AxiaFunder Review

With double-digit realised gains so far, returns of 20%+ highly possible, and being unaligned with recessions and property crashes, why wouldn't you consider this opportunity?

Before you read on, AxiaFunder is available to you only if you have invested at least £10,000 in unlisted investments in the past 12 months and invested in more than one unlisted company in the past two years (such as through crowdfunding websites).

Plus, either you:

Have an income of £100,000, or savings and assets excluding your own home worth £250,000.

Or one of the following applies to you:

- Been in a network of business angels for at least the past six months.

- Worked professionally in private equity in the past two years.

- Worked in the provision of finance to SMEs in the past two years.

- Been the director of a company with £1 million + revenue in the past two years.

What does AxiaFunder do?

AxiaFunder* helps you fund legal cases for claimants. (Claimants are people or businesses making a legal claim – potentially through the courts – against others.)

These cases are expected to win the claimants at least five times the amount of funding raised within 36 months – longer if there are multiple hearings. You'll take a cut of these awards.

The legal cases you fund can be grouped into three types:

1) Housing disrepair claims: large batches of low-value cases to help tenants in local authority or housing association flats to get the housing repairs that they are entitled to – as well as some substantial financial compensation for the delays. Each batch of these cases is for £100,000 to £480,000.

2) Other grouped or batched claims: recently, AxiaFunder has started to fund other types of cases either in batches or in group claims, which is when many claimants make a single joint claim together. You should expect all claims to win or lose together in group litigation.

3) Higher-value commercial litigation: this has included cases for breach of contract, professional negligence, insurance claims, shareholder disputes, commercial fraud, and claims against an EU member state for failure to implement or breach of EU law. These are typically for up to £500,000. Note though that AxiaFunder hasn’t funded a new individual case of this kind for quite a while.

AxiaFunder further splits those into standard and (very) high-risk opportunities. If it's in the second, relatively higher-risk category, that is noted in the executive summary section of the documentation you get to review before deciding whether to put your money in.

When did AxiaFunder start?

AxiaFunder* got going at the beginning of 2019. The total amount funded through it is £21 million.

What interesting or unique points does it have?

Possible losses are very high, but insurance protects you

You can theoretically lose more than you lend in an individual case if the claimant is unsuccessful. But the circumstances needed for that to happen are very particular and therefore unlikely. This is because of after-the-event insurance. This insurance cover means that, if a case is lost, you shouldn't have to pay the opponent's legal costs on top of what you've paid to fund the case.

More details on that in What Are The Risks Facing An Investor In Litigation Funding?

You should still be prepared to lose everything you put into a case, in the event the claimant loses.

Insurance sometimes helps you recover around 85% of the amount you lent. So far, this has applied to only one case, so you shouldn't rely on it.

Super high returns and a wide variety of risks

Returns on individual cases can sometimes lead to doubling or even tripling your money.

AxiaFunder typically forecasts annualised returns in the 20%-40% range. That's the annualised return, so, if the case takes two years to settle and you then make a total of 70% on the amount you put in, that's an annualised return of over 30%.

As you might expect when the potential rewards are this high, the risks are not limited to incurring losses when claimants lose their cases only.

Indeed, there's a wide variety of other potential risks. Not all of them can easily be predicted, or even perhaps defined, in advance. That’s not least because funding legal cases in this way is still a fairly new and niche area.

We call this money lending, the financial regulator doesn't

Technically, what you're doing is not classed as lending but investing. However, the structure is such that it has much more in common with money lending – in practical terms from your point of view.

Therefore, if I use the words “lending” or “loans” below, it's with this in mind. (More on this in the section “Is AxiaFunder truly P2P?“)

There's nothing like this high-return alternative opportunity anywhere else

The profile of these loans (see, I'm doing it already) is completely different to anything else available.

It's very useful to do completely different kinds of lending, because it can balance risks. Specifically for AxiaFunder*, when some kinds of lending are doing badly, perhaps due to a recession, AxiaFunder's results won't be so closely aligned with it – and probably not aligned at all.

The rewards of lending in a single loan through AxiaFunder is almost binary in that you're talking about either a possible total loss of your money, or a probable very high return.

Yet data and experience shows that the vast majority of cases are won, because experienced lawyers can typically assess the prospects of success with 85% accuracy or better. (However, when AxiaFunder gives you the opportunity to decide to take part in very high-risk opportunities – as opposed to its “standard” offers – expect many more such claims to fail.)

How does AxiaFunder work?

Raising case funding

While you can buy second-hand from other people, you typically fund cases from scratch.

If there's slow take-up to fund a new case, it might be co-funded with another funding partner.

Some cases pay out all the amount raised to the claimant at once, whereas others pay out your cash to them steadily, when it's actually needed to cover legal costs.

Other cases are funded in phases, meaning more money is raised through the AxiaFunder platform as and when needed. Cases can require several stages of funding, especially if the opposing party doesn't settle before court, or if the claimant later appeals against a court decision.

Every time you have an opportunity to put money in – or more money in when talking of phased funding – this is called an “offer”. So you might choose to fund the same cases multiple times by funding at different phases.

Funding the three types of cases

Housing disrepair cases are typically very small, at £2,400-£3,300 each, so they're funded in batches of 40-200 claims. This is called portfolio funding. Each claim is assessed, won or lost on its own merit.

Group litigation – when lots of claimants make a single joint claim together – is the same in that way. Meaning lots of claims are batched together. However, in contrast to portfolio funding, you expect all claimants to win or lose in one go.

Commercial litigation cases are usually large enough to be funded individually. However, smaller, four- or five-figure commercial litigation cases from a claimant are funded together.

Simplified example of funding a legal case through AxiaFunder

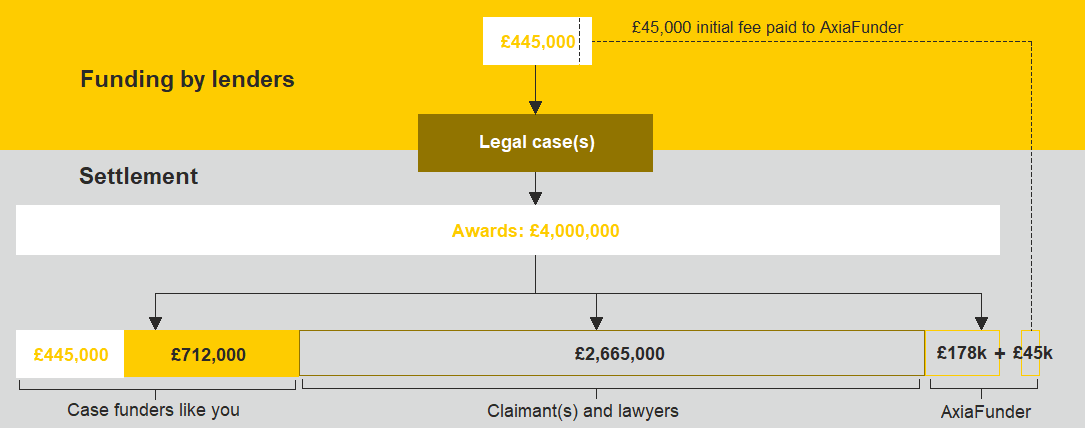

In this example, the awards – called damages – are nearly 10 times the amount put in and you get well over double your money back. (Click/tap to expand.)

Getting your rewards

The overall rate of return you receive in the end goes up or down with each funding round (each “phase” or offer related to a case), as the information and circumstances relating to the progress of the cases changes.

The rate of return also changes, one way or the other, the longer it takes for a case to be resolved.

Portfolio cases typically start resolving from around six months in. Perhaps 2/3 of cases are expected to be finished and paid out to you in 18-24 months. You get your payouts in ten tranches. Most tranches include 10% of the number of claims in a portfolio.

The lawyers usually expect commercial litigation cases to be over within 36 months. When these cases are batched together in a single offer for you, you receive your payout as each case is repaid.

Your returns might be based on a fixed annual percentage rate, as with ordinary lending, or you take a share of the claimant's awards for the case.

AxiaFunder review: how good are its loans?

AxiaFunder* has been rejecting around 90% of applications for funding.

It aims for cases that it expects will pay out total awards of at least a five times return on the lending costs, although it can be 10 times or more.

The bulk of that will go to the claimants and their lawyers, but it gives a large safety margin to cover your loans, and you'll get your cut before the claimant or lawyers receive their compensation and fees.

AxiaFunder expects 85% to 95% of housing disrepair claims will settle before going to trial. It will be interesting to see how AxiaFunder performs in that regard, as more of its outstanding cases mature, which will be a strong sign of quality.

When the money is raised in tranches to fund different stages of the case, it comes with the risk that AxiaFunder won't be able to raise money at those later stages, so that the claim might collapse. This is similar to a lot of property-development lending in P2P, when developments are paid for in tranches.

Still, I consider this risk to be small while AxiaFunder continues to have great results, and as the risks shrink further as it grows and attracts more partners that pre-fund cases.

When it comes to outlying, high-risk commercial litigation cases, AxiaFunder's record of correctly assessing the prospects of success has not been good, although it's still very early days on those. Factor that in when you’re deciding whether to take part in those types of cases or how much money to put in.

Otherwise, its record in assessing more standard claims has been very good and within expectations.

AxiaFunder during COVID-19

AxiaFunder was too new during the pandemic to learn anything from its results during this downturn. Even so, legal cases are unlikely to be impacted by recessions and property crashes as much as traditional lending is.

The COVID-19 downturn did, however, cause a massive backlog in the courts. Such an event, were it to happen again, could slow down the resolution of cases, which could impact your returns – although you could also accumulate more returns over the period in which the cases are outstanding.

AxiaFunder’s misfortune in 2024

Funding individual commercial litigation cases has become a rare event, as AxiaFunder focuses now on portfolio cases and group actions.

This shift lowers the risk of a single case going wrong, but comes with the added risk of losses across all outstanding cases in the event that a single law firm that is running multiple portfolios or major group actions goes bust.

Indeed, this already happened once. Fortunately, AxiaFunder is covering the £500,000 in losses on those. And it has since required that law firms have security that puts investors in first place, which substantially minimises that same risk from occurring again.

The main form of security in question is a first legal charge on the cases themselves. When cases are won, AxiaFunder investors are thereby entitled to their money and profits before the claimants get anything, even if those cases have been distributed to other law firms after the original firm went out of business. This is rather like how your mortgage company is entitled to its money first, if you fall into arrears and have to sell your home.

Yet this incident is a useful reminder: when funding legal claims, something might go wrong from the point of funding right up until you have actually received your money back with the profits.

At a minimum, you'll want to take your own steps to a) spread your AxiaFunder investments across investment offers that have different law firms behind them and b) ensure you're spreading across different types of cases.

How much experience do AxiaFunder's key people have?

While each claim is in the hands of the claimants' own lawyers, Michael Lent is the key person working with AxiaFunder. He's the lead solicitor in assessing the viability of most of the cases to decide whether they have merit.

While we have no data on this, he says he has a long-term record of winning nine-out-of-ten cases, which is in line with expectations.

To the best of our research and available sources, his experience in this space, and at a senior level, is as vast as it gets, and it's very precisely tailored to what AxiaFunder offers. It's not just that he practices the same types of commercial litigation himself, but he also has a lot of experience in assessing the viability of such claims. His (admittedly short) record at AxiaFunder so far looks promising.

Michael Lent was once successfully sued by a former employer many years ago. While his mistake implies at least a degree of what insurers sometimes call “moral hazard”, it was not for a major issue and not to do with his skill as a solicitor. Without any other signs of moral hazard, I see no reason to be concerned.

AxiaFunder uses other experienced lawyers to assess claims, too, and it will keep growing this team. Solicitors in the UK, and in some other countries, have an effective system to rank individual lawyers and legal departments at law firms, making it easier for AxiaFunder to find promising candidates.

We know that AxiaFunder is able to establish reasonably quickly whether they're making good decisions or not, and so they can easily switch to other lawyers when necessary. Solicitors also have £3 million in insurance that might protect you, in the event they make terrible mistakes.

AxiaFunder has arranged funding for two cases outside of the UK (Spain and Cayman), but it didn't have a plan on how to select the case assessor. If it starts to fund more international cases, I'd like to see it implement a systematic way of doing this.

I'm in the unusual position of including two other people who don't normally crop up as key and/or experienced people in P2P lending, when it comes to assessing their overall skills. But it's justified here.

Cormac Leech – a well-known name in alternative investing – and Diana Sweeney assess the applications from a completely different angle. What they're looking for is whether the defendant will be able to pay up and other factors that demonstrate that the case is worth funding, outside of the legal aspects.

They have no prior experience in assessing applications for funding of this kind. We're generally very cautious and critical when key people are missing experience in assessing the opportunities available to you. However, their processes (see the next section) and methods, as they described to us in detail, with some supporting evidence, are extremely plausible, creative and intelligent.

AxiaFunder review: lending processes

This is a subject that could take 2,000 words all by itself, but I'll be brief.

The starting point is whether the claim itself has legal merit. This begins with an assessment of the existing laws, the results of similar cases and what the defence might say.

Equally important is being confident that the defendant is actually going to be able to pay if a claim is successful. For example, if the defendant is government funded, the risk it can't pay is small.

AxiaFunder* calculates the costs of pursuing the case all the way to trial to see if it's sensible, and whether the expected rewards are high enough.

AxiaFunder wants every case to be backed up by after-the-event insurance – with just one exception that's happened so far. So it looks into whether the risk can be insured, and on what terms.

It's not just the solicitors assessing the case for AxiaFunder that need to be good, but the claimant's solicitors who are actually taking on the case. AxiaFunder assesses them and looks to see that how they will be rewarded is aligned in everyone's best interests.

In portfolio cases, AxiaFunder regularly audits the solicitors who are actually conducting the cases to track their performance and ensure they're following all the correct procedures.

The defendant's ability to pay that matters. But the claimant’s financial position is also important because claimants might potentially have to pay the defendant’s costs if the claim is lost. So to some extent AxiaFunder assesses the claimant's finances as well.

As we saw in AxiaFunder’s £500,000 error, assessing and monitoring the solicitors running the cases, and protecting against their potential bankruptcy, is also important.

Aside from the £500,000 error, AxiaFunder has both a first legal charge and a debenture placed on all law firms that AxiaFunder works with on housing-disrepair claims.

A first legal charge on the cases means that you are to be paid first in the event a law firm goes bust and can't repay all its debts. The debenture is arguably more important, as its main purpose is to include legal terms that prevent law firms from trying to grow too quickly, which is what caused the £500,000 problem.

Ultimately, with such a rare kind of lending as this, AxiaFunder's processes will be proven more in the results than in an assessment of its methods.

How good are AxiaFunder's returns, bad debts and margin of safety?

Overall returns

Data provided to us by AxiaFunder* shows that the returns on all resolved cases (including won and lost) since it started have been 12.74% per year as of the start of 2025, assuming you split your money equally between every offer that you're notified about by email. (That will mean sometimes putting additional money into the same cases.)

That annualised return figure includes everything: all types of cases, including cases classed as “high risk” and including my estimate of the negative impact from the bust law firm. (See beneath the next sub-heading for more on that.)

If you exclude resolved claims that AxiaFunder classes as “high risk” then the total all-time return rises to 22.65% per year.

Returns on housing disrepair portfolios

AxiaFunder* has been beating its latest targets. Its historical annualised returns on paid out tranches of housing-disrepair claims has been 22.41%, if you had put the same amount of your money into each offer.

I have excluded a big item from that figure, as there were housing-disrepair claims funded by a law firm that went bust. That lead to this story: AxiaFunder To Cover £500,000 In Losses. Cases through this firm just broke even. As a couple of million pounds went through it, it has had quite a big impact on overall returns for all case types.

Returns on group actions

AxiaFunder raised £2 million in four offers in group actions in 2024. These were all related to Dieselgate. These are all ongoing.

AxiaFunder has estimated that you will either lose all your money or get two to three times the amount you put in. When you take into account how long the payout might take, it estimates an annualised return of between 30% and 90%. You can read more on these claims here.

Returns on commercial litigation

If you had put an equal amount of your money into every resolved commercial-litigation offer, you would have made a 16.40% annualised return.

Of the 17 resolved cases so far, there have been three losses. One of those losses was in a group of three smaller claims pooled together that came out with a modest overall positive return. The losses in the other cases are basically total.

The biggest overall commercial win so far has been an annualised gain of 77%. That case took little more than half a year to close, returning £14,300 on every £10,000 that was put in.

The biggest nominal gain has been +175%: £10,000 turned into £27,500, but it took nearly four years, so the annualised return was 35%.

The quickest case took seven months to resolve and the slowest 57 months.

The expected profit for investors comes from focusing on commercial cases that meet each of 10 different criteria, e.g. with minimum expected awards of typically (with some exceptions) five times the amount invested. (Again, the awards to be split between you, lawyers, the claimant and AxiaFunder, as demonstrated in the infographic above. One or two other parties are also likely to take some of the share.)

Summary of results

Here's a summary, based on 4thWay calculations from detailed data. These are for resolved cases – whether won or lost – and assumes you put the same amount of money into each offer:

| Total returns for | Result |

| All offers | 12.74% pa |

| All offers, excluding the bust law firm | 16.40% pa |

| All offers, excluding “high-risk” offers | 22.65% pa |

| All offers, excluding the bust law firm and the “high-risk” offers | 29.68% pa |

| Housing-disrepair (portfolio) offer, excluding the bust law firm | 22.41% pa |

| Commercial litigation offers | 16.40% pa |

| Commercial litigation offers, excluding “high-risk” offers | 30.25% pa |

You can see a little of AxiaFunder's own figures and its graph here, although its published statistics are confusing.

Has AxiaFunder provided enough information to assess the risks?

AxiaFunder* has taken extreme efforts to be transparent and I'm very satisfied with its openness with us in terms of the reams of documentary evidence and data, answers to our questions, access to interview key people, and the quality, candidness and fullness of answers provided.

For lenders like you, it provides quarterly reports on how each of the cases you've funded are doing.

Its statistics on its website for the public are fairly useful and clear, and we believe the summaries of its key people are accurate and up-to-date. It also has a nice, brief summary of its methods in assessing opportunities on your behalf.

When it comes to the information it provides you with to assess each opportunity, the details are very extensive, but they are also repetitive, lengthy and legal, so you need to have the right sort of mind – and preferably be a quick reader – to go through it all when choosing whether to put your money in.

It's highly likely these reports are that cumbersome for regulatory reasons, i.e. it's supposed to be for your benefit.

However, our own experience and tests at 4thWay show that far more benefit is had when all the key points are laid out in a much shorter summary, because most people don't get past the first page.

Is AxiaFunder profitable?

We don’t get detailed, audited published accounts from AxiaFunder.

However, AxiaFunder* tells us it has been profitable since the second quarter of 2023 and profits have been rising fast.

While its reputation will take something of a knock from its £500,000 error – which reduced its profits in 2024 and will this year of 2025 – it won’t prevent AxiaFunder continuing to make money and grow. Its (highly abridged) published accounts indicate a most recent annual profit above £100,000 and its balance sheet has continually improved over the years.

What can you tell me about AxiaFunder's cybersecurity?

Our security provider's soft probe of the AxiaFunder website finds no malware and it's also marked clean by Google Sage Browsing, McAfee and Yandex. The website is secure and it has a valid security certificate. This offers you protection when you give up any personal data. It automatically redirects you to a secure version of its site. Its website technology is up-to-date.

We don't yet have any details about its firewalls or monitoring to prevent and spot attacks.

During the fund raise, your money is held by ShareIn. While AxiaFunder is directly regulated by the FCA, ShareIn is another regulated company that assists AxiaFunder with holding lender money, among other things. AxiaFunder only receives your money after the funds are raised and holds them just until they are drawn down by the solicitor firm. This is effectively an additional barrier to criminals, reducing the risk of losses through the AxiaFunder website due to cybersecurity breaches.

Is AxiaFunder a good investment?

Funding just a single case is indeed very high risk, as you'll be told, because you shouldn't be completely surprised if you lost all your money on any one case.

But this changes when you have a large number of unrelated cases and when you take good steps to assure yourselves that the defendant is likely to be willing and able to pay if they lose.

AxiaFunder is increasingly using more law firms for running cases and will continue to increase the variety of types of cases, so that you can be more diversified.

With all that in mind, the risks are in no way aligned with the extremely high returns you can earn. AxiaFunder's business model, its processes and its people are not going to disappoint you, so I think it's a very good investment.

It's right up there among the few, best high returns investment I've ever seen for those looking at the more extreme end of investing.

What is AxiaFunder's minimum lending amount and how many loans can I lend in?

You put in £1,000, increasing in amounts of £1,000, for each case – or batch of cases – that you take part in.

AxiaFunder* still needs to arrange more cases – and more types of cases – to enable you to spread your risks further. You're now helped by the newer portfolios and group action, which give you some immediate diversification. You still need to spread across other offers though and shouldn't rely solely on a single portfolio offer.

Limit your pot in each offer. Even if 90% of claims are successful on average, if you spread your money equally between just 10 individual cases, you still have a one-in-four chance that 2-3 of those cases are lost, which could wipe out any gains you make even with very high returns that have often doubled your money.

You can reduce that risk substantially by putting your money into offers that contain multiple cases, so you're spreading your money more swiftly. While that sometimes happens with commercial litigation offers, it's especially portfolio offers that contain many dozens of cases in one.

You also reduce the risks by committing to put less of your money into each individual case and taking advantage of every offer that comes over the years. For example, if you take the time to get into 20 cases your risk of 2/10 or 3/10 cases losing is cut in half compared to 10 cases. And roughly in half again after 30 cases.

Does AxiaFunder have an IFISA?

No.

Can I sell AxiaFunder's loans to exit early?

Yes, although there are possibly exceptions for which we have no details at this stage.

It costs you 2.5% (including VAT). You can sell your holdings for a profit or loss, although the price range is capped by AxiaFunder. The cap is tailored to each case.

AxiaFunder will also set a minimum amount that you can sell.

If you're at the other end – buying these second-hand parts, it costs you 3% (including VAT and stamp duty reserve tax). So, unusually, AxiaFunder charges relatively high fees for trading, and at both ends of the deal.

What more do I need to know?

Bad debts might happen fast in some cases

Some cases lose within just three to six months, as problems in those claim become apparent earlier on.

So, if you're putting money into supporting lots of cases, you might find that you suffer a number of losses before you see any cases win. This shouldn't unduly upset you; it's par for the course.

Thoughts on AxiaFunder's fees

At this stage, estimating AxiaFunder’s fees is more art than science. We need a little more data, but, more than that, we need time to see how well cases perform and therefore how much it earns in success fees.

We currently estimate its portfolio fees might average in a range of 12% to 22%. Its other cases might earn it fees of 50% or more of the amount lent. Well over half of those fees are success fees, which it takes as a cut from lenders, potentially by taking 20% of your gains.

While understanding this is a highly specialist area requiring a lot of expertise on AxiaFunder's part, it's still tricky to know what a fair fee is. AxiaFunder will clearly be very well rewarded for its efforts – but so too will lenders like you.

Is AxiaFunder truly P2P?

As far as the claimants are concerned, they're borrowers and you're lending them money to fund their claims. As is sometimes the case in this industry, the technical way this comes about is not straightforward.

AxiaFunder* structures the deals like other types of crowdfunding. It channels case funding through Scottish Limited Partnerships, or SLPs. Each case – or batch of cases – has its own SLP. These are bankruptcy-remote companies, which means they shield you from losses if AxiaFunder itself goes bust.

AxiaFunder used to use other bankruptcy-remote companies, called special purpose vehicles (SPVs). SPVs are used by a handful of other P2P lending companies. AxiaFunder switched because the SPV structure – in AxiaFunder's specific circumstances – sometimes led to an additional tax cost. The difference between an SLP and an SPV, otherwise, has no impact on you in practical terms.

Any ownership you have in a partnership expires when all the cases are resolved.

I hope you're still with me. Now:

The claimant – the borrower – owes the SLP, if the case resolves successfully. You own the shares in that SLP (with minimal voting rights), along with everyone else who is funding the case. Sometimes, a large number of cases will be structured as an investment fund within an SLP.

It won't be relevant to the majority of lenders using AxiaFunder, but the starting rate for savings and the £1,000 personal savings allowance don't apply to AxiaFunder lending. Read more about relevant tax breaks.

Legally, you’re usually effectively buying rights to the claims by paying some of the costs. You'll get your money and awards before the claimant does.

In pure lending terms, this is perhaps most analogous to a business revenue loan, where you get rewarded depending on how well your borrower does.

This entire structure reduces the risk of your money or returns being diverted to AxiaFunder, or other parties, in the event that AxiaFunder has to go out of business. It achieves this to the same or similar extent as standard lending contracts do. That's the whole point.

4thWay's definition of P2P lending is a practical definition for lenders and investors that focuses on the actual key risk to you of your money being siphoned off. By our definition, AxiaFunder does offer P2P lending.

Thanks for reading the AxiaFunder Review and well done for getting to the end of this complex one!Pages linked to above

AxiaFunder To Cover £500,000 In Losses.

Double, Triple (Or Nothing) Your Money With This Offer.

How Does Peer-to-Peer Lending Tax Work?

AxiaFunder's (fairly meagre) public statistics on its website.

4thWay's definition of P2P lending.

What Are The Risks Facing An Investor In Litigation Funding?

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from AxiaFunder and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.