Why Do Peer-To-Peer Lending Rates Fall? 5 Reasons

You may have noticed that the lending rates you can earn are higher when a peer-to-peer lending website or IFISA first launches. Then, peer-to-peer lending rates fall over the following years to more sensible levels.

The five possible causes of falling peer-to-peer lending rates are:

- Supply and demand.

- Bad debts.

- Competitive forces.

- The economy.

- A change in the underlying loans, such as borrower quality or the types of loans that are approved.

I'll cover each of the reasons one at a time. But, firstly, here are some examples of the path rates take.

How far rates have fallen?

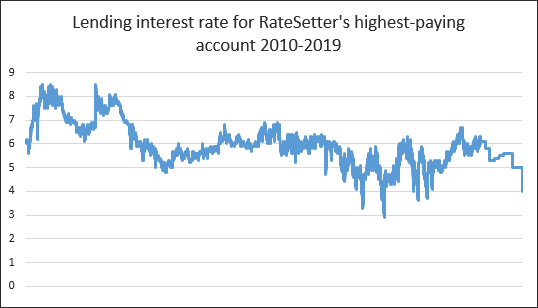

Here are RateSetter lending rates over time:

At RateSetter, lenders have always received what they expected to, so the above nicely tracks lenders' actual results.

The story is the same elsewhere. Here are some more examples:

- Zopa's typical returns have fallen from around 6%-7% in the mid-noughties down to around 4%-5%.

- Funding Circle was paying around 6%-7.5% at the start of the 2010s, which went down to around 4%-5% over the years. Although Funding Circle currently expects to do better for loans approved in 2019.

- Lending Works'* rates spent a lot of time at 5%-6.5% and are now coming down to around 4%-5.5%.

- Growth Street paid around 6.5% and now pays around 5.5%.

- CrowdProperty used to pay a flat 8% to lenders, but it now pays 7% on some loans.

The five reasons why peer-to-peer lending rates fall

1. Supply and demand

The primary cause of falling rates is supply and demand.

The supply of lender cash starts off too small compared to demand for money from borrowers. More borrowers chasing less cash means they have to pay higher borrowing rates to get it.

But rates come down if the supply of lending cash picks up faster than peer-to-peer lending platforms can realistically find more quality borrowers. In other words, lenders effectively start competing with each other to lend.

New peer-to-peer lending websites and IFISA providers have to convince lenders to trust them. And they usually have to do this without being able to show a prior record.

There are exceptions. Loanpad, for example, bases its lending off the Handf family, which has been doing property lending for many decades.

But, for the most part, new P2P lending companies have no concrete record to show lenders. The risks are less well established and less certain at this time. Many potential investors choose not to lend at all. The bottom line is that lenders require higher interest rates as compensation for more unknowns.

As loans mature and the platforms' record develops, more lenders become interested and they're willing to earn a lower rate to take part.

How can peer-to-peer lending companies charge borrowers higher rates to begin with?

Why do borrowers pay those higher rates to begin with? It's not because they want to compensate anxious investors.

Mostly, it's because new peer-to-peer lending websites can afford to be choosy. Typically, they receive far more creditworthy borrower applications than they can possibly accept, until more lenders bring their cash to the platform.

They can therefore approve loans to the creditworthy borrowers who are less fussy about the interest rate they pay. The ones who don't shop around as hard.

Sometimes, lenders' initial interest rates are also boosted by early incentives. To that end, peer-to-peer lending and IFISA providers sometimes take a smaller cut to begin with, so they can pass more on to lenders.

2. Bad debts and bad-debt forecasts

Unquestionably, bad debts have played a part in falling published rates. Or, if not bad debts themselves then improved forecasts.

For many types of lending, bad debts don't start developing for months or even years. Prior to that, lenders enjoy a honeymoon period.

Some peer-to-peer lending accounts lower the lending rates as and when their forecasting models improve. For example, Lending Works' recent interest-rate reductions were entirely to divert more interest to the reserve fund.

4thWay was told this was driven by its new head of risk, who is forecasting bad debts in a different way. This has lead to a relatively modest increase in bad-debt projections. Historically, Lending Works' has done pretty well with forecasts, although they have tended to be a bit too low. The new method will hopefully iron out this small discrepancy.

3. Competition

There are a lot of banks and non-bank lenders competing for borrowers. The main way to attract borrowers is through the price – the interest rate and fees. Due to intensifying competition, over the past ten years, there has been a strong downward pressure on interest rates for borrowers. This is across many kinds of lending, especially bread-and-butter loans, including standard personal loans and small business loans.

With borrower rates pushed downwards, lender rates also come down.

4. What's the economy got to do with it?

After the Great Recession of 2008/10, it was a fantastic time to lend for many years. This most benign period has faded and so lending conditions are now more normal. Unsurprisingly, bad debts across the country have therefore risen a little bit. This impacts the interest earned by lenders.

5. Standards change too

This is more of a hidden reason, and it's why 4thWay needs to keep an eye on P2P lending sites for you – and a reason for you to subscribe to our email alerts. Borrower-selection standards sometimes fall at the same time that rates do.

Take Zopa as an example. To begin with, it was so small it accepted just 0.5% of borrower applications. That was unnecessarily stringent. But lending was just a few million in Zopa's first year, so it had no choice but to be super selective.

Now it accepts 20% or more of loan applications and new lending is around £1 billion a year. Inevitably, it can no longer focus on the most fantastic borrowers in the UK and so it accepts a wider range of borrowers, as the high-street banks do.

Can rates and lending standards fall too far?

The standard of borrower in many cases has sunk already to something more sustainable and normal, and interest rates have done the same.

Yet, for the most part, in peer-to-peer lending, 4thWay's talented experts say that the rates are still satisfactory or better for the risks involved.

It remains to be seen how many providers will allow their rates to fall into silly territory before competition eases up, but it will happen. Keep an eye out for it.

Lending standards can absolutely fall too far as well; for example, when a provider chases too many borrowers to line its own pockets with fees. And this can and does happen at some peer-to-peer lending companies. It's something else to watch out for on a regular basis.

A key sign to keep track of is if the provider talks a lot about growth and hiring a bigger team to reach out to potential borrowers, without reaffirming its existing borrower standards. Another is when a platform branches into other forms of lending of which it has zero or near zero experience.

Typically, 4thWay's experts in those cases recommend that you avoid the new kind of lending until there is a track record, or until the provider hires people with the training and skills needed.

4thWay also keeps a close eye on performance and updates 4thWay PLUS Ratings as the outlook changes.

Lenders, you would do well to create and stick to your own borrower standards – your own lines in the sand. Don't be smooth-talked into lending to worse borrowers or at lower rates than you wanted without an overwhelming case to do so. Past results are irrelevant once peer-to-peer lending websites steer into a completely different quality of borrower.

Read our guide: How One Lender Is Losing Money – A Lesson In P2P Lending Diversification.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Lending Works, Loanpad and RateSetter, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.