See why 4thWay now accepts ethical ads.

How To Check The Financial Services Register For Monsters

Peer-to-peer lending websites and IFISA providers that do not appear to have the correct permission from the financial regulator are the ones that are most likely to turn out to be the real monsters that cause panic, fear and financial loss to individuals.

Below, you will see the most basic way to use the Financial Conduct Authority’s register of authorised businesses.

Checking this register doesn’t guarantee your safety by any means, but even for beginners it is a useful tool to help you cross off any peer-to-peer lending websites and IFISA providers with the most obvious issues.

Note that every now and then 4thWay double checks that the businesses listed in its P2P lending and IFISA comparison tables still appear to have the right permission, although it is not always possible to know if the types of permission listed are exactly the right ones, since it varies based on the legal structure of the P2P lending business.

1. Go to https://register.fca.org.uk/

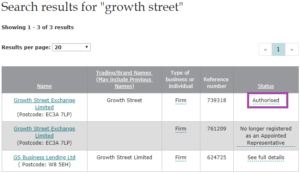

2. Type in the name of the peer-to-peer lending website or IFISA provider, and click Search the Register.

3. Check the full name of the business, the post code and the reference number against those shown on the P2P lending website.

3. Check the full name of the business, the post code and the reference number against those shown on the P2P lending website.

If it doesn’t say “authorised” and instead says “interim permission”, this is not a good sign. We believe P2P lending sites should have won full approval by now.

A P2P lending site could be listed as an “appointed representative” in the register, which means that it piggybacks off another firm’s authorisation. This other firm is called a “principal firm”.

4. Click on the name of the peer-to-peer lending site.

5. If the P2P lending site is an appointed representative, scroll down to Principals, click on the plus sign to get more details, and click on the name of the principal.

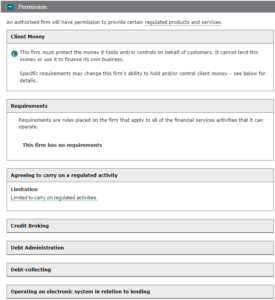

6. Whether you are now looking at a P2P site’s own entry or that of its principal, scroll down now to Permissions and click on the plus sign to get more details.

6. Whether you are now looking at a P2P site’s own entry or that of its principal, scroll down now to Permissions and click on the plus sign to get more details.

The permissions vary, to some extent, but most P2P lending sites or their principals should have the permissions in the image to the left. (Click to enlarge.)

7. The permission that gives you the clearest signal is “Operating an electronic system in relation to lending”.

However, not all P2P lending sites have that permission, because they might have a different legal structure which requires other permissions.

8. You should usually also expect to see that the P2P lending site or its principal has permission to hold client money.

But, again, this might not always be the case. For example, if a P2P site holds individual lenders’ money in an electronic wallet or e-money account, and that account is provided by a licensed e-money issuer regulated in the UK or Europe, then it is possible the e-money issuer has the permission to hold client money.

As you become more knowledgeable, you will want to learn more about the other information in the financial register and combine this search with others, such as a search of the Companies House register. But doing the above is a fantastic start, and already more than most investors do in any kind of investment.

Read The Peer-To-Peer Lending Fraud Checklist.

Read The 13 Key Peer-To-Peer Lending Risks Risks.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.