See why 4thWay now accepts ethical ads.

Latest Interest Rates from the Safest P2P Lending Companies

This article was corrected on 14 December. Previoulsy, we had recorded Wellesley's new one-year rate as 4% (before cashback) when it should have been 3%.

On Monday 15 December, Wellesley & Co., a property P2P lending company with a zero bad debt record and a bad-debt provision fund, will change its interest rates for the first time in six months.

It is also offering cashback to existing lenders.

This is just Wellesley's second change in interest rates since it started matching loans over one year ago.

Wellesley is also reducing the types of loans it offers due to lack of demand. It is removing the six month, 18 month and four-year deals.

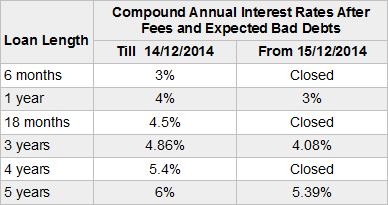

The rates will all fall slightly as follows:

Wellesley's new interest rates

If you elect to be paid the interest at the end of the loan

We always convert Wellesley's rates to compound interest so that it matches other P2P lending companies, which makes them easier to compare. That's why the rates look different here compared to Wellesley's own website, which says one year, 4%, three years, 4.25% and five years, 6%.

If you want Wellesley to pay you interest monthly, instead of annually, you'll get the same compound return as shown in the table. (Well, one-hundredth of a percentage point less.) You can't choose to be paid monthly if you take out the one-year deal.

The actual money you have lent (as opposed to the interest) is always repaid at the end of the fixed period. The advantage is that you don't have to re-lend repayments, as you do with most P2P lending companies.

What happens to existing lenders and their loans?

Your existing loans won't suffer an interest rate reduction. It's just when you lend new money, or re-lend repayments.

Cashback to lenders is 1%, paid immediately on new Money lent by existing lenders, so that you can re-lend it.

How will Wellesley compare from Monday?

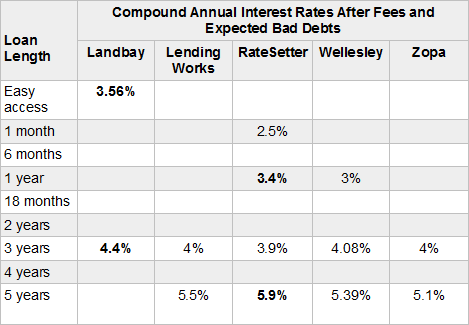

Here's how Wellesley will now compare to some of its most similar competitors (but don't forget the Wellesley cashback of 1%): Landbay, Lending Works, RateSetter and Zopa.

All these companies are targeting the lower-risk end of P2P lending. Bear in mind that any of the following rates could also change on Monday:

Interest rate of lower-risk P2P lending companies

Available rates as of this morning, 12 December 2014, except Wellesley's, which change next week.

The interest shown above assumes you re-lend interest and you manage to lend it again on the same day, but it could sometimes take longer. Wellesley pays interest throughout the term regardless; Landbay loans are interest only, which means you need only re-lend the interest, not the actual loan. Although we call its lowest rate “easy access”, it is not “instant” access – generally you might have to wait a day or two.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Lending Works, RateSetter and Wellesley & Co. and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.