How Investors Beat The COVID-19 Downturn With P2P Lending

In this special P2P Lending COVID-19 guide, read how savers and lenders can survive and thrive despite the COVID-19 outbreak. You'll learn about:

- The history of epidemics and downturns on P2P lending and other investments.

- The attitude to your investments that you need to adopt now.

- How to achieve your saving and investing goals in this environment.

- Balancing your investments today, while some providers are temporarily freezing loan sales.

- Which P2P lending accounts and IFISAs are going to beat the COVID-19 downturn.

I promise that anyone who gets to the end of this page will get a huge golden star. You have the patience of, well, a formidable investor!

Anyone I talk to has a different story about how the pandemic has affected them so far. Everyone seems to have different thoughts and feelings, but one of the most common ones is fear of the unknown.

Uncertainty – the unknown – is always present in our lives, including in our finances.

But there's a large amount that we can control. You can start like this: take a breather, calm yourself and try to react with less emotion to sudden events.

Next, it makes sense to look again at what your financial plans and goals are. Focus on what needs to be done to steer through short-term shocks – whatever they may be.

For we might not know what sudden shock events are going to happen, but we do know that they do happen…

When the shock happened

An article in the Harvard Business Review says:

“By all accounts, this recession is the severest since the Great Depression. The wave of bad economic news is eroding confidence and buying power, driving consumers to adjust their behavior in fundamental and perhaps permanent ways.

“They now realize that spending in much of Europe and the United States over the past two to three decades was built on a quicksand of debt and dwindling savings and home equity.

“In the ensuing meltdown, consumers face piles of bills, stagnant or falling incomes, and shrinking nest eggs.”

Does that sound like the effects of the pandemic to you? Well, that particular article was written in 2009 and it's referring to the financial crisis, otherwise known as the Great Recession.

What happened during that time is that stock markets and property markets crashed. Consumers didn't go on to adjust their behaviour in “permanent ways” – which bodes well for toilet-roll supplies when the pandemic is eventually over.

Despite the severity of that recession, investors who stayed the course did just just fine. Indeed, while every downturn is different, patient investors do better over time compared to those who react aggressively or wildly to news or events.

And another shock

I remember when a friend of mine was worried around that time, back in the financial crisis, about his Zopa lending. Bad debts started to pick up and he was beginning to get quite panicky. I told him to relax and keep doing what he was doing, putting a proportion of his spare cash in every now and then, and re-lending.

He easily withstood those years, which now look like a blip to him, where his lending returns were somewhat lower – although still positive.

Indeed, his Zopa lending ensured that the overall results of his entire savings and investments – which included many things – recovered from those troubles much faster than people who were investing in the stock market alone.

Getting some perspective

Do you know how pandemics and downturns have affected investors in the past?

Here is a historical perspective on shares, as well as both bank lending generally as well as P2P lending specifically.

When we write about bank lending below, we're talking about all their bread-and-butter lending, and not any of the complex, crazy investment products or super-sub-prime stuff they got into that caused all the chaos.

Just quickly, before you dig in to the details, remember that we're talking about broadly what has happened in the past. On the other hand, individual banks, individual P2P lending companies, and also individual lenders/investors with their specific portfolio of loans and investments, will all have had their own unique results.

So make sure in your P2P lending that you spread across a very large number of loans to reduce the chance of disappointing results through sheer bad luck.

Impact of viral outbreaks on the stock markets

None of the epidemics in recent history have had a noticeable impact on the stock markets.

The last virus to cause a severe downturn was probably the Spanish flu – which was so named because Spain was basically the only country to admit it was suffering an epidemic.

That was 100 years ago. The impact of this nasty strain of flu on investments is too tough to identify, because a world war was raging at the time.

Impact of downturns on the stock market

But, just as no virus is the same – and I think we can all agree SARS-CoV-2 is different – no downturn is the same either.

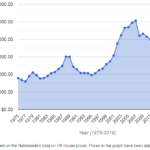

So we need to look beyond viral outbreaks to look more broadly at downturns from any cause. If you look again at the graph above, you can see that there were lots of little downturns and a few big ones, even though viruses had nothing to do with most of them.

The big one in the middle was during the Great Recession. Global investors needed about seven years to recover lost ground through rising share prices and dividend payments.

It took another few years for the average global investor to recover their previous highs in real terms, i.e. after taking into account the amount prices had risen during that period.

Most investors hadn't put all their money in at the very peak of 2007, so for most investors we're talking here about recovering lost ground, not recovering actual losses.

The average investor who had been investing regularly for three or four years already would probably have needed no more than five years to recover their losses.

Impact of downturns on bank personal lending

Stock markets are a lot more volatile than money lending, although each year of lending is a different vintage, which means that results are not identical from one year to the next.

We've shown you this chart from Liberum before, but it bears repeating.

We've shown you this chart from Liberum before, but it bears repeating.

By clicking or tapping on the graph, you can see that even during the low point of the financial crisis, banks continued to make money on their personal loans.

Indeed, the stability is quite remarkable if you're more used to stock-market investing. Banks made money on these loans every year for 20 years – and continued to do so after the graph ends.

Higher-risk personal lending also remained profitable in the period.

There's no source of data that enables us to separate out higher-rate/higher-risk personal lending results for the banks.

But a good proxy is credit-card lending, for which we do have data. See the graph.

Impact of downturns on P2P personal lending

Zopa is the oldest peer-to-peer lending company in the world, so its performance on personal lending extends back to the financial crisis.

Zopa is the oldest peer-to-peer lending company in the world, so its performance on personal lending extends back to the financial crisis.

Zopa shows in its very steady performance that it can easily compete with the banks.

It's not shown in the graph, but bad debts were less than 1% every year, except in 2008 when they reached closer to 3%. But still, as you can see, lenders earned a comfortable profit. Zopa sensibly put up rates between 2007 and 2010, and covered the higher losses. Indeed, the opportunity to charge higher rates led to higher returns for lenders in 2009 and 2010.

Read the Zopa Review.

Zopa was much smaller at the time and it's no longer the same as it was. Mostly because businesses that arrange loans need to expand up the risk scale as they grow. However, Zopa has consistently shown that it understands its borrowers well, estimating future bad debts with remarkable accuracy even as it has grown.

No other P2P personal lending website was around at the time. However, take a quick look at the returns paid out by RateSetter, the third oldest P2P lending company by just a month or two.

No other P2P personal lending website was around at the time. However, take a quick look at the returns paid out by RateSetter, the third oldest P2P lending company by just a month or two.

RateSetter started off just doing personal loans and these loans continue to be the far biggest slice of its business.

At least up until this point, every lender has received every penny they have expected to get, thanks to its successful reserve fund.

Yes, RateSetter was not around during the last severe recession, but the stably positive lending interest received has been comparable to banks.

I chose RateSetter as an example for another reason. It's one of the very few peer-to-peer lending companies that has said rates are mostly influenced by supply-and-demand, i.e. if lots of lenders want to lend it can push interest rates down.

It's told 4thWay that it sets no floor on interest rates and lets the market (lenders and borrowers) decide. Almost all other P2P lending companies set rates themselves. RateSetter lenders should therefore watch the rates.

The flipside of that is that you might, at some point over the course of the next 12 months, have a good opportunity to lend at very attractive rates through RateSetter. That's after lenders get scared, new lending during the crisis restarts, and the supply-demand balance shifts very much in the lenders' favour. That's another reason to watch the rates!

Read the RateSetter Review.

Impact of downturns on bank small business lending

Let's move on from personal lending and look to business lending.

It's not easy to get figures on run-of-the-mill bank business loans – the kind that are simple to approve, mostly through automated checks.

But you can pull out some broader business lending figures from banks' financial reports to shareholders. With a well-run bank like HSBC, you'll see that it made billions of pounds in profits on global business lending in each of the four years from 2007 to 2010. This includes more than straightforward small business loans though. Still, you can be sure that HSBC has consistently made profits off its commercial borrowers prior and since.

Royal Bank of Scotland was much-maligned during that last major downturn with good reason (such as its acquisition of the bank ABN Amro). Yet it also continued to do fine on its business lending.

Across all its different business lending segments it made a profit throughout the period. Its worst year was 2009, where its interest income was £2.3 billion and losses offsetting that were a little under £1 billion. This includes overdrafts and ordinary loans to larger businesses, which is different to most P2P lending.

If Royal Bank of Scotland is an average bank then about 40% of the corporate lending probably had some form of collateral. Plus, its invoice finance, which can include quite a large number of higher-rate loans, also remained positive.

As you could imagine, these four years include some of the toughest for business lending in many decades.

Impact of downturns on P2P business lending

No business P2P lending companies were around during the last downturn. P2P is doing similar kinds of straightforward lending as the banks, so, to an extent, we can extrapolate from the banks' results.

Indeed, new international rules (Basel 3) that prevent bank runs make it artificially less attractive for banks to lend to businesses. Under those rules, banks are now made to hold nearly twice as much money in reserve for small business loans than they have to for buy-to-let mortgages and other loans. This means that creditworthy businesses are increasingly turning to peer-to-peer lending companies.

While interest rates have been compressed somewhat in recent years, there's still room for more bad debts.

Funding Circle's chief risk officer says that he tightened criteria last year, and this year has again tightened criteria while increasing interest rates. He says that bad debts could rise “multiple” times over and still lenders will probably end with a positive result. The “end” he's referring to is when all the existing loans are repaid and bad-debt recoveries completed.

But Funding Circle stopped providing detailed data to 4thWay or the public in 2018, so it's not possible for us to do our own stress tests to see how it might perform in a major downturn.

Read the Funding Circle Review.

Of the P2P lending companies that do straightforward business loans like the high-street banks, just one of them either supplies 4thWay with its data or publishes it for all to see. That is LendingCrowd*. It's small, especially compared to the giant Funding Circle, but transparent.

LendingCrowd started in 2014, long after the Great Recession. It has provided highly satisfactory returns to lenders so far. Its response to the COVID-19 lockdown has also been particularly mature; for example in this update.

By our best estimates (bearing in mind very limited bank data for comparison) LendingCrowd has so far offered lenders higher returns than the banks are likely to have been getting in recent years, and probably more than Funding Circle lenders are on target to earn. This bodes well for the crisis period.

LendingCrowd currently has a 2/3 (“Excellent”) 4thWay PLUS Rating, which means that in a minor recession we conservatively calculate it will leave the average lender with positive returns. In a severe recession similar to 2008, you might need to re-lend your money for a little longer in order to cover your bad debts.

Read the LendingCrowd Review.

Impact of downturns on bank commercial property lending

Commercial property is shops, shopping centres, restaurants, hotels, industrial buildings, warehouses and the like. Commercial property lending – specifically the types that the banks get involved in – can broadly be classed into these types:

- Lending against non-residential properties earning rent (commercial investment properties).

- Lending to support property developments.

In recent times, around £3 out of every £100 in commercial property loans has turned bad, according to the Cass Business School's Commercial Property Lending reports.

The average loan-to-value is about 60%, which means you can expect the vast majority of those bad debts to be clawed back from borrowers after recovery procedures are initiated. Recovery procedures in this case will typically mean a sale of the property.

In most cases, any outstanding interest will be paid off at the same time, because the property owner doesn't get anything from the sale until everything is settled.

RICS pointed out that in times of rising property prices – which is most of the time – actual losses after recoveries have been close to zero. Indeed, this is still the case when loans-to-value are higher (i.e. worse).

Evidence from both Cass and the Financial Services Authority (later renamed to the Prudential Regulation Authority) suggests a far higher proportion of debt turning bad in the financial crisis, and even more in its aftermath.

The end result, according to the Bank of England, had 6% of loans written off (that's bad debts after recoveries) between 2008 and 2012.

The performance between banks was incredibly variable, with the worst banks writing off 20% of their commercial lending. That's likely a combination of poor lending standards as well as lending too much at the riskier end of commercial property.

The bulk of bank commercial property lending charges borrowers between 2% and 12%. For the average bank, interest earned over two years will have offset all losses.

Impact of downturns on bank development lending

I just want to drill down further into development lending, a sub-segment of commercial property lending.

Cass found that property development lending has a somewhat higher proportion of loans that went bad versus investment properties during the Great Recession. Developers find it harder to sell units in a protracted downturn – at least when property prices have fallen substantially.

In the previous section, I mentioned two reasons for higher write-offs of bad debt at a minority of banks: poor lending standards and riskier commercial property lending. There was a powerful third reason: banks were desperately short of cash due to the credit crunch. This impacted developers more than any other borrowers.

Property development loans have a lot of clauses that can be used to call in a debt, even though they are generally not used aggressively, because it can lead to poor outcomes for everyone.

But there were a lot of news stories at the time about banks pulling the plug on viable development projects, so that the properties could be forcibly sold. The banks could then more quickly get some cash back to prop up their balance sheets and prevent horrible things like bank runs.

Impact of downturns on P2P commercial property lending

No P2P property lending platforms were operating during the last major downturn. However, many of the people now approving P2P property loans were working hard at other property-lending businesses at the time.

CrowdProperty, OctopusChoice, Loanpad and LendInvest (the latter not being P2P but still alternative development lending), among others, have stated that they and their partners had positive returns during that time, with either few or no loan losses.

There will be some variability though. P2P lending websites that do higher-rate property lending and typically face substantial numbers of bad debts are likely to face more borrowers with their own cashflow issues. Expect them to have to initiate recovery procedures on more loans during these times and be patient while recovery efforts are underway.

Impact of downturns on residential BTL lending

It's worth briefly looking at prime buy-to-let lending. Landbay – formerly a P2P lending company but now, sadly, exclusively available for institutional lenders – has often said that residential mortgage lending suffered losses of less than half a percent during the Great Recession, which was easily covered by interest earned.

There's relatively little buy-to-let lending in P2P at the primest end, with the possible exception of some Octopus Choice loans. There's more of it that is a shade less prime, which is in some ways more similar in level of risk to commercial property lending – although it will still be impacted differently in each downturn.

So, different types of lending performed differently through the financial crisis. Yet overall banks continued to make profits on their bread-and-butter lending throughout the period.

That should serve as a great example of why you diversify. Perhaps this time development lending will do far better, but then other kinds of loans or other investments – as we're potentially already seeing with the stock market – will do much worse.

Re-focus on your plan

I'm impressed, but I knew I could count on you 4thWay readers to get this far! Your nearly halfway to getting your golden star.

No more history lessons. You've earned that we get down to the nitty gritty. Because there's a lot that you can do to stay in control.

It starts by focusing on your goals.

What is it that you're trying to achieve with your savings and investments? What are your P2P lending goals? What is your timeline?

No, you don't have to tell me. I can't hear you. Maybe your mic's off. But now's a good time to remind yourself.

For most investors, it's been about taking a medium-term or even long-term view. It's not about what happens in 2020. And I'm betting that most of you reading this have been wanting your plan to be able to handle any volatility that comes up in between.

We've always said that peer-to-peer lending is not like savings accounts and that you need to be prepared to lend for at least as long as your borrowers take to repay the loans naturally, and that longer is even better. You need that time to earn enough income to offset losses that can occur earlier on. And you need it to be confident that the returns you earn are going to fairly match the risks.

Naturally, it's nice when you have the option of selling your loans early, as you often do in P2P lending. But you should plan longer-term and see early exit as a potential bonus feature. The fact that an early exit is not guaranteed actually leads to fairer and less volatile results. Read more in How COVID-19 Shows That P2P Lending Is A Fairer Investment.

Swings in money lending are not like the wild ride of the stock market, which has seen in-year falls of 10% about once every year since 1950, according to Capital Group.

4thWay has seen no records showing an overall loss in straightforward money lending in the UK in a given year since the invention of credit reports. But it's not completely and totally out of the question that it could ever happen.

Again, it's not as dramatic as shares, since money lenders have stronger legal ways to recover losses and prices are more stable. But even the possibility of occasional overall losses could be part of your planning. The important bit is to make sure the losses are temporary and fleeting.

A kind of worst-case scenario is factored into the 4thWay PLUS Ratings. If you've spread out across at least six of those rated accounts (which is the minimum suggested diversification), you're already likely to be on track to earn results within your expectations in the timeframe you had in mind.

Negative lending years are fewer and further between than negative stock markets. Over the past 20+ years we've seen four or five down years for stock markets, including at least two massive crashes. Bank lending – and then P2P lending – has not seen any negative years in that time.

Those who were investing at the worst time will also recover faster in money lending, as the losses are nothing like as large as shares. Shares fall 20%-40% in a big downturn. While it's usually well worth it in the end, the stock market can take a long time to recover. Money lenders – if they ever experience losses at all – can expect low, single digit losses over a well-diversified portfolio even in very tough times.

Where are you in your investing journey?

The vast majority of you have been lending through P2P for a while and have got yourselves some nice gains over the past few years. Based on P2P lending companies listed on 4thWay, those gains are likely to be between 5% and 7% per year on a well-balanced portfolio.

That interest you've earned already gives you a massive cushion against downturns, which will be on top of any interest you're still earning and any reserve funds that are protecting you. It's going to be hard to make an overall loss, in your case.

If you just started on your investing journey as the disaster started, it's even more important to remember your goals. You haven't yet built up a cushion, but pulling out of your good loans now while leaving any early bad debts is not going to be the way to end up with a positive investing record.

Which savings and investment products should you use?

You've thought of your goals and where you've already got to with your investments.

Your plan also includes something called “asset allocation”. You've been doing this already, even if you've never heard the phrase before. It's when you choose to put some money into one or other savings account or investment.

Any spread you have now across more than one type of investment or savings product is already working to minimise the risks. It's ensured that you won't be among the hardest-hit investors.

Reviewing your goals is an opportunity to improve your mix of savings and investments to meet them.

We've been advocating that investors look to just four ways to save and invest, as they offer excellent risk-adjusted returns at a fair price:

- Use savings accounts/cash ISAs.

- Buy your own home.

- Buy shares in the stock market, most likely through share ISAs and pensions.

- The “4thWay” – P2P lending accounts/P2P IFISAs, which sit in between the others on the risk-reward scale.

These four types of investments, blended for your goals, will continue to provide satisfactory returns for people who deploy simple, sensible saving and investing strategies.

For more on this mix of savings and investments, as well as for ideas of which savings accounts and stock-market investment funds to look for, read The Investment That’s Better Than P2P Lending.

We're not keen on other types of investments for most people, such as gold or bonds, as we've explained in Peer-to-Peer Lending Vs Other Investments and Peer-to-Peer Lending vs Bonds.

What blend of savings and investments is right for you?

Any shift you make now in your investments should not be because of a COVID-19 panic. It's about what your goals and timeframes are:

- The less time you have to invest, the more you have in savings. If you've saved a large deposit to buy a house in six to 18 months' time, you need all or most of your money in easy-access savings accounts to protect it from short-term fluctuations.

- If you're investing for five years, you need a blend of investments weighted towards savings and P2P, and less in long-term, volatile investments such as shares.

- If you're investing for longer, you likely need less in savings with the rest split between P2P lending and the stock market, so that you can grow your pot. Leave a lot in savings for a long time and you're very likely to end up with less than you started, in real terms. Because prices will rise faster than the interest you earn in savings accounts or cash ISAs.

P2P diversification

It's absolutely fine to have just one P2P lending account or P2P IFISA, if it's a small proportion of your overall savings and investing pot. That means all your savings accounts, shares and other investments too.

Your realistic goal, after all, cannot be to achieve positive results in all your investment choices all the time, but to do well overall.

If you're putting a substantial proportion of your investing pot into P2P, we believe that six P2P lending accounts and IFISAs is generally going to be the minimum.

4thWay-rated accounts are a good starting point, since, using the international Basel stress tests, we believe a basket of those would turn out fine for you if you lent throughout a severe recession and property crash similar to 2008.

Due to the extremely mild impacts of downturns on money lending compared to the stock market, it takes just a few outperformers to keep you in the plus. Regardless of how bad COVID-19 gets, I expect a fair number of these accounts to suprise you by performing considerably better through the downturn than you imagine at this time.

The impact will probably look worse than it is to start with, in that borrowers can quite reasonably be offered payment holidays through a difficult time, but in so doing the whole debt is technically then a “defaulted” debt – a bad debt.

Some types of lending will see a hit earlier. And some loans will turn bad and need a long time for recovery procedures to be completed. To take it emotionally and ensure you're not lending solely to the worst-hit borrowers, you spread across different risks by ensuring a blend of different types of lending.

You'll find a mix in the 4thWay comparison tables. And our top choices to survive and thrive during the COVID-19 downturn are coming up later on this page.

Holding on through the storm

For those of you who have been investing in the stock market, withdrawing your money now is likely to lock in horrible losses. Talk about timing the market badly!

Similarly, as COVID-19 impacts worsen, don't lock in losses by selling all your good loans and quitting, leaving just your bad debts in P2P.

While bad debts occur, if you have been investing with no real confidence, understanding or belief in what you're doing, you're likely to make the mistake of selling your good loans and crystallising your losses.

it might be even harder to resist a dramatic sale if you do some lending in the sorts of loans that have high interest rates and high levels of loans that suffer problems. For example, asset-backed lending and some kinds of bridging loans. You don't want to sell all of these to leave just your bad debts outstanding.

If you wait patiently, you earn more interest on your good loans. Combined with recoveries, most lenders can expect to come out fine with patience. And where some investments disappoint, your diversified portfolio carries the rest.

Raising the cash to either diversify or re-distribute your money

If you're not spread across the savings and investments that you feel you should be, in the right proportions, you can re-jig your position without a massive sale of your good P2P loans. In some cases, a sale is currently impossible anyway, as some P2P lending sites have suspended sales.

To re-distribute, you switch off re-lending options for your P2P accounts. Normally you receive payments every month. Use those payments now to move money steadily over into other P2P accounts, savings accounts or investments, till you have a balance that reflects your goals and horizons.

If you're using P2P IFISAs, check first with your providers if they allow partial transfers or partial withdrawals. Most do.

Typically, repayment loans pay you back 3% to 5% of your money every month, plus interest. Even interest-only lending sometimes involves early repayments, and you have the interest you receive too. A lot of P2P lending is also shorter-term loans. Within a few months, you could be better diversified.

By continuing to re-lend and re-invest your money somewhere, you ensure that you're not lending or investing just at the worst point in the downturn. You'll be lending to batches of borrowers before and afterwards, and buying shares when prices are lower and more attractive, not just at peaks. It's the tried-and-tested way to weather recessions.

If you've not kept any cash for emergencies and rainy days – or lockdown days – switch off re-lending in your P2P lending accounts until you've built up a pot for it. You could also stop re-investing dividends in your stockbroking accounts or stocks and shares ISAs.

Look for a large margin of safety

The longer that lockdowns, quarantines and other measures last, the more bad debts we expect as a result.

This could be the first significant test of the 4thWay PLUS Ratings. Our P2P and IFISA ratings are based on a stricter version of the Basel stress tests that the banks use to assess what might happen to their loans in an event like a recession or property crash.

We find that most patient investors that mostly use a spread of rated lending accounts are well protected against most downturns, since a large margin of safety is built in.

Where To Lend Through COVID-19?

Update on 2nd July: you now get more information on the top P2P lending accounts for COVID-19 in a free report received by existing newsletter subscribers today. New subscribers can get the same report for free when you sign up.

We'll come to the top peer-to-peer lending accounts for the COVID-19 downturn in a minute. First, some background.

We advocate lending across different platforms and also across different kinds of loans and borrowers, precisely for bad times where some types of borrowers can be worse affected than others.

But that doesn't mean you can't tactically shift the weight of your lending depending on what's going on.

In the last recession, properties sometimes were forcibly or quickly sold for as much as 55% below the valuation at the time the property owner got a loan. Commercial property was even worse. For a short time, the average price of commercial property sales was more in the region of 45% below the initial valuations.

But the property market and property lending is not at the centre of today's economic troubles, as it was in 2008.

The total lent versus property valuations is substantially lower (better) than it used to be.

The total lent versus property valuations is substantially lower (better) than it used to be.

The residential property market itself is obviously less bubbled than back then, with Nationwide house-price data, adjusted by allAgents for inflation, showing that prices are still quite a way off the peak in 2006.

Monthly loan payments are also still a bit more affordable than at the end of 2009, according to Nationwide, which was when prices were not too far off the bottom of the market.

Commercial property prices on the whole are probably not in bubble territory yet, although pricey in London.

The property crash would need to be a lot bigger than last time to have the same impact on bad debts – and yet a large crash is less likely.

Thus, I expect much better results in property lending compared to other forms of lending and other investments, and better results than during the financial crisis.

Undoubtedly some tenants will struggle. And you might be required in these times to offer payment holidays to landlords who have borrowed from you. But ultimately the properties will still exist, and still be available for sale to recover bad debts.

The top three P2P lending accounts/IFISAs during the COVID-19 downturn

Here are the three P2P lending accounts that we look to weight money towards at present, since they offer considerable margin of safety against loss of your money or even loss of interest. All three are available as IFISAs.

Loanpad's Premium Account, paying 5%

Top of the list in this space is Loanpad*.

Loanpad is a huge hidden gem. It doesn't yet have a 4thWay PLUS Rating, because it hasn't had a long enough history for us to conduct the Basel tests upon which our ratings are based.

However, I have no doubt whatsoever that it will earn one after enough time has passed and enough loans have been completed.

Loanpad loans are sourced from a family firm that has been successfully lending to property owners and developers for many decades.

Loanpad pays 5% while diversifying lenders automatically across all outstanding loans, which are short-term (bridging) property lending and development lending. The maximum loan-to-value on all the property loans is a fantastic 50%, with an incredibly low average LTV of just 30%!

The family business that partners with Loanpad lends its own money substantially on top of each loan, taking first loss in the event that a borrower is unable to repay in full. On average, the firm lends an additional 33% of the total lent to the borrowers.

Loanpad is headed by a lawyer with a lot of experience in property, which, at the very least, greatly reduces the risk of fraud in any loan deal.

The risk of making an overal loss from bad debts, even in a severe downturn, is exceptionally low. It's a no-brainer for investors.

To cap it all off, two technology experts at Loanpad formed a team of engineers with UCL and Mercedes F1 to successfully develop breathing aids for the NHS in the fight against COVID-19. So we can support those supporting the NHS, while earning excellent risk-adjusted returns.

Loanpad has already confirmed that it allows partial transfers into (and out of) its IFISA, in the event you want to spread some of your existing lending into it.

Visit Loanpad* | Read the Loanpad Review.

CrowdProperty, paying 7% to 8%

CrowdProperty is run by one of the most impressive and credible teams we've ever seen in development lending and in the P2P and IFISA space in general.

It's no surprise that they have a perfect score in developments, both prior to and since starting CrowdProperty. They also have a good head for data and numbers, which is what we always see at exceptional development lenders.

When a property developer successfully raises a CrowdProperty loan, it does so up front. All the cash needed to develop the property from start to finish is raised from lenders at the beginning. CrowdProperty hands it to the developer in tranches as phases of development are completed.

This means that you don't need to be worried during the pandemic that funds are going to suddenly dry up in the middle of the project, as you would do at some other P2P lending websites.

The developer still pays interest to you on all the money it has raised, even if it has not received it from CrowdProperty yet.

Like Loanpad, CrowdProperty only does first-charge lending, meaning you're at the head of the queue to recover your money if a loan goes bad and the property needs to be sold. No banks or other businesses that are lending to the same developer can muscle in first.

CrowdProperty leaves lots of headroom in the event that a project or sale faces severe delays. CrowdProperty does no central London lending, avoiding the most over-priced part of the UK market.

In these strange times of lockdowns and empty toilet-paper aisles, where contact has to be kept at a minimum, the majority of CrowdProperty's development sites can be surveyed with drive-bys and also with walk-throughs when the site is empty. Development monitoring surveys are usually being done by webcam/facetime.

With CrowdProperty, you can select loans yourself, if you wish, meaning you can read about, or ask CrowdProperty about, what steps the developers are taking to ensure their supply lines and to safeguard their labour during the pandemic.

As with Loanpad, CrowdProperty has already confirmed you can do partial transfers into and out of its IFISA.

Visit CrowdProperty | Read the CrowdProperty Review.

Proplend tranche A investment property lending, paying around 7%

Proplend's tranche A investment-property loans are 3/3 “exceptional” 4thWay PLUS-rated. This shouldn't surprise you: they are loans for just half the property valuation, i.e. 50% loan-to-value.

Furthermore, the 4thWay PLUS-rated loans are on completed properties that are already receiving more rent than the monthly loan payments.

You might need to be patient if some of your loans suffer trouble, but it will turn out to be well worth the wait.

Naturally, tenants of those commercial and residential properties could start struggling if their businesses suffer and government COVID-19 programmes prove insufficient for them. But Proplend* considers each new borrower, property and loan application with the pandemic in mind, with its latest loan going live just last Thursday.

The minimum lending amount is high here, at £1,000 per loan. Again, take the time to spread your money across as many of these loans as possible. Don't pile too much money into one loan.

Visit Proplend* | Read the Proplend Review.

Expand your portfolio

I urge you to spread across as many of the above three as possible, plus other peer-to-peer lending accounts, because you should not rely on any one provider.

Since we launched in 2014, 4thWay has steered UK investors away from the small number of disasters that have happened so far, so watch our ratings and reviews, with an eye on 4thWay's 10 P2P Investing Principles to help keep you on track when choosing your next lending account.

Using economic forecasts as a basis for investing decisions

I used to keep a database of economic forecasts. It extended back to the 90s, before the dot-com crash. And it went on until after the property market crash of 2008.

I took most of the UK's prominent forecasters and many from around the world. I tracked forecasts on property prices, interest rates, the stock market, the price of gold, oil and more.

Here's what I found: not a single forecaster built up a convincing record of reliable forecasts. No-one was even close, whether they were suggesting no change, or a rise or fall – big or small.

Yes, an economic forecaster here or there might make a really good call and become a regular in the media after that. But look closely at that forecaster's record before and after, and you see that divination is not actually one of their talents. It's simply too hard.

I once read a financial journalist say something along the lines of “Forecasts don't work, but it's all we've got, so here's my recommendation based on the latest forecasts…”

I can't think of anything crazier than saying that something doesn't work, but I'm going to use it anyway. There are rational ways to make investing decisions, as my colleagues and I have already written about today.

Keeping a sensible spread between savings, P2P lending and the stock market – and owning your own home if you can – is a sensible way for the majority of investors. Select investments that you believe offer a large margin of safety. Invest for long enough. Invest regularly. And diversify.

Most investments require people to be patient and stick with what they're doing for many years, not trying to second guess the economy. Lending and re-lending regularly (and investing regularly), and being patient, is how to go about getting satisfactory results.

It’s instinctive to want to sell investments if they're going down in value, but investors are more likely to do better, and recover faster, by not doing so. If it helps, stay away from the news.

Don't overlook your other investments

Benjamin Graham, the highly successful founder of modern investing, was in favour of a simple strategy. Investors split their investing pots 50% in shares and 50% in bonds.

This was back at a time when people bought individual bonds and didn't buy through bond funds, which come with higher costs, have investment returns that diminish in correlation with those costs, and have additional volatility risks on top.

4thWay has often written about how peer-to-peer lending is now a more suitable type of investment for most people than bonds and that Benjamin Graham would approve. (Read Peer-to-Peer Lending vs Bonds.)

Yet, if you're underweight in shares or haven't reviewed your holdings for a while, now is a good time to take stock – or stock up.

The FTSE 100 is trading at under 13 times typical company earnings as of 24th April, 2020. This is not ridiculously cheap, but it's a good price for your average large company. Any long-term investors dripping money in over the next 12 months – without trying to time the bottom – is likely to be satisfied of the outcome in the coming years.

Using share funds

Paradoxically, “cheap” in the investing world translates into “outperforming”.

Cheap index tracker funds enable you to buy into lots of companies and get better results than the average investor, after costs. Look to UK fund providers Vanguard, AJ Bell, Interactive Investor and Fidelity. You can read more about them at MoneytotheMasses and Monevator.

It usually makes sense to spread some of your money into other types of trackers or other geographic regions, with a bigger focus on developed countries for more reliable results.

Picking your own shares

For stock pickers, after the pandemic-led crash that's already happened this year, there are powerful opportunities around to complement the three top P2P lending picks above.

For patient investors for the long run, you've got stock-market listed companies trading at discounts that are not just cash cows, but also have great pricing power and large moats. (Moats are defences to keep businesses strong against competiton).

As of 24th April, 2020, Moneysupermarket (LSE:MONY), Rightmove (LSE:RMV) and Berkshire Hathaway (NYSE:BRK.B) stand out vividly as trading cheap or even absurdly cheap compared to where businesses like these deserve to be.

Don’t watch obsessively

My siblings and dad write an average of 21 messages a day related to COVID-19 in our family chat group. I know someone else who never used to watch the news, ever, but who is now watching it all evening, every evening, just for the pandemic updates.

You need to stop obsesssing, if you're an investor.

Warren Buffett suggested during the last market swings that you: “Don’t watch the market closely.” He added that investors who think they can time getting out are “not going to have very good results.”

Markets bounce back fast, and you don't want to be out for that. According the Credit Suisse Global Investment Sourcebook, in the stock market, the bounceback was 30% in 2009, a year after a big crash. In 1973 the bounceback was a gain of 97% – in real, inflation-adjusted terms! Big downturns are typically followed by big comebacks.

Bonds and bank lending have similar bounces. With peer-to-peer lending usually being the same types of loans as offered by banks, we can expect the same here. Indeed, Zopa's two best years were 2009 and 2010. 4thWay estimates lenders earned +40% interest in each of those years compared to an average year.

Don't check your lending accounts every day

On a similar vein to watching the markets too intently, you can also obsess over any bad debts in your portfolio. That might easily convince you to turn temporary losses into permanent ones.

It's better for your mental health to check your lending and other investments rarely – and usually when there's something specific you want to do, such as re-lend, re-invest or save any cash you've earned. The time for wondering whether you're making a good investment is before you invest, not each and every day after you've invested.

Pay yourself first and put yourself first

Downturns are temporary, but investing costs are permanent.

In the stock market, shaving 1% in investing costs is far more important than market falls. After two to three decades, that seemingly small cost saving will boost your final investing pot by a quarter or a third!

In lending, for the same reason, getting the bulk of the rewards is far more important than taking action in a downturn.

The peer-to-peer lending companies mentioned above pay out the vast majority of the rewards to lenders. Most of the money that they retain is not profit; it covers the costs of finding borrowers, assessing them and running the loans on your behalf.

P2P lending remains a strong medium-term investment

You were here for the risk. Are you going to stick around for the reward?

A friend of mine has been growing a new business selling some really fantastic new glasses and sunglasses that are a stylish feat of engineering.

He's happily in a long-term relationship, but in the event that it ever breaks down, he doesn't want his partner to lose out after having been with him for all the risk of starting a new business, but then getting none of the reward. He asked my advice how to ensure that his partner gets a fair share of the business in the future if that happens. (To which I recommended he adapt the Slicing Pie method.)

You can write a legally binding agreement with someone you love. But you can't write a legally-binding agreement with your own investments. That's why, if you marry your investments for the risky phase, then divorce them by selling up at a loss, you have no contract to ensure you still get the rewards for all that risk you took early on.

So your only choice is to stick around for the rewards. The good news is that they're worth waiting for – and the wait is not so long compared to many other investments when you spread across lots of loans and P2P lending accounts.

P2P will go strong, being far less volatile than the stock market and providing positive returns to investors overall. There will be considerably more investors in P2P lending in five years than there are today. Be patient, and stick around for the reward.

Don't over-react when it's over

That leads very smoothly to the next point we want to make – and well done for getting this far as it's nearly our last.

It's quite normal after a downturn for people to be forever put off investing. Or at least for a long time. They make a temporary loss during the downturn, but turn it into a permanent one by pulling all their money out.

If you get disappointing results in shares, P2P lending or property, don't make the same mistake as millions of investors have before you.

Maybe you'll suffer bad luck in your own portfolio with one type of lending. Maybe it won't even be bad luck, but instead you lent too much money through a single P2P lending platform that offered high rates but didn't have sensible underwriting standards.

But if you quit P2P lending completely now, when will you ever get back in? Will you make it back in for the bounce?

Take care of yourself

Don't let the stress and uncertainty lead you to lose sight of what's important. Stay in touch with your best friends, get some exercise, do something you enjoy, and find little things that make you smile and come back to a level of peace.

“In moments when one is flooded with emotion, it's important to know how to self-regulate. Breathing exercises, soothing hot showers, bracing cold lakes, walks in nature, singing and dancing to music, and active sports can all be helpful. Stillness and movement can both be sources of relief.”

Esther Perel

Thank you

It's at times like this that I really feel grateful for all the support our users and readers have offered. Thank you for reading our research, visiting the 4thWay website, and opening accounts by clicking through us.

This is for you for making it to the end of the page!

Links you'll find in the above page:

4thWay research and articles

The Investment That’s Better Than P2P Lending.

Peer-to-Peer Lending Vs Other Investments.

Peer-to-Peer Lending vs Bonds.

4thWay's 10 P2P Investing Principles.

External research and articles

Harvard Business Review article on 2008 recession.

MoneytotheMasses on tracker funds.

COVID-19 related research, articles and news

How COVID-19 Shows That P2P Lending Is A Fairer Investment.

Funding Circle New Lending Update On COVID-19 17th April 2020.

LendingCrowd Update On COVID-19 13th March 2020.

P2P lending sites and 4thWay's reviews

Visit CrowdProperty | Read the CrowdProperty Review.

Visit Funding Circle | Read the Funding Circle Review.

Visit LendingCrowd* | Read the LendingCrowd Review.

Visit Loanpad* | Read the Loanpad Review.

Visit Proplend* | Read the Proplend Review.

Visit RateSetter | Read the RateSetter Review.

Visit Zopa | Read the Zopa Review.

Compare

4thWay P2P lending account comparison tables.

4thWay IFISA comparison tables.

None of the authors hold shares in the companies mentioned and commit not to do so for at least 30 days after the publication of this article.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from LendingCrowd, Loanpad, Proplend and RateSetter, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.