See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

CrowdProperty Gets Going

CrowdProperty took five months to get its first deal completed, but just five weeks to do its second. Clearly, it's speeding up.

New P2P lending websites can offer interesting opportunities. The interest rates tend to be higher, so if you can satisfy yourself that the people running them are experienced and focusing on keeping risks right down, you can get yourself a great deal.

So let's take a look at CrowdProperty:

About CrowdProperty

CrowdProperty does two types of property loans:

- Loans to property developers.

- Loans on properties that already have a profitable record, e.g. a buy-to-let property that has been receiving good rents.

You can earn between 5% and 11%.

Your money is lent out once the borrower's total required amount has been reached.

CrowdProperty ensures that you're always first in the queue to get your money back n the event the borrower can't repay and CrowdProperty needs to repossess and sell the property.

Borrowers require “a proven track record of excellence in property”.

CrowdProperty has 1,600 registered lenders, 80 of whom have lent their money so far, suggesting they have so far lent considerably more than the minimum £500 on each project, on average.

Example deal

Currently there are two deals you can contribute to. Here's one of them so you get the idea of the sorts of projects being funded.

You can currently lend to a property development in upmarket Farnham.

This loan will pay you 10% for 12 months.

The development is estimated to have a sales value of £1.5 million when it's completed. It will involve knocking down a bungalow to make a high-end detached property with a detached double garage.

As is typical for developments, more than one loan is made to the developer, which takes loans in tranches as and when it needs the money for the next part of the work on the development.

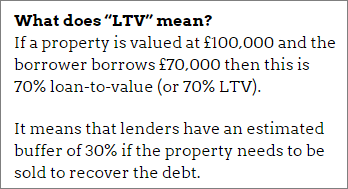

The loan on  CrowdProperty is for £575,000 and it's the second tranche. The loan it got for tranche one, was £275,000, but that means the total loan is still just 57% of the expected completed value of the property. (The so-called “loan-to-value”. See sidebox.)

CrowdProperty is for £575,000 and it's the second tranche. The loan it got for tranche one, was £275,000, but that means the total loan is still just 57% of the expected completed value of the property. (The so-called “loan-to-value”. See sidebox.)

There will be additional costs of £179,000 for “finance and other costs”, which means the expected profit after costs is £471,000, or a 45% profit. Interest on the loan is covered nearly five times by these profits.

The project is being managed by a highly experienced property project manager who has completed over 100 refurbishment projects.

So far, £140,000 of the £575,000 has been pledged by lenders.

Lending costs

Costs are a tricky subject, as is often the case with many types of investments.

CrowdProperty, like most P2P lending websites, claims that lenders have zero costs, since the costs are all in an arrangement fee charged to the borrower. But please read There's No Such Thing As “No Lender Fee”.

Like virtually all P2P lending websites, CrowdProperty does not give us enough information to see what our costs are when we lend through them.

With the very limited information currently available, our best estimate is that costs of lending your money on CrowdProperty are between 3% and 10% interest per year.

So the effective borrower interest might be 13% to 20% (but you don't see that information) while you receive 10%.

About the founder and team

CrowdProperty's four-person team is highly experienced.

The biographies emphasise property deal experience, with 70 years in property and banking. Although they describe little in the way of professional risk-modelling experience, this is usually the way with property P2P lending websites.

One of the founders is Simon Zutshi, who is well-known in the property industry as a highly successful property investor. He's also a best-selling author and he founded the largest property investing network in the UK.

I interviewed Zutshi, recently, just before chairing a property P2P lending panel show in which he took part.

Some of his interesting comments included an indication that CrowdProperty might potentially consider buying out individual lenders if a borrower or property project fails. He is that confident that the projects they select are winners in the right hands. (Although this was not a promise or guarantee!)

Zutshi also estimated CrowdProperty rejects around 90% of loan applications, which is one indication that the company is selective of its borrowers.

More

If you want to stay informed on all the new and old property P2P lending websites you can lend your money through, sign up to our newsletter below.

Our service is free to you. All P2P lending companies will be included in our fair and accurate comparison tables once we have finished adding them all. We don't receive compensation from CrowdProperty, but we do from some of the other P2P lending companies for providing you with the 4thWay® Risk Ratings and 4thWay® Insight Reports for free. We’re paid when you click through from us and open accounts with them. This doesn't affect our editorial independence. Learn How we earn money fairly with your help.