See why 4thWay now accepts ethical ads.

How Much You’ll Lose If Zopa’s Provision Fund Fails

Neil wrote about the inevitability of some (not all) bad-debt provision funds eventually failing in his Candid Opinion blog, When The First Bad-Debt Provision Fund Will Fail.

That blog was about under what circumstances a (hypothetical) fund can be expected to fail dramatically.

Today, I want to take his work further by writing about how much you could expect to lose.

For this, I'm going to do a Zopa stress test. Specifically, I'm going to use a highly simplified, but drastic, scenario to test the oldest P2P lending company's bad-debt provision fund.

Here's the scenario

Just look at what would have to happen to Zopa for its bad-debt provision fund to be breached.

Zopa has the smallest bad-debt provision fund of all the safest P2P lending companies that don't generally secure loans against property as well.

Yet the pot size is still very decent indeed, being at least 2.1% of the total outstanding debts.

In addition, at time of writing, Zopa tells us its historical bad debt since 2010 has been just 0.25% per year. This is an extraordinarily low bad-debt rate that any bank would be envious of.

In bad economic times, bad-debt rates will clearly rise. However, the bad-debt rates on loans to lower-risk borrowers tend not to rise as much as those to higher-risk borrowers.

Even so, let's say that an unprecedented disaster occurs where the average annual bad debts rise 16-fold to 4% in one year and the following two years the problems rumble on at 2.5% a piece.**

From my rough estimates, that would be considerably worse than the during the three awful years of the recent financial crisis and recession. And that one was already severe.

Knock-on effects

There would be other side-effects that compound the problem, such as:

- Some good borrowers will rush to pay down debt faster – and therefore you earn less interest from these good borrowers to help make up for potential losses.

- Lots of individual lenders will refuse to lend any more, which means fewer new loans and, therefore, less extra money from fees going to the bad-debt provision fund.

And there'd be positive things going on too, such as:

- Interest rates on new lending could rise due to fewer lenders competing to lend.

- Borrower quality could potentially rise, because Zopa could be more selective if there's less money to lend.

- Since there would still be a good number of completed loans, it would mean the bad-debt provision fund would continue to have money dripped in.

- And Zopa could very well decide to increase payments to the bad-debt provision fund from the fees it receives, or even from its coffers, to help maintain or save its reputation.

Although I think the balance is in favour of the positive side, to keep this Zopa stress test simple and drastic, I'm going to say that all these positives and negatives cancel each other out.

Zopa stress test: losses are well contained

Here's how my scenario pans out in catastrophe year one: 4% bad debts would clearly wipe out the 2% bad-debt provision fund, although the hit to lenders would be reduced to an average of 2%.

If you have not taken the sensible precaution of spreading your money across a lot of loans, and you have below average luck, you might take a hit of, I don't know, 4%.

However, it's nothing like as bad as it seems!

Because you have been making between 3% and 5% interest on your good loans. So you're just about even, before inflation.

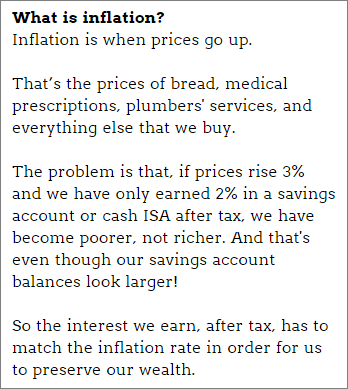

You're probably still up if you have spread your money across lots of borrowers. But after inflation it doesn't look so pretty. You've become a little bit less wealthy in real terms.***

That's an important consideration.

But in pound terms you haven't really lost money. And if you have made a profit over the previous six to 24 months then you might still be up overall, even after inflation.

Compare that to a horrendous year in the stock market of 15% to 30% falls and you can see why these are much lower risk investments.

And in the following two years

In the following two years (of 2.5% bad-debt rates), you would have to do far worse than average to lose money due to the interest you receive on your good loans (and your bad ones before they go bad).

Not least because my stress test takes the unlikely scenario that the bad-debt provision fund won't be topped up fast enough to help you at all, even as the catastrophe subsides.

And the following year or two is likely to rebound and yield plenty of profits to more than make up for your losses.

When things could get worse

This Zopa stress test was a really dreadful scenario and I've not been fair to Zopa with some of my assumptions in order to really test it hard, and yet the result still doesn't look like a disaster.

Disappointing, yes. Disaster, no.

But you should read Neil's Candid Opinion blog, because he shows how any P2P lending companies' strong defences could be eroded over time.

If you sign up to our newsletter below, we'll be here to let you know right away if any of the different warning signs that we keep an eye on are beeping at us.

*Commission: our service is free to you. All P2P lending companies will be included in our fair and accurate comparison tables once we have finished adding them all. We receive compensation from Zopa, and other P2P lending companies not mentioned above, for providing you with their 4thWay® Risk Ratings and 4thWay® Insight Reports for free, which pay us when you click through from us and open accounts with them. This doesn't affect our editorial independence. Learn How we earn money fairly with your help.

Our service is free to you. We don't receive commission or fees from the above-mentioned companies. We receive compensation from some other P2P lending companies when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. This doesn't affect our editorial independence. Read How we earn money fairly with your help.

***Rather like what happens most years to people using savings accounts!

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.