HNW Lending Review

Security consistently shows its worth, directors take first loss of 10% and interest paid out on closed loans has been 20+ times losses - yet lots to understand before lending.

HNW Lending's Manual Property & Asset Lending Account, averaging 48% LTV after directors taking first loss, received an Exceptional 3/3 4thWay PLUS Rating.

This manual lending account is paying around 9.04% interest and the average lent is just 48% of the valuation of the borrowers' properties.

Its auto-lend account pays 7.00% with additional borrower interest covering rare losses and also has the 3/3 4thWay PLUS Rating.

The minimum lending amount is high at £10,000 (£5,000 in the IFISA), although you can choose to spread this automatically across at least 15 loans.

Visit HNW Lending* or keep reading the HNW Lending Review.

When did HNW Lending start?

HNW Lending has completed £150 million across more than 550 loans since 2014.

Most of its loans are property loans, particularly short-term bridging loans, although it also completes loans against expensive cars or other items.

What interesting or unique points does HNW Lending have?

At least one HNW Lending* director co-lends in almost every loan, now taking the first loss of 10% or more in most loans.

If a loan goes bad and it can’t be fully recovered, the first thing that will happen is that the directors lose their share before anyone else suffers any consequences. Its founders and shareholders currently lend over £3 million in the same loans as everyone else, which is a large amount of skin-in-the-game.

Furthermore, it’s not unusual for a director to buy out a lot more of a loan that is currently in trouble, again taking first loss on that share.

HNW Lending frequently offers loans that are a fraction of the valuation of the property security.

4/10 loans are for less than half of the property valuation, after first loss. Lenders who spread their money equally across all of those loans are earning 8.22%.

It’s a roller coaster for lenders, however, as huge numbers of loans suffer problems and it takes a long time for them to be recovered – although ultimately recoveries have been exceptional to date.

Lenders get unusual personal service: you can ask for updates on your own specific loans by emailing kim@hnwlending.co.uk.

How good are its loans?

Borrowers are typically property rich but cash poor. They put up valuable properties as security, often valued around twice that of the loan amount, and then nearly 4/10 borrowers suffer problems repaying on time. Long court battles ensue with some of the larger bad debts.

As a result, over a third of the loans that HNW Lending classes as bad debts (defaults) take two to seven years beyond their initial planned repayment date and/or their date of default to be settled.

Roughly half of the loans approved by HNW Lending are junior, meaning that a bank or some other lender gets its money back first, plus its interest, if a property needs to be forcibly sold.

The overall quality of HNW Lending’s security has been proven time and time again. Six full annual cohorts of loans have matured. Each time, HNW Lending has swiftly gone after all of the bad debts and the security, recovering almost all of the large amount of bad debt.

In other words, even the bad debts have paid for themselves many times over – and that’s before adding on all the interest in the loans that remained good.

HNW Lending can be loose in how it approves some loans, where it appears that property or items are clearly worth a lot more than the loan. This helps it find more loans for lenders that will pay decent interest rates. To offset the additional risk, the expected valuation of the property compared to the loan amount usually needs to be considerably higher than normal.

How much experience do HNW Lending’s key people have?

Its key decision maker – who’s also the CEO – had a decade’s property experience prior to HNW Lending. A trained former chartered accountant, his property background doesn’t hold identical skills and experience to those we’d expect. However, we’ve followed his learning curve over ten years at HNW Lending and seen some gradual improvements.

The CEO clearly works very hard to prevent lenders from losing money and he puts his money where his mouth is. With the biggest problem borrower in its first three years, for example, after recovering much bad debt, he ensured it was only him who had any money left on the line, with all P2P lenders repaid. This has happened several times now.

I would still like to see a wider variety of professionals working for HNW Lending.

HNW Lending review: lending processes

HNW Lending mostly sticks to property or items it understands with a maximum loan of 70% of their value, and 65% in junior loans, which is a sensible limit.

Unusually, it doesn’t always obtain independent valuations of property, vehicles or other assets used as security. However, it will only consider skipping the full valuation in special cases, such as when the estimated value is over double the loan amount.

Valuables used as security are insured and stored securely by HNW Lending.

Borrowers usually pay interest on a monthly basis which can be a useful early-warning system of potential trouble repaying later on.

HNW Lending is super quick to label a late debt as a default (aka bad debt) and to start pursuing the borrower for it vigorously, although it still takes longer to recover many debts than its nearest competitors.

Starting fast is good, but HNW Lending’s own loan terms, target borrower market, aggressive loan sales policies and other techniques used to defend or support its interests do appear to leave more motivation and means for borrowers to drag bad debts out for longer in the courts.

History has shown my colleagues who have assessed bank lending for decades that, the longer recovery procedures last, the more likely it becomes that there will ultimately be losses. Thankfully, that pattern hasn’t yet occurred at HNW Lending after all these years.

At the end of 2020, HNW Lending explained tighter lending standards to reduce the number of loans that turn into bad debts in the first place, to ensuring borrowers meet the regular interest payments and that they are able to repay in full at the end.

In particular it now undertakes more detailed assessments of the borrowers, regarding their creditworthiness. It’s tricky to statistically identify whether the increased scrutiny of the borrowers and the ability to repay at the end – and therefore relying less on the properties alone – has led to improvements. However, it appears that there has been something of a reduction in problematic loans – at least in typical years.

How good are HNW Lending’s interest rates, bad debts and margin of safety?

Almost all loans that turned bad have historically been recovered in full – complete with additional interest. For example, just £500,000 of the first £68 million lent through HNW Lending has been written off (less than 1%).

HNW Lending* repeatedly defies gravity. Each year has had high bad debts – 30%, 40% or even 50%+, before recoveries start coming in. While this is not good for lenders’ mental health, HNW Lending has so far gone on to recover virtually all of the amounts due. There have been four or five waves of those rising and falling bad debts as the recoveries come in over several years. Lenders are still paid interest for the entire period the loans are outstanding, and usually they get that interest in full, too.

Even by their usual standards, it’s recently been a tough period for many borrowers of the specific type and quality that HNW Lending lends to and the current wave is probably the worst yet, but not to the extent yet that I worry bad debts will overwhelm returns.

That opinion comes with the caveat that HNW Lending is much more complex to assess than most providers. Just for example, new lending has been lower in recent years, leaving a large imbalance of more bad loans in recovery than in good standing, which could impact the overall level of returns for lenders.

However, the average loan size of the outstanding bad debts, after HNW Lending’s own first loss, is 44% of the property valuations. (That figure is slightly flattering, as it doesn’t take into account that some bad debts have partly been repaid by selling some of the properties used as security, when the borrower used more than one property.)

In 4thWay’s very harsh, conservative interpretation of the Basel stress tests – which are tests global banks are required to do to assess whether their loans are strong enough to handle a recession and property crash – HNW Lending’s loan book comes out well.

Overall, the margin of safety still looks good, provided you spread your money out across a score or more loans (either manually or through auto lending) to contain risks.

Commentary on both recent and historical bad debts

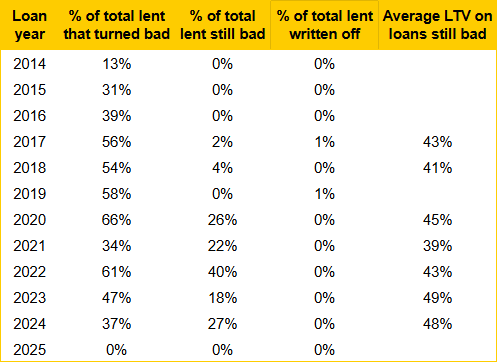

LTV means loan-to-value and is how large the loan is compared to the property valuation, e.g. a 48% LTV on a £48,000 loan means the borrower’s property has a £100,000 valuation.

LTV means loan-to-value and is how large the loan is compared to the property valuation, e.g. a 48% LTV on a £48,000 loan means the borrower’s property has a £100,000 valuation.

Pandemic followed by property market, inflation issues, construction industry problems, court-system backlogs and HNW Lending court-claim problems have caused more loan problems and delays in recovering bad debts in recent years, especially impacting 2022 loans.

This likely stretched out the length of time that HNW Lending has needed to recover some debts, as recovery timelines have worsened on many loans.

Generally, open court cases are plodding in the right direction as usual.

While we don’t yet have legal clarity, several appeals and cases won by HNW Lending this year remove some of the doubts revealed in HNW Lending Wins Ruling, Contra To Lost Case Last Year.

And, for those of you who have been following that story, an outside lawyer has provided a very brief opinion to 4thWay that adding in a named lender on those claims (to replace the anonymous lender “1” that HNW Lending has been using in court) should be an easy thing to do.

You can see the general trend in that table above. Huge amounts of loans at HNW Lending – usually around half – turn bad at some point. After many years tick on, the oldest loans have been fully recovered with 0% to 1% of the total lent written off. Lenders earn interest while the loans are outstanding bad debts.

Prior to those recoveries, you see the trend of the bad debts rising and then starting to fall as HNW Lending fights hard to recover money from borrowers who tend to resist hard in the courts.

E.g. for loans issued in 2020, well over half the bad debts are now recovered and for 2021 it’s a little over a third. For 2022 it’s not yet a third, as less time has passed to win court cases, win appeals and repossess and sell properties.

As more time passes, more of the profile of each of those will improve, just as they did in the five years prior to that (2015-2019): those years averaged 50% of the loan amounts turning bad, but hardly any losses resulted in the end.

Bear in mind that since HNW Lending is so quick to call a loan a default, and since 4thWay conservatively takes HNW Lending’s definition for much of our own analysis, it might inflate the scale of bad debts compared to some other providers.

Conversely, the loan-to-value figures in the above table are slightly flattering, as they don’t take into account when one or more properties taken as security for some of those borrowers has already been sold.

In short, the story of HNW Lending’s loans are always scary while they are happening, but the overall picture is that HNW Lending has continued to do what it has always done, and repay nearly everything to lenders in the end.

HNW Lending’s Auto Invest

Auto Invest currently pays 7% and spreads your money across at least 15 loans. When we have asked for an update on the number of loans, it has invariably been a lot higher than this. The spread across lots of loans is by far the best feature of the Auto Invest account.

In addition to the hefty first loss taken by one of the directors, some of the excess interest paid regularly by borrowers is held back for auto-lend lenders. This covers late repayments, missed interest payments, and ultimately makes up for bad debts that haven’t (yet) been recovered.

To date, lenders using auto-lend have always received the full interest due to them and all losses have been covered.

Auto-lend’s cash surplus from spare interest paid in by borrowers is often very small, although this is can sometimes be due to HNW Lending using the surplus to buy out exposure to the worst loans in advance of recovery procedures being completed.

As a lender, you should consider the surplus a nice bonus to help keep performance on track, rather than a major feature to reduce risks in a terrible property-market crash and recession. However, the surplus is not intended to be your main defence there – the property taken as security is, combined with the interest you earn which offsets any excess losses.

HNW Lending’s Manual Lending

Most money lent through HNW Lending* is done manually.

When choosing your own loans, lenders might expect to earn around 9.04%, which is more interest than auto-lend, at least in part because no interest is diverted to cover late payments or bad debts.

Losses will be unevenly spread for manual lenders who haven’t adopted sensible strategies for themselves in spreading risk across lots of loans. With manual lend, the responsibility not to put too much money into any one individual loan is entirely yours.

Has HNW Lending provided enough information to assess the risks?

HNW Lending* is transparent with 4thWay, sharing a great deal of detailed information and data with us. It’s quick to respond to our questions. Its history is deep enough for our full risk-modelling techniques (enabling us to assess it for a 4thWay PLUS Rating).

P2P lending providers with loans like HNW Lending require a very close eye from 4thWay, because in the nature of them you can easily miss swelling problems – or conversely misinterpret their typically huge initial bad debts with a catastrophe when actually they are highly resolvable. There is more room for error or misforecasting here than just about anywhere else.

I particularly take my time when I’m leading the reassessment on HNW Lending to slice data in many ways, meet with HNW Lending and receive additional qualitative reports, and to reduce the chance of error in analysis and judgement for this very complex loan book, which is not of the best quality in terms of accuracy but still good enough when interpreted in the most cautious way possible.

While 4thWay gets detailed information, HNW Lending should provide much more information and statistics on its website directly to potential lenders, particularly on the proportion of outstanding bad debts, so that lenders can better understand the types of loans they’re getting into.

Information available to non-registered users of the HNW Lending website lacks clarity on such things as its first-loss cover, auto-lend interest rates and late loans.

To signed-in lenders, HNW Lending provides detailed information on each loan. It shows them the current status of each loan, including late or bad loans that are held in the auto-lend account, as well as information on the first-loss paid for by an HNW Lending director.

In addition, lenders get a detailed creditworthiness assessment for each loan, showing how the borrower can afford the monthly payments and repay at the end. Plus, for outstanding bad debts, HNW Lending provides comprehensive monthly updates to lenders. This is an important and desirable feature that is often missing in peer-to-peer lending.

Is HNW Lending profitable?

HNW Lending’s published accounts are too abbreviated to reveal much.

However, it’s highly plausible – and even likely – that HNW Lending is accurately telling us that it has made million-pound profits for at least five or six years. (That’s before dividends, which are payouts to directors from profits.)

The spread between what lenders are paid and what HNW Lending charges borrowers is sufficient, and HNW Lending’s own cost base likely low enough, that it is probably highly profitable.

What is HNW Lending’s minimum lending amount and how many loans can I lend in?

If you want to use auto-lend and earn a target 7%, it currently spreads a minimum of £10,000 across at least 15 loans, and typically over 30-40 loans, with a maximum of 10% of your money in any one loan. If you use the IFISA, the minimum you can put into it is £5,000.

If you prefer to pick individual loans yourself for around 9%, it’s very exclusive, with a high minimum of £10,000 in each loan you lend in. This reduces to £5,000 per loan for HNW Lending’s IFISA.

What more do I need to know?

Be prepared for a wait to receive your money back

Manual lenders can have a long path to getting all their money back when loans turn bad. You do earn interest while you wait perhaps six months to two years (sometimes longer) for legal procedures to be completed.

Auto-lend lenders potentially face that same issue, if lots of lenders want to sell at the same time.

Regulatory and legal structure

HNW Lending approves nearly all loans using the most typical, standard P2P agreement, which is regulated by the FCA. It also approves other loans using other structures that simulate the P2P, direct lending structure. Both structures are common.

It’s unusual for there to be a blend of structures, but the reasoning is straightforward: the regulator requires that HNW Lending’s IFISA uses P2P agreements, while the alternative structure sometimes used in its P2P lending account is easier and incurs fewer costs for HNW Lending.

Moral hazard

Since 2024, 4thWay promised consumers of our reports that we’d start writing more on each provider about the scale of potential “moral hazard”, because we have learned over time we can give a little more weight to our judgement of the evidence.

Moral hazard is an expression I learned about in a former life: it’s used in insurance to mean the total weight of evidence – often circumstantial and superficial – that speaks against the character of the people involved, which might potentially lead to an unpleasant surprise. For our purposes here, that means considering the level of moral hazard in those running HNW Lending.

HNW Lending is by its nature a wheeler-and-dealer, which is fine when the loan size is not unreasonable compared to the property and when the lending rates are sufficient, but it also begins to build the picture – potentially – of the type of person who would want to approve such loans.

HNW Lending routinely provides poor quality data, rarely seems to directly acknowledge or admit mistakes, has unusually intense court battles with borrowers and has suffered unusually close scrutiny from the financial regulator in the past.

An independent lawyer 4thWay consulted didn’t at all seem perturbed by the judge’s comments about HNW Lending’s director that I reported on in this page, nor about the judge finding that HNW Lending had created a regulated loan even though it wasn’t authorised to do so. Nevertheless, those sorts of items would make it onto any insurance provider’s list of so-called “moral hazards”.

I have to say though that the director’s mature response to this most recent update – including the moral hazard section – is a tick on the positive side.

We will continue to monitor HNW Lending vigilantly to do our best to see that it’s maintaining standards.

Conflicts of interest

HNW Lending charges very high level of penalties to borrowers whenever they go late – and it keeps that revenue itself.

We don’t know how often HNW Lending charges the default interest. A long time ago we were told it’s not charged often and yet we know from individual cases from other sources that borrowers rack up huge interest bills and are charged from the point of default, which is declared swiftly.

It’s potentially a lot of money, since such a very large proportion of the loan book is quickly put into default when the property-rich, cash-poor borrowers are a few weeks late.

So it’s possible that it is earning two times what lenders earn, and that 2/3s of its revenue is due to the penalties. That level of revenue is not necessarily obscene for these kinds of loans, and for the overall package offered to lenders by HNW Lending in terms of risk-reduction features.

Yet the fact that income is possibly heavily weighted around bad-debt penalties causes a potential conflict. This could reveal itself in lower quality loans for example, as HNW Lending can earn bigger fees when loans turn bad.

It can also cause deliberate feet dragging to get claims through the courts, in order to rack up greater penalties for borrowers. All else being equal, the longer a recovery takes, the worse the prospects for full recovery (and it’s worse for the borrower too).

HNW Lending has indicated in the past it will pay individual lenders from its own earnings on a loan before individual lenders lose money on it, which is a useful feature – although not one that mitigates the conflict of interest.

(Note that a court in a case involving another online lending platform some years ago stated that lenders should be paid the default interest and charges and it shouldn’t be kept by the P2P lending provider. However, HNW Lending structures its default charges in a different way; a fresh court case and ruling would be needed to determine whether the same should apply to it.)

Well done for making it through this long and relatively complicated HNW Lending Review!

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from HNW Lending and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.