CapitalStackers Review

Attractive opportunities for active lenders to pick high-quality loans with very large profit potential

CapitalStackers' Property Lending Account/IFISA currently has two alt ratings of secured and hidden gem, as we have no doubt it will receive the top 4thWay PLUS Rating soon, when its history is sufficient.

These loans have been paying lenders an average 13.41% interest after bad debts.

Visit CapitalStackers* or keep reading the CapitalStackers Review.

What does CapitalStackers do?

CapitalStackers* does development loans with its lenders taking the junior position. This means that another lender – typically a bank – will get its money back first if there are issues with the loan. It also does some bridging loans.

When did CapitalStackers start?

CapitalStackers matched its first P2P loan in March 2014. Lenders have lent £42 million.

What interesting or unique points does it have?

CapitalStackers’ high interest rates have been backed by exceptional results. This has led to average returns of 13.41%. The lowest return has been an outstanding 5.64% and the highest a whopping 30.60%.

CapitalStackers puts it fees on the line first and the directors invest very heavily in the loans themselves, especially in the riskier layers.

The directors and close family have always lent a large amount of money in the same loans. Still today, they do 1/4 of the lending. They lend alongside you through the same online lending platform, so they put their wealth firmly on the line.

CapitalStackers focuses on an interesting area that is still less common in P2P, and where other providers have had hit-and-miss results.

Its focus is on providing the additional cash over and above that provided by banks to complete developments.

The banks used to offer these loans too, but have pulled back considerably since the Great Recession, leaving developers short of the funds they need to get developments completed.

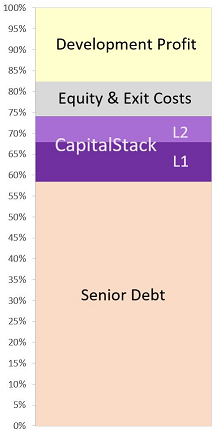

“CapStack” lenders might typically put their cash down first, e.g. to assist a property developer in buying the land. Yet you’ll be just second in line for being repaid in the event a loan goes bad. So you’re behind another lender such as a bank (which provides the “senior debt”).

You may also be third in line, if CapitalStackers splits the loan into two layers. Lenders who choose to take the higher risk in third place earn higher interest rates.

It doesn’t stop there, as loans can be split into as many as five layers.

As the junior lender in most development loans, you’re paid considerably more interest. CapitalStackers* passes on substantially more of the rewards to lenders than other P2P lending companies doing similar loans.

CapitalStackers review: how good are its loans?

The average loan size is just 64.38% compared to the expected sale price of the completed developments.

That helps to give solid cover if issues cause development costs to rise, or if the property needs to be repossessed and sold, or sold in a hurry at a cut price.

On average, senior lending is for the first 36.60% of total lending to the borrower, when compared to the estimated value of the finished development.

If you exclude loans where lenders through CapitalStackers are the senior and junior lenders, and just include those where high-street banks are senior, the senior part on average is more like 55%.

On those loans, the total lent reaches about 70% or even 80%. If a property were to be sold for half the expected price, you could expect to lose all your money in that loan. Now you can see why CapitalStackers awards such high interest rates to lenders.

But that only tells part of the story. The borrowers are very high quality and when things go wrong the borrowers and CapitalStackers have shown the agility to adapt the development plans and pull through. Plus, CapitalStackers builds in an enormous runway in case of development or property sale delays, or for higher costs.

How much experience do CapitalStackers’ key people have?

CapitalStackers’ team is right up there as one of the most competent we have seen. It has many decades of relevant banking experience, it has high standards, including ethical standards, and it does appropriate risk modelling using professional firms. It covers all the bases.

Whenever borrowers have suffered any issues, CapitalStackers has proven themselves to be talented at finding ways to help developers get their projects completed and the properties sold.

I’m very happy to have these people providing high-interest investments.

CapitalStackers review: lending processes

CapitalStackers works closely with high-street and specialist banks to arrange the deal, where the bank is the senior lender and CapitalStackers’ lenders are the junior ones.

Funding for developers is fully arranged in advance and disbursed in phases. At some P2P lending companies, there’s the risk that a developer completes part of a project, but then the money dries up for the remainder of the development work, because it’s not been fully agreed or raised in advance. So I like seeing that it’s all settled up front.

All the development loans have planning permission. As well as using its own considerable experience, CapitalStackers gets independent valuations on all properties and developments.

CapitalStackers* takes diligence in assessing loan applications, and monitoring loans and developments, to a whole new level – beyond the comprehensive assessments we would usually expect for these kind of complex, high-interest loans.

They understand the borrowers and have a far better understanding of the numbers than we usually expect – or even require – to see for these sorts of loans.

Their expertise has enabled them to help developers to complete projects and sales when unexpected issues have arisen. CapitalStackers has shown the skill and ingenuity that we would hope for in responding quickly and helping the developers get their projects back on track.

How good are CapitalStackers’ interest rates, bad debts and margin of safety?

All loans issued in CapitalStackers’ first six-and-a-half years have been fully repaid with full interest. Some of those loans went very late, but those delays are normal and expected in most development lending, and the proportion of loans going very late is well within sensible bounds.

Quite a few loans issued back in 2022 are seriously delayed or soon will be, due to inflation, construction worker shortages and property-market issues. That is the first year to have had severe issues across a high proportion of loans.

Also, as of the beginning of 2025, for the first time in ten years, two outstanding loans in the riskiest layers of the stack now seem likely to lose money, as their prospects worsened through 2024.

In one of those loans, CapitalStackers’ management and the borrower directors will lose all their interest and most of their lent amounts, as they are in the riskiest layer. At present, all other lenders are still shielded from the expected losses, as they sit in safer layers further down.

The other bad loan now might see full losses of interest and lent amounts for CapitalStackers’ management in layer four, and for all lenders in the next riskiest layer – layer three. The layer beneath that – layer two – can now possibly expect some loss of interest.

Thus, for the first time, ordinary lenders using CapitalStackers’ online lending platform can expect some losses. That loss appears to be roughly equal to 1.5% of the total lent through CapitalStackers.

It was inevitable that lenders would lose money at some point in some CapitalStackers loans, especially as you’re receiving very high interest rates for very junior lending to developers. These losses are therefore well within expectations, considering the difficulties faced by borrowers who started in 2022.

Interest earned by lenders so far has been 16 times those potential losses for individual lenders.

CapitalStackers doesn’t yet have the history behind it for us to do our bank-like tests of its loans in a severe recession or property crash. Yet I’m certain that it will pass those tests easily and receive 4thWay’s PLUS Rating of 3/3, “Exceptional”.

This means this hidden gem will one day become the highest-paying account to have earned the top rating.

With the risks so well managed, lenders who take the time they need to spread across as many loans as they can will be lending with an excellent margin of safety.

Has CapitalStackers provided enough information to assess the risks?

CapitalStackers is exceptionally transparent with 4thWay. It provides a huge amount of access to its people and supporting information. It goes so far as to give us the information it submits to the financial regulator and a whole lot more, giving me a lot of confidence.

With lenders, too, CapitalStackers now provides pretty clear and comprehensive statistics, and it does its best to explain how these complex loans work. I would encourage you to give the decision makers a call to discuss their statistics and individual loans; it’s an opportunity you can’t get with all P2P lending providers.

Is CapitalStackers profitable?

CapitalStackers* is already profitable – a rarity at the moment in the burgeoning P2P industry – and indeed it has been for many years now. It’s a small business but with very low costs, making it seemingly easy to sustain.

It has backing from an accountancy firm. It has a network of connections that we believe will enable it to expand and grow further, offering more loans as more lenders are attracted to it.

What can you tell me about CapitalStackers’ cybersecurity?

A soft security probe of CapitalStackers’ lending portal finds it to be in good health with no apparent malware. It is marked clean by Sucuri, Google Sage Browsing, McAfee and other internet and security technology providers.

CapitalStackers’ website is secure and it automatically directs you to a secure version of its site.

Its website technology is up-to-date and it runs a firewall to monitor and if necessary block information going into and out of the website.

Is CapitalStackers safe and a good investment?

If you want to choose just one potentially very high-return investment for your lending and investing portfolio, CapitalStackers* is the one.

An extremely professional business and with heart to go with it – I think you’ll find it hard to find a borrower or investor who feels let down by CapitalStackers in any way.

What is CapitalStackers’ minimum lending amount and how many loans can I lend in?

The minimum lending amount at CapitalStackers is £2,500 in each loan, which is high compared to most P2P lending companies. When you’re buying second-hand loans from other lenders, the minimum drops to £500.

CapitalStackers currently approves relatively few loans, but you don’t have to transfer money until the loan is fully sold. You’ll need to take quite a few months to spread your money across more loans.

Does CapitalStackers have an IFISA?

Yes, CapitalStackers has an IFISA.

Can I sell CapitalStackers loans to exit early?

Yes, you can sell your loans to other lenders, if they want to buy. CapitalStackers doesn’t charge for this, although it reserves the right to do so in future.

As the development progresses, the certainty of successfully completing the project increases. Therefore, with CapitalStackers’ loans, the risk of losses falls considerably as the months go by.

As a result, you can often sell your loans for more than you paid. The lender who buys your share effectively gets a lower interest rate that better fits the lower risks, and you increase your total profits. Read more in The Safest 20% Returns In P2P Lending.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from CapitalStackers and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.