See why 4thWay now accepts ethical ads.

Crowd BTL Investing: Landbay vs CrowdLords

Landbay* is a P2P lending website that allows you to lend your money to experienced buy-to-let investors.

CrowdLords is not P2P lending. It's being a buy-to-let investor yourself, albeit as part of a crowd of landlords sharing a property.

Note that CrowdLords is for people classified as “high-net worth” or “sophisticated investors”. Still, the following article might interest you because much of it is still relevant if you want to know the difference between lending to landlords through P2P websites and becoming a landlord yourself.

BTL lending (Landbay) is lower risk

Lending to landlords is lower risk than being a landlord yourself, which means, everything else being equal, Landbay is lower risk than CrowdLords.

The main reason is that you're higher up the food chain if the property needs to be sold when something has gone wrong. After the sale, you get your money back first, including interest, then banks and other lenders do, and, finally, if there's any money left, the landlords get some or all of their money back.

If Landbay didn't know what it was doing or if it was deliberately aiming for higher-risk lending, the above might not have been true. But Landbay is highly selective of the landlords it allows to borrow and the properties must be earning at least 1.25 times the mortgage payment in rent.

In addition, the most that Landbay* will allow landlords to borrow is 80% of the estimated value of the property, giving individual lenders a safety net in case the property needs to be repossessed and sold.

BTL investing (CrowdLords) is higher reward

Precisely because it is lower risk, Landbay's mortgages pay you less too.

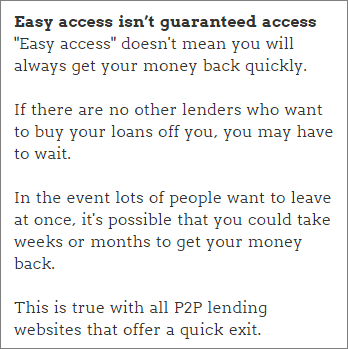

You are currently offered 3.56% for easy access (see sidebox) or 4.4% for a three-year fixed deal, with the protection of a modest bad-debt provision fund and the substantial protection of the property itself.

access (see sidebox) or 4.4% for a three-year fixed deal, with the protection of a modest bad-debt provision fund and the substantial protection of the property itself.

CrowdLords, on the other hand, is offering projected returns of between 6% and 8% on the three properties currently available for you to become a joint BTL owner in right now.

That estimated return of 8% per year might typically include 3%-4% per year in income from rent (after costs) plus a guess at how much profit you'll make on selling the property at a higher value in five years, e.g. 16%.

Even higher returns are available if you invest in developer-BTL properties, which means your investment helps fund the development and then, when it's completed, it turns into a BTL property that you co-own. There's one such property offering an estimated 16% per year, but the risks are also substantially higher.

CrowdLords isn't identical to BTL

CrowdLords properties come from other landlords, who pass on some of their ownership to you, so that they can buy even more properties

These landlords run the properties for you, so you don't have to.

On the downside, one of the attractions of being a BTL landlord is that you increase the rewards (and risks) by borrowing most of the money you need to buy the property.

Here's an example to clarify that. Say you have £100,000 to invest:

- If you buy a property for £100,000 with cash and the price rises 10%, you make £10,000.

- If you put your £100,000 down as a deposit on a £200,000 property, and that property rises 10% in value, you make £20,000, so you actually make 20% on the deal.

So your initial outlay is the same but you make twice as much money. Naturally, borrowing increases your risks considerably too.

Through CrowdLords, you miss out on the advantage (and risk) of borrowing to buy. That probably explains why the returns of 6% to 8% are a modest premium over many of the safest P2P lending websites for the additional risks involved.

CrowdLords is not selective

One thing that increases your risks is that CrowdLords doesn't select investments for you like Landbay selects its borrowers.

Even new and accidental landlords are allowed to offer you a share of their properties through CrowdLords. So it's entirely down to you to judge them.

This never happens in P2P lending, at least not yet, where borrowers usually have some very stiff, or at least reasonably stiff, checks that they have to pass before they're allowed to access your cash.

CrowdLords has virtually no history yet, so we'll watch it with interest – albeit from the sidelines, since it's not P2P lending and therefore not part of the 4thWay to save and invest.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Landbay, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.