See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

6/9/15: Safest Peer-to-Peer vs Savings Accounts

Last updated on 6 September 2015.

There's not much point lending your money if you can get similar rates with savings accounts and cash ISAs!

That's why it makes sense to compare the P2P lending interest rates to the very best savings accounts and cash ISAs (tax-free savings accounts) on the whole market.

Skip to the end of this article for a quick list of the risks, pros and cons of P2P lending versus savings accounts. And please go to Get Started With The Safest Peer-to-Peer Lending Websites to see how we classify these as “safest”.

Find the right account

Look to the contents on the right for the type of account you want (e.g. easy access, three-year fixed rate and so on).

We even include the special kinds of savings accounts that don't normally show on savings comparison tables (e.g. inflation-linked savings, when available). Please let us know if you spot one you think we're missing at editorial@4thway.co.uk

We only exclude savings accounts that are difficult to open or operate, or that have tricky small print.

All interest rates are annual rates.

The best easy access accounts on the market

“Easy access” means you can get your money back at zero cost in just hours or days, either online or by telephone, with unlimited withdrawals.

Best easy access peer-to-peer

Landbay* (read summary): 3.56% per year (see notes)

Best easy-access savings account

KentReliance Easy Access Account (issue 10): 1.65% per year (see notes)

RCI Bank UK Freedom Savings Account: 1.65% per year (see notes)

ICICI Bank HiSAVE SuperSavings Account (issue 1): 1.55% per year

Best easy-access cash ISA (tax-free savings account)

National Savings & Investments Direct ISA: 1.5% per year (no transfers in)

Post Office Online Easy Access (issue 2): 1.41%

Notes

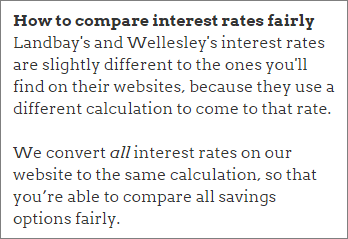

Landbay's interest rate tracks the Bank of England base rate + 3%. The figure is slightly higher here than on its website because Landbay doesn't account for you earning interest on top of interest.

Bear in mind that to get your money back in peer-to-peer you need to sell your loans to someone else.

There is usually someone to sell to within 24 hours or, at most, a few days. There could be some tougher times, e.g. when there are rising job losses and more lenders want to call in their loans to get to their savings.

RCI Bank deposits are protected by the French Deposit Protection Scheme, not the UK's.

Kent Reliance Building Society has an unusually high minimum savings amount of £1,000.

The best one-month accounts on the market

One-month accounts are for those of you who want to be able to get your money back within one month and are operated over the internet or by phone – or by post if the deal is exceptional.

Best one-month peer-to-peer

RateSetter (read summary): 2.8% per year

Best one-month savings account

Charter Savings Bank 30 Day Notice (issue 1): 1.4% per year

Best one-month cash ISA (tax-free savings account)

Aldermore 30 Day Notice Cash ISA: 1.3% per year

About one-month accounts

Charter Savings Bank and Aldermore have unusually high minimum savings amounts of £1,000.

The best one-year accounts on the market

One-year fixed accounts are for those of you who want to save or lend for one year at fixed interest rates. We show internet and phone accounts – and postal accounts if the deal is exceptional.

Best one-year peer-to-peer

RateSetter (read summary): 3.7% per year

Best one-year savings account

Kent Reliance 1 Year Fixed Rate Bond (issue 34): 2.1% per year (see notes)

BM Midshires 1 Year Fixed Rate Bond: 1.9% per year (see notes)

Saga 1 Year Fixed Rate Savings: 1.75% per year (see notes)

Nationwide 1 Year Fixed Rate e-Bond: 1.65% per year

Best one-year cash ISA (tax-free savings account)

Al Rayan Bank 12 Month Fixed Term Cash ISA: 1.9% per year (see notes)

Tesco Bank Fixed Rate Cash ISA: 1.75% per year

About one-year accounts

Al Rayan Bank and Kent Reliance have unusually high minimum savings amounts of £1,000.

The BM Midshires account can be opened online or by telephone, but to withdraw your money you have to notify them by post.

Saga's account is for over 50s only.

The best three-year accounts on the market

Three-year fixed accounts are for those of you who want to save or lend for three years at fixed interest rates. We show internet and phone accounts – and postal accounts if the deal is exceptional.

Best three-year peer-to-peer

RateSetter (read summary): 5.4% per year

Lending Works* (read summary): 4.8% per year

Landbay* (read summary): 4.4% per year

Zopa (read summary): 3.8% per year

Best three-year savings account

Charter Savings Bank Three Year Fixed Rate Bond: 2.55% per year (see notes)

Virgin Money Fixed Rate e-Bond (issue 145): 2.25% per year

Best three-year cash ISA (tax-free savings account)

Virgin Money Fixed Rate Cash e-ISA (issue 135): 2.25% per year

About three-year accounts

Charter Savings Bank has an unusually high minimum savings amount of £1,000.

The best five-year accounts on the market

Five-year fixed accounts are for those of you who want to save or lend for three years at fixed interest rates. We show internet and phone accounts – and postal accounts if the deal is exceptional.

Best five-year peer-to-peer

RateSetter* (read summary): 6.3% per year

Lending Works* (read summary): 6.1% per year

Zopa (read summary): 5% per year

Best five-year savings account

Secure Trust Bank Five Year Fixed Rate Bond (issue 22): 3.08% per year (see notes)

Virgin Money Fixed Rate E-Bond (issue 142): 2.51% per year

Best five-year cash ISA (tax-free savings account)

Virgin Money Fixed Rate Cash E-ISA (issue 134): 2.51% per year

About five-year accounts

Secure Trust Bank has an unusually high minimum savings amount of £1,000.

About the peer-to-peer lending opportunities

About Landbay

Lend to successful buy-to-let borrowers. Landbay can repossess the buy-to-let properties and sell them to recover your money, if necessary. All loans are for no more than 80% of the estimated property value and averaging less than 70%. All properties produce rent at least 25% higher than the monthly loan costs. Landbay has a small bad-debt provision fund.

We're waiting for a few small details from Landbay to finish calculating its 4thWay® Risk Rating**, but we're confident that it is comparable to the other P2P lending opportunities mentioned here. No one has lost money through Landbay.

Visit Landbay* or read more in Get Started With The Safest Peer-to-Peer Lending Websites.

About Lending Works

Lending Works is highly selective of its borrowers. Just 5% of loan applications turn into loans. Lending Works has a moderate-sized bad-debt provision fund and its the only consumer P2P company to have insurance to cover losses if a borrower is unable to pay due to unemployment or accident.

Lending Works has a calculated 4thWay® Risk Rating** of just 13: again, not far off the top scores of 0-8 out of 50 for savings accounts.

No one has lost money through Lending Works.

Visit Lending Works* or read more in Get Started With The Safest Peer-to-Peer Lending Websites.

About RateSetter

No lender out of around 18,000 lenders has lost money on RateSetter in the four years since it started.

This is partly down to it offering loans to “super-prime” borrowers only. These borrowers are mostly individuals, but now perhaps 20% of its loans are business and property loans, which are further up the risk scale.

RateSetter lenders' zero losses are also down to its very big bad-debt provision fund.

Due also to its long and outstanding record, RateSetter has the lowest 4thWay® Risk Rating** of 10/50, very nearly as safe as savings accounts (which have a maximum rating 8/50).

Visit RateSetter or read more in Get Started With The Safest Peer-to-Peer Lending Websites.

About Zopa

Zopa is the oldest P2P lending website in the world and probably the only one to have gone through a deep, deep recession and yet come out with a gold medal.

It has a ten-year record of low losses and, indeed, zero losses since it created a bad-debt provision fund. Since 2010, bad debts have average a meagre 0.25% per year.

Its calculated 4thWay® Risk Rating** is 12/50, making it nearly as safe as savings accounts (which have a maximum rating 8/50).

Visit Zopa or read more in Get Started With The Safest Peer-to-Peer Lending Websites.

Important differences between savings and peer-to-peer lending

- Tick for savings! Savings accounts (including cash ISAs) are safer than even the safest peer-to-peer lending companies from a sudden crash and economic disaster.

- Tick for peer-to-peer lending! However, you're far, far more likely to preserve and even grow your wealth with peer-to-peer lending, because the interest rates you can get with savings accounts and cash ISAs are, usually and on average, too low to keep up with rising prices.

- Tick for peer-to-peer lending (sometimes). Many P2P lending companies will allow you to get out of your loans and get all your money back early without cost. (From those above, that includes Landbay) However, if lots of lenders want to leave at the same time, it could still take you a while.

- Cross for savings. To get reasonable rates, you usually have to tie your money in for many years. You pay high penalties for leaving longer and fixed deals early.

- Cross for savings. You can usually expect interest rates on savings accounts and cash ISAs to be lowered at the earliest opportunity. This will be as soon as a fixed period is over or when the bank has hit its new deposits target.

- Cross for peer-to-peer lending. Not all the safest P2P lending companies will always remain the safest. This is the key difference that makes them not the same risk as savings accounts. Sometimes, these businesses will come under intense business pressure to weaken their safety standards and the less disciplined ones will do so. If you sign up to our newsletter, 4thWay® will keep you up-to-date on whether standards have slipped, so you can avoid lending in their newer, riskier loans.

- Cross for peer-to-peer lending. Normally you can sell your loans easily and get your money back quickly. However, during severely bad circumstances, you might not be able to get access to your money for weeks or months, or to do so you might have to sell them for less than they're worth to another lender.

- Cross for peer-to-peer lending. If you want to keep all your money on loan, you need to re-lend your loan repayments and interest. Although this is usually quick, it can sometimes take days and even longer. This effectively lowers your interest rate from the quoted rate, but probably just by a few tenths of a percentage point each year, on average.

Landbay is an exception to that last bullet point: you receive interest from day one.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Funding Circle, Landbay, Lending Works and RateSetter, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or when you make an investment, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

Sources: I used 4thWay® data for the best peer-to-peer lending products. I used Moneysupermarket, Which? and Comparethemarket data, and my own research, to find the best savings products.