See why 4thWay now accepts ethical ads.

Lend for a Month or Year and Earn 6%

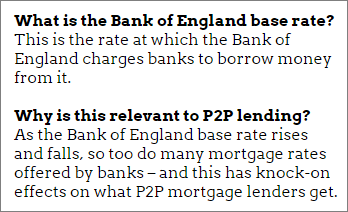

New P2P lending company Fruitful launched quietly a couple  of weeks ago to “invited” lenders with a promise of a minimum of 5% above Bank of England base rate. It currently pays 6%.

of weeks ago to “invited” lenders with a promise of a minimum of 5% above Bank of England base rate. It currently pays 6%.

When Fruitful becomes more widely available, it will provide protection to your savings by lending to borrowers seeking commercial mortgages. These will be full-term, variable-rate mortgages, as opposed to temporary property loans, such as bridging loans while a property is being developed.

Lenders are not subjected to lock-ins, or “compromising” terms and conditions. In addition Fruitful is regulated by the Financial Conduct Authority (FCA).

Early exit with no fee and no adjustment

Fruitful's early exit option is the most intriguing aspect of its proposition.

Firstly, you can leave your loans fee free. This is not new, since other P2P lending companies offer the same.

Fruitful also believes it's structured so that you can withdraw your money quickly. This also happens elsewhere, although it is not a given in P2P lending.

Where Fruitful's early exit really stands out is that, provided another lender wants to buy your loan part off you, you will get all your money back with no adjustment.

Normally, there is an adjustment whereby you receive a bit less than you have outstanding if the interest rate has risen. This is so that the new lender buying your loan parts does not lose out by getting an old, lower interest rate.

For example, say that you're earning 6% and in the meantime the rate rises to 9%. A new lender won't normally agree to taking over your loan part earning 6% when he can earn 9% on a new loan. So an adjustment is made where you get back, say, 99p for every pound you lent. The lender pays 99p for each pound of loans he gets. And this is how the adjustment is made.

Fruitful does not explain who will pay this cost and how. We put this to Fruitful founder Luke Barnes, who said: “Fruitful has the unique benefit of lending on full-term mortgages, not short-term loans or bridging options. As with most full-term mortgages, we run on a variable-rate system. Our borrowers' APR always stays x amount above the BOE base rate, ensuring our savers always receive at least 5% over the BOE base rate as well. So in short, there will never have to be an adjustment paid by any of our savers.”

Earning 6% regardless of how long you lend for

A cost-free and adjustment free exit at Fruitful means that you could earn 6% even if you're just lending for a year, or even one month, assuming Fruitful's variable interest rates don't change.

Currently, the best rates from other P2P lending companies over one month are around 2.5% and for one year under 4%. A 6% rate is usually associated with lending for several years or at higher risk.

Dairy cows for African families

If you like your P2P lending company to have an altruistic bent then Fruitful has struck a partnership with charity, sendacow.org. Keen to become an ethical finance company from day one, Fruitful pledges to buy a dairy goat for families in need in Africa when a new customer deposits at least £1,000.

“Fruitful’s brand encourages people to ‘plant seeds’ for the future and in this case, a dairy goat doesn’t just offer milk – it’s multi-functional.” says Luke. “A family can make yoghurt, cheese and use its manure to enrich the soil so other things can grow and to become self-sustaining.”

Congratulating Fruitful on its launch, Sir Richard Heygate, a pioneer in the field of banking technology with IBM, partner of management consultancy, McKinsey said: “I like the way Fruitful is offering savers a healthy return on their cash while securing their funds against mortar.”

Fruitful’s current interest rate is 6%. However, Fruitful promises savers a minimum of 5% above Bank of England base rate at all times. The base rate is currently 0.5%.

Sources: Fruitful

Commission: we don’t receive any commission from any of the P2P lending companies mentioned in this article for publishing their mathematically calculated 4thWay® Risk Ratings and our editorially independent 4thWay® Insight Reports, which are our own proprietary research products to help individual lenders like you make good investment decisions. We do not take commission for including P2P lending companies in our free comparison tables. All P2P lending companies will be included over the next few weeks. This does not affect our editorial independence. Learn How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.