ArchOver Peer-to-Peer Becomes Affordable

ArchOver*, the only secured and insured business peer-to-peer lending company, is lowering its lending limit from £5,000 to £1,000 from next week.

ArchOver only lends to one grade of borrower, which it calls, variably, “grade A” and “grade A+”, although perhaps its most useful description of its borrowers is: “We only deal with borrowers that are successful.” It also says they are usually growing or expanding.

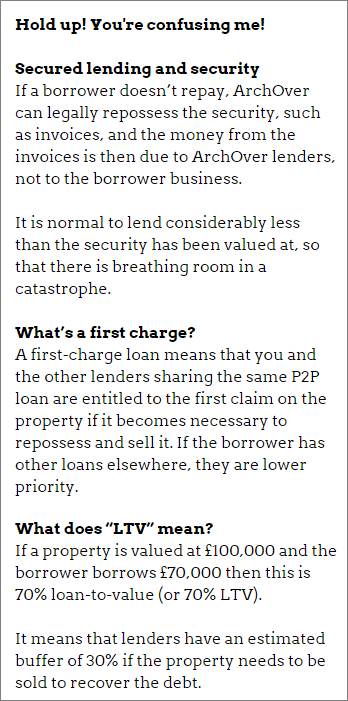

ArchOver's prime focus is on  the property taken in security. The loans are always secured with a first charge against the assets from which the cash will come, e.g. against invoices due to be paid.

the property taken in security. The loans are always secured with a first charge against the assets from which the cash will come, e.g. against invoices due to be paid.

This is a “floating” first charge, which means that as invoices are repaid and new ones issued, the charge stands on the new invoices.

All loans are 80% loan to value (LTV) or better and the borrowing business must always have security (e.g. invoices due) that maintains at least this minimum level. (See sidebox for a definition of some key terms in this article.)

The loans are also insured to the amount of the security, not just to the amount of the loan. The only other peer-to-peer lending company we know of to provide insurance is low-risk consumer loans company Lending Works.

Plus, ArchOver “often” uses gap insurance to cover the difference in case the security turns out to be far less valuable than thought.

ArchOver is new and so it has completed few loans, although they're all big. The minimum loan is $75,000. We have heard no word of any bad debts yet.

Interest rates

You don't bid in an auction. Lending rates are fixed at between 5.5% and 9% (before bad debts). Borrower rates are 1.5 to 2 percentage points more than that and borrowers pay fees as well.

Costs

ArchOver says there are no lending fees, but as my colleague Matthew Howard wrote, “There's no such thing as “no lender fee”.

ArchOver does not publish enough information for us to estimate your costs.

By reducing its minimum lending amount to £1,000, ArchOver is following in the footsteps of LendInvest, a property P2P company that did the same in December.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from ArchOver and Lending Works, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.