See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

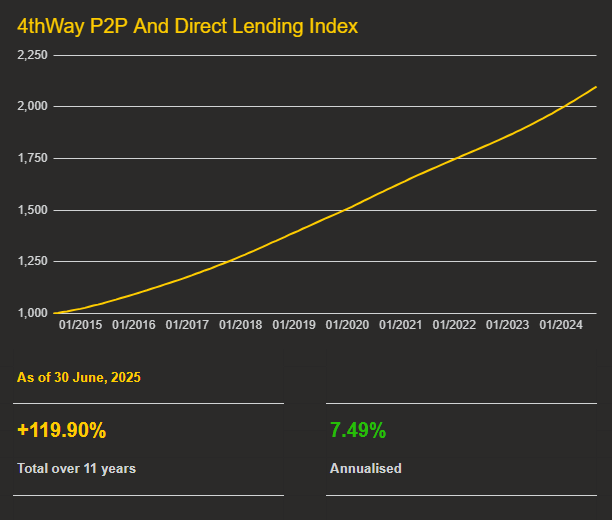

4thWay P2P And Direct Lending Index: Q2 2025

Annualised returns after costs and losses have averaged 7.49%, with no losing months. The graph above is not smoothed but actual results over time.

I note that, if all write-offs from bad debts were squashed into the same period of time, it would have meant just 2-3 months of losses out of 132 months (11 years).

The total losses are equivalent to less than 1.5% of one year’s lending, i.e. not every year, just one year in 11.

Constituents’ returns have massively outpaced the stock market. In the 11 (non-calendar) years since the start of the index, annualised returns after costs have been 7.49% pa.

In the same period, the stock market returned 5.37% pa after reinvesting dividends and after costs 1.

Put another way, £10,000 became £21,990 versus £17,706 for the stock market.

Key numbers

Number of calendar years with positive returns

P2P and online direct lending: 10/10.

Stock market: 7/10.

Longest losing streak

P2P and online direct lending: 0 years.

Stock market: 6.3 years 2.

Market size

Constituents have over £700 million in assets under management (AUM, also called total outstanding lending volume), which is over half the value of the peer-to-peer lending market.

Primary constituents

The table below shows the types of lending available today and the rates currently available for investors who start lending today, before any bad debts.

| Provider/ model |

AUM | Description | Rates |

| CapitalRise*/ DL 3 |

£110 million | Prime bridging and development lending with no capital losses | 9.67% |

| CrowdProperty/ P2P 3 |

£169 million | Mostly development lending with negligible capital losses | 9.83% |

| Invest & Fund/ P2P |

£115 million | Primarily development lending, no loans have ever been in serious arrears, no losses | 8.03% |

| Kuflink/ P2P |

£97 million | Bridging and development lending, negligible losses covered by Kuflink | 8.75% |

| Loanpad*/ P2P |

£95 million | Bridging and development lending under 50% LTV, no losses | 6.00% |

| Proplend*/ P2P |

£68 million | Commercial property lending with investment income, negligible losses | 8.44% |

Find out more about these and other providers in the comparison tables.

4thWay PADL Index methodology and inclusion criteria

The 4thWay P2P And Direct Lending Index (PADL) starts from the end of July 2014 and shows actual returns after costs and credit losses.

All online direct lending, including peer-to-peer lending, is eligible for inclusion in the 4thWay PADL Index, provided the data supplied to 4thWay is verifiable and meets high standards.

Using detailed data from the lending platforms, 4thWay takes the way many bond indices are calculated as a minimum standard.

Bond indices typically take the loan amount, rate and term, and extrapolate the amount made by investors based on generating a schedule, while marking down bad debt as it is written off or charged off.

4thWay’s methodology improves on that by using intra-loan events, such as additional default interest paid out to investors and actual cash flows where possible.

More

1. Stock-market comparison is based on FTSE 100 total returns data from Curvo and Investing.com, after estimated wrapper and fund costs, fees and expenses of 1%, which is conservative compared to most share investors’ frictional costs.

2. FTSE 100 total returns after costs1 saw share investors with a smaller investment pot on 31st October, 2020 than they had over six years earlier, on 31st July, 2014.

3. “P2P” means the platform model is based on article 36H P2P agreements. “DL” means the platform operates using one of several other direct lending models, or models that effect the same for investors.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from CapitalRise, Invest & Fund, Kuflink, Loanpad and Proplend, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or when you make an investment, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.