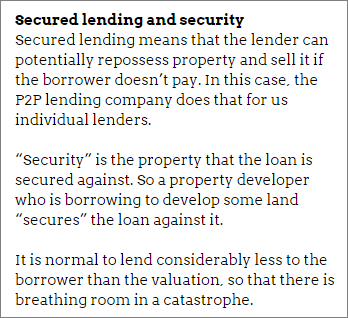

1. Separating security from operations

I asked David Serafini of LendInvest to explain the purpose of the many companies linked to LendInvest.

LendInvest Limited is the main company under which it carries out its operations and where it records its profits from the fees it receives from lenders and borrowers.

LendInvest Security Trustees Ltd holds the security  from the borrowers separately.

from the borrowers separately.

This could make it more easy to deal with recovering any bad debts if LendInvest Limited was to go under.

One of Assetz Capital's companies, called Assetz Capital Trust Company Limited, is another a company for holding security.

This is a trustee company run by accounting firm Grant Thornton.

Wellesley & Co. has a similar company set up that it runs itself, called Wellesley Security Trustees Limited.

2. Bad-debt provision funds

Wellesley & Co. has a bad-debt provision fund, which is a pot of money set aside to cover your losses if all other attempts to get your money back from a bad debtor fail.

It has set this up as a separate company called Provision Funding Limited.

Assetz Capital also has a bad-debt provision fund for some of its lending products. This is called Assetz Capital Provision Funding Limited.

If one of the P2P lending companies goes bust then an administrator would allow the outstanding loans to wind down, paying you your dues and chasing bad debts, as before.

The bad-debt provision funds should continue to serve their purpose, which is why it's vital that they're held in separate companies so that they're not used to pay the P2P lending companies' own debts.

3. Different companies for different loans

Assetz Capital could have multiple companies because it has different types of loans. It might be easier to use separate companies for its accounts management.

This certainly seems to be the case for Wellesley & Co., which has under its umbrella: Wellesley Lease Finance Limited, Wellesley Business Advances Limited, Wellesley and Rural Industry Finance Limited, and Wellesley Secured Funding Limited.

The names give a clue to the different loans or customer segments that Wellesley either lends our money to, or intends to in future.

Assetz Capital has myriad companies that have been set up by the same founders and directors, seemingly with the same purpose of separating different types of loans.

It looks like many of these companies, while often called “Assetz Something-or-Other Limited”, are not part of Assetz Capital but are instead ordinary lending businesses founded by the same people, and these are completely separate from their P2P lending company.

4. Container companies

Wellesley must have found its structure a bit disparate at some point or perhaps the regulator didn't like the lack of clarity.

That's why it eventually set up Wellesley Group (UK) Limited to put its main P2P lending “limited”, namely Wellesley & Co. Limited, as well as many of its other companies, under one roof.

5. Different companies for different products

Wellesley has another company that is set up specifically for a different product it offers: its new bonds that can be put in ISAs. This company is called Wellesley Finance Plc.

You can read about the bonds in Wellesley P2P ISA Bond is Not P2P Lending. (Note that since I wrote that piece Wellesley has made the name of its bond as well as much of its marketing much more clear.)

6. Founders' and directors' needs

LendInvest was founded by a company called Montello, and Montello itself has set up many companies. I stopped counting when I found 10 of them, such as Montello Development Finance Partners Limited, Montello Capital Advisors Limited and Montello Capital Partners Limited.

David of LendInvest says he's not with Montello, but as he understands it there is a separate company to lend different pots of money.

Each business or partner that wants to invest in Montello loans might get its own Montello company to house it in.

And new companies have been needed as Montello has grown and changed direction. Sometimes not all the Montello partners will have wanted to take part in a new big deal, so this is also managed with a new company.

While Montello is a separate business to LendInvest, it is Montello that initially finances all, or at least the majority, of the loans through LendInvest.

Montello lends to the borrowers first and then LendInvest buys parts of those loans off Montello when individual lenders decide they want to invest.

Parallels outside of peer-to-peer lending

The three P2P lending websites mentioned above all do bridging loans, among other things.

A quick comparison with non-P2P lending companies that offer bridging loans – so ordinary bridging loans companies – you'll see that they also have many different companies listed at Companies House (the UK register of companies)

So multiple companies is not unusual.

It looks okay so far

From what I've seen so far, there doesn't seem to be any cause for concern in the webbed structure of these P2P lending companies.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Wellesley & Co., and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.