See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

7 Reasons To Put Half Your Savings In P2P Lending

In a recent article, one of his first for 4thWay, freelance investment journalist Cliff D'Arcy suggested the maximum amount that any of us should lend through P2P is 5% or at most 10% of our wealth.

Susan, a 4thWay reader, told me on the phone that this frightened her. I'm not surprised. It shocks me too.

You might be reassured to know that Cliff's view isn't the norm at 4thWay.

4thWay is about honest opinions that don't hold back. Recently, we started hiring high-quality freelance journalists like Cliff to introduce external views, so that you can get different candid opinions to those of the experts and researchers at 4thWay.

As I told Cliff when he started, 4thWay is not a sales brochure for P2P lending sites but a place where investors can easily learn about the scale of all the risks.

I particularly wanted Cliff to be one of our external contributors myself for his cynicism, competence, unique writing style and fresh eyes on the subject of P2P lending.

It's great to see he hasn't let me down, starting with that strong opinion on the 5% rule as well as a powerful scoop from a major P2P site, both of which can be found in Major P2P Founder Warns: “Our Industry May Never Be Profitable”.

What's my opinion?

I'll come to “why” in a minute, but first, this is what I think most people in general, including myself, should do with our spare money:

- Keep some money in the bank, or savings accounts or cash ISAs (tax-free savings accounts), for emergencies and short-term needs.

- Look to buy our own homes if possible and when the time is right.

Invest half of our remaining spare income or wealth in the stock market through “index trackers”, wrapped up in tax-free places like share ISAs and pensions if necessary.

Invest half of our remaining spare income or wealth in the stock market through “index trackers”, wrapped up in tax-free places like share ISAs and pensions if necessary.- Lend the other half in peer-to-peer lending, again, wrapped up in IFISAs or P2P pensions if necessary.

Savings, your own home, shares and P2P lending: four really fantastic saving and investment products that are the best solutions for the vast majority of people. Hence our name, the 4thWay.

So 50% of your “investing pot” is for P2P lending and the other 50% for shares. Your investing pot is less than 50% of your wealth due to your emergency savings and, hopefully, your own home.

What's the point of 5%?

My view is that if an investment is so risky that you would just put in 5% of your money then it's a waste of investors' time. Neither I nor any of the other founders of the 4thWay would have bothered to set this website up if lending was so high risk.

Indeed, some of my co-founders and early colleagues have worked in lending for decades, which is something they wouldn't have done if there was no money in it. There would have been no money to pay their salaries!

I also would not have spread my own money across hundreds of loans through a variety of P2P lending sites for myself.

Good investing is mostly about controlling the risks, which means we need to be highly confident that we have a large margin of safety that protects us from losing money.

Most investment ideas cannot give any of us that confidence. So my 5% (or even 10%) rule is: don't waste your time.

To put my 5% rule into perspective, I believe that 5% is a sensible maximum amount when you want to buy shares in startups, by which I mean doing the incredibly risky investing that is called “crowdfunding”. I don't mean 5% of your money in a single startup. I mean 5% across all the startups you choose to invest in.

And that's if you invest at all in crowdfunding; I think most people shouldn't touch it. Crowdfunding is an investment where the majority of us cannot confidently invest while saying we have a large margin of safety against heavy losses.

Personally, the way I describe crowdfunding to friends and journalists is that it is the highest risk investment this side of a scam. That's where a 5% maximum limit comes in. Why bother at all with that amount?

Why 50% in P2P lending?

Here are the key reasons why I think 50% of most people's investment pot should be in P2P lending. They are the same reasons why I co-founded 4thWay, by the way.

1. Lending is a highly stable form of investment

Barring subprime lending lunacy, lending has always been, on average, a very stable form of investment that is easy to control and measure the risks, even in a downturn. It has been a great way to earn an income for millennia, reserved for the wealthy until now.

I'll give you a few recent examples.

I'll give you a few recent examples.

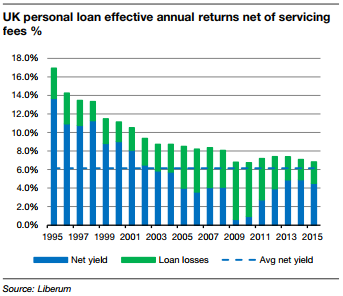

Liberum research found that UK banks made money on personal loans every single year for 20 years, including through the worst of the recent financial crisis.

In the graph to the right, you'll see the “net yield”, in blue, which means the money banks made from lending after the costs of administering the loans and after losses from bad debts.

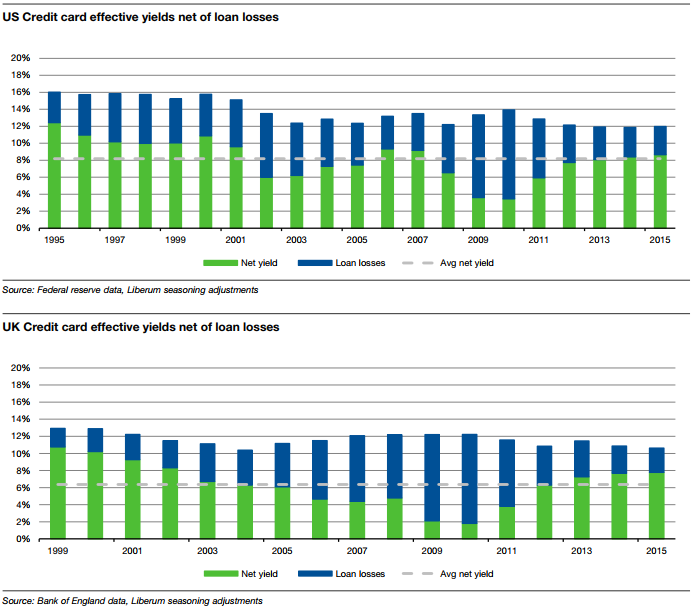

Liberum also managed to put together data on both the UK and US credit-card markets and found the exact same picture, with no overall loss in any year. (See the graphs below. This time the profits are in green, not blue.)

Average annual interest earned by the banks in credit cards and loans over the period, even after bad debts, were 8% in the US and 6% in the UK:

The figures are consistent however you slice ordinary lending activities.

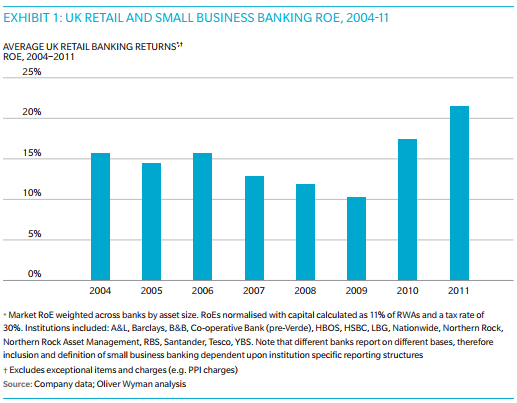

Take Oliver Wyman's 2012 research.

Take Oliver Wyman's 2012 research.

It looks into the banks' bread-and-butter products like lending – as opposed to the complicated, financial-crash causing crazy stuff.

The research shows that, with their non-crazy products, the banks made very solid profits every year between 2004 and 2011, which includes the financial crisis.

The large bulk of those profits are from lending to people and businesses, including mortgages, rather than savings accounts or current accounts.

Remember these figures just reflect ordinary bank products. Factor in the stupid stuff and the banks made huge losses overall in many of those years.

That just goes to show that if your favoured P2P lending sites start offering complicated financial products, run like the next crash is breaking over your head.

2. Contrast with the stock market

I don't want to diss the stock market. I love the stock market too. It remains a very sensible place for most of us to put in half our investing pots. By following sensible, low-risk investing rules, we can expect to do just fine with our stock market investments over the long run.

That said, the stock market lacks the stability that many people need for at least a good chunk of their investments.

Now, usually when investing in stocks it is best not to look at the graphs at all, and instead learn the underlying details. But here a graph – any graph – nicely demonstrates my points.

I could take absolutely any graph from any place and almost any period of time to demonstrate what I'm about to explain. This week I was helping a friend who is investing in an index tracker across dozens of German businesses, so I'll take a graph about that:

As I said to my friend at the time, her index tracker has just about everything a shares fund like that should have: it spreads her money over quite a few (mostly stable) businesses and it has very low costs. As a result, this fund that just tracks the market has delivered better results to investors than the vast majority of funds being actively managed to “beat” the German market.

Glancing at the graph and imagining someone who regularly invests, buying shares both when prices are high and in the dips, I imagine those investors will have done fine.

Someone with a 15-year investing horizon who just invested at the start will also now be doing okay, as shown by the graph ending on the right a fair bit higher than it started on the left.

And yet my friend would have made losses that she will not have recovered for years if she invested in 2001, 2002, or 2007, and she would have made losses for shorter periods if she invested in 2011 and 2015.

Indeed, if she invested in 2001, she would have been sitting on a loss a decade later in 2011. And we haven't even considered “inflation” yet, which means that money decreases in value and you need more money to buy the same things.

In other words if your investing pot is the same amount ten years later, you are considerably poorer because it hasn't grown to match the rising prices of things we want to buy.

She would have been disappointed if she had just planned to invest for those ten years. Stock-market investing is most suited to the very long-term.

Clearly, the graph shows that, over the short-term, the stock market can be very rocky indeed. The graph is very different to the earlier ones showing lending results.

The best research (by a million miles) in shares investing comes from Dimson, Marsh and Staunton, three LSE professors who produce the outstanding Credit Suisse Global Investment Returns Yearbooks and Sourcebooks. They have found that if you invest in shares listed in just one country you would have had a 25% chance of losing to inflation even if you put your money in for 20 years. And that's before you count the costs of investing, such as the annual fees you pay to your stockbroker or share ISA provider.

There are some very solid ways to reduce those risks, such as investing regularly, choosing “smarter” trackers and investing in several developed markets across the globe. But the point is that even over very long periods you can come out worse than you expect if you haven't put in some work.

3. P2P lending sites have poached skills from banks

It's all very well talking about the results of bank lending, but we're talking about P2P lending. The good news is that, for the most part, the same people who were assessing potential borrowers for banks and other lenders before P2P was born are now doing it in P2P.

Most money being lent in P2P is going through P2P sites with lots of banking experience. In addition, P2P lending sites have built new technology and tools to do an even better job than the banks and to lower costs.

Liberum also showed that from 2005 to 2012 Zopa, the first P2P lending site, showed very steady returns through the great recession of 2008. Although all the other P2P sites have shorter histories and have not experienced a major downturn yet, the performance of the vast majority of loans is well in line with the best practice shown by banks.

4. Lenders are at the top of the food chain

When it comes to getting your money back, lenders have the prime position in the food chain, and above individual borrowers, above businesses, their directors and their shareholders. This considerably lowers the risks.

Consider that if a business owes money to either you or a bank, and that business goes bust. The business' remaining possessions and facilities are sold. Then, you or the bank get your money back first from those sales and from any remaining cash the business had in its posession.

Only after that, if the business has anything left, are the founders or owners of the business allowed to get anything back. That's why it is safer to lend to a business than own shares in it.

The situation is similar when we lend to individuals. Whether we're offering them mortgages or personal loans and they fall into difficulties, aside from an allowance for their basic human needs, courts oblige borrowers to prioritise payments to us lenders over spending any spare cash for themselves. Their properties could be repossessed and sold on our behalf.

(Very poor borrowers have no spare cash, which is why it makes sense for most of us to lend to wealthier, lower-risk, “prime” borrowers.)

5. Easy to ensure that you earn fair interest

As individuals doing P2P lending, it's easy, at least compared to almost all other investments including the stock market, to ensure we're getting a fair return (i.e. we're being paid fair interest rates) that gives us a large margin of safety even in a big recession.

Relative to other investments, it is remarkably easy to assess the risk of a batch of borrowers. Any one of those borrowers might disappoint you, but if you lend to 100 or 200 borrowers like that, the risks of being wrong fall to a very small level indeed. The mathematics of diversifying like this is mindboggling (in a good way). In contrast, you might invest in 10-100 perfectly fine businesses on the stock market and still wouldn't be surprised to lose 20% next year.

If at any point you're no longer confident you're getting a fair return with a big safety margin, stop lending or switch to other P2P lending sites. It's as simple as that.

6. Savings accounts are high risk

There, I said it.

I'm not talking about the risk that the government literally takes our savings off us, even though that does happen throughout history from time to time even in developed countries like ours. Actually, probably more often than you realise.

But what I'm talking about mostly is the stealth tax that is inflation, rising prices. On average, the interest we earn in our savings accounts and cash ISAs does not keep up with rising prices. This means that £50 you save today might have ticked up to £60 in ten years, but the cost of a meal in a premium restaurant might have risen from £50 to £75 in that time. So you would have got better value out of spending your money earlier instead of saving.

Savings accounts are called low risk because the risk of suddenly losing a large chunk of the money is low, especially due to government protections in place. But for those saving for the medium or long term they pretty much guarantee you'll be poorer in real, inflation-adjusted terms.

7. Lots of information to measure the risks

In 20 years of investing, P2P lending is the first new type of investment I have seen that is very open about the risks and costs. We lenders are provided with lots of data and information, and have opportunities to request more information.

As for other new investments, they usually make me shudder. I think of “collateralised debt obligations” (an investment product that was a cause of the subprime crisis and great recession), guaranteed equity bonds (a high-cost share investing product) or even endowment policies (a kind of a pension with features that make it very expensive with unsatisfactory returns). It's all the same.

As a class, these and many more have been horrible investments due to their confusing terms, lack of information, and varied hidden costs. I hope you have sent them packing by whacking them soundly with a very large barge pole.

Without lots of available information, it is impossible for investors to measure the risks and the rewards, and therefore invest sensibly and get a fair return.

Many P2P lending providers give useful details that go far beyond almost any other investment.

(That said, like every type of investment or savings product I've ever seen, without exception, they still need to do better on explaining costs. Read about that in There's No Such Thing as “No Lender Fee”.)

How to lend 50% of your money

How to lend wisely is an altogether different subject, but I can't leave this without mentioning that how you lend is important. If you don't follow sensible rules, you shouldn't be lending or investing at all.

You need to follow 4thWay's 10 P2P Investing Principles. And, preferably, lend and re-lend your money for several years.

Back to Cliff

Cliff told me that he doesn't suggest a maximum 5% because he sees the risks are high like they are in crowdfunding, which is nice to know. But, whatever his reasons, I'm encouraging him to write another candid piece for us soon on why he suggests that limit, so that we can all get more views on this.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.