See why 4thWay now accepts ethical ads.

Pensioners To Get Better Savings Options Than P2P

Generally speaking, savings accounts don't come close to beating the interest rates being offered by P2P lending companies.

However, from time to time you can find good accounts that come close enough to take a look.

Great savings accounts for older people

National Savings & Investments (NS&I) is launching accounts for people aged 65 and over, nicknamed “pensioners' bonds”.

You can save for one year and earn 2.8% AER or you can save for three years and earn 4% per year AER. These rates are considerably better than the best savings accounts to adults under 65.

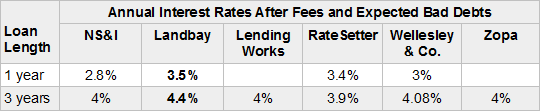

These are not the NS&I Savings Certificates, so you do have to pay tax on them. Even so, they compare pretty well with the current rates offered by the safest P2P lending companies:

NS&I 65+ account compared to safest P2P lending companies

Available rates as of 15 December 2014, except for the NS&I accounts, which aren't available till January 2015.

Interest and loan repayments are compounded, which assumes you re-lend. NS&I interest is compounded too. Compounding means you earn interest on top of interest already earned.

Landbay's “1 year” loan is actually an extraordinarily high easy-access offer. (The interest quoted is still an annual interest rate, however.)

NS&I is launching these accounts in January 2015 – with the precise date still to be announced – so by then the P2P lending interest rates might have moved a little bit. More people might need to borrow in the New Year after a Christmas binge – and a rush of borrowers generally pushes up interest rates.

While none of NS&I's rates quite match the top rates from the safest P2P lending companies, its savings accounts are backed by the government, so they're as safe as savings get. For a small loss in interest they're worth considering.

Getting the interest you expect

In addition, NS&I will earn you interest every day. Of the P2P lending companies, only Wellesley offers you that over both one and three years, and Landbay offers you it just over one year.

For the rest, you will need to re-lend the repayments and interest you get in order to get the rate you expect. All the companies will re-lend your money automatically, if you want, spread across many borrowers, so that you don't have to manage it yourself.

While we expect that you'll be able to re-lend your money swiftly most of the time, often within hours, there will sometimes be delays and this will reduce the interest you receive.

Minimum contributions

You have to save at least £500 in the NS&I savings account and there's a maximum of £10,000 per person (which is £20,000 per couple).

You can lend as little as £10 with the P2P lending companies, with no maximum. The minimum for Landbay is £100.

Getting your money back early

You can get early access to the NS&I savings accounts with a penalty of 90 days' interest.

With Wellesley & Co. and Landbay there is no penalty for leaving early.

If rates have risen since your loans were made, RateSetter, Zopa and Lending Works will reduce the amount you get back to compensate new lenders who your loans are allocated to on leaving.

In addition, Zopa charges a 1% exit fee and Lending Works charges 0.6% or £20, whichever is greater. 0.6% will be greater for withdrawals over £3,333.

With P2P lending, there is always a chance that your exit will be delayed, because your loans need to be taken over by new lenders.

Non taxpayers using the NS&I account

If you're a non taxpayer, you can't use an R85 to stop NS&I deducting basic-rate tax automatically; you must get it back through your tax returns.

Longer deals

These are the only two pensioner bonds on offer. If you want a better rate over a longer period, nothing beats currently beats RateSetter over five years, paying 5.9%.

Commission: we receive commission from all the P2P lending companies mentioned in this article for publishing their calculated 4thWay® Risk Ratings and our editorially independent 4thWay® Insight Report, which are our own proprietary research products to help individual lenders like you make good investment decisions. (Landbay's and Zopa's ratings and reports are coming soon.) We do not take commission for including P2P lending companies in our free comparison tables. All P2P lending companies will be included over the next few weeks. Learn How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.