See why 4thWay now accepts ethical ads.

Assetz Invoice Finance: P2P Lend Against Due Bills

Expected interest rate of 10% to lenders before bad debts.

Expected interest rate of 10% to lenders before bad debts.- You can lend as little as £1.

Assetz Capital has just released some details of its new business invoice lending venture.

The P2P lending company already does business loans, as well as short-term and developer property loans. Lenders have lent £55 million through it in the past 18 months.

It is now going to let you lend money to businesses against their due invoices.

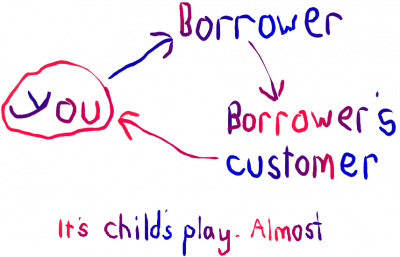

Assetz invoice finance. Child's play. Almost.

This is simpler than it sounds:

- A business is awaiting payment from its customers.

- The business asks to borrow through Assetz.

- Assetz decides whether the business is solid enough to lend to.

- You and other individuals then lend money to this business, but for less than the outstanding bills (invoices).

- When the customer repays the borrower (usually in 40 days), you get all your money back plus interest.

- In the event your borrower goes under, you'll still be first in line for payments due from its customers.

It's also going to be very easy to spread your money between lots of borrowers, which removes the risk of losing a lot of money if just a few loans go very wrong.

Lower rates. Lower risk?

The expected interest is 10%. This is perhaps a bit lower than you might expect for this kind of lending, but from the scant details we've received, the risks here might also be lower than average.

Assetz invoice finance is made available through a joint venture with The Interface Financial Group (IFG), an invoice discounting business. (Invoice discounting is a form of invoice finance.)

In the past four years, IFG has had bad debts of just 0.04% on its invoice discounting business. If we compare this with MarketInvoice, a P2P lending company that also does invoice finance, annual losses over the past three years are over 10 times higher, although they might come down further as more recoveries are made.

MarketInvoice has a great record for lenders, with interest rates after bad debts for 2014 just under 12%. Unfortunately, MarketInvoice is restricted to high-net worth lenders or sophisticated lenders only, with “sophisticated” being defined in law.

Assetz invoice finance will be available some time in the next three months.

Commission: we don’t receive any commission from any of the P2P lending companies mentioned in this article for publishing their calculated 4thWay® Risk Ratings and our editorially independent 4thWay® Insight Reports, which are our own proprietary research products to help individual lenders like you make good investment decisions. We do not take commission for including P2P lending companies in our free comparison tables. All P2P lending companies will be included over the next few weeks. Learn How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.