To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Same Loan Grade, Different Risk

It's like when your say that a piece of art looks beautiful while the man at your side shakes his head in disgust.

You're both entitled to your opinions. Similarly, there are no regulations that define what an A+ loan is, or an A, or any other loan grade.

Same grade, very different risk

Funding Circle and rebuildingsociety both have loan grades from A+ to C- and they both help lenders like you and me lend our money to business borrowers. Yet for equivalent grades, rebuildingsociety interest rates are higher for equivalent grades.

There is usually a good reason, and there is here: the risks are higher. And it's not just because rebuildingsociety is a newer P2P lending company.

We wrote recently about some loans coming up on rebuildingsociety.  One of those loans was a £95,000 loan to a start-up – with no track record and very poor security.

One of those loans was a £95,000 loan to a start-up – with no track record and very poor security.

What credit grade would you expect this start-up to get out of the A+ to C- range?

You're nearly right. It got a C (with no minus).

Funding Circle, on the other hand, won't touch start-ups with a barge pole.

Barely a dozen of its A+ loans have gone bad in four years out of 1,000 loans, which sets a high standard and leaves a lot of room for businesses below.

It calls its own C-grade loans “average risk” and C- just “below average” risk. Not “Danger!”, but just “below” average. (Although I don't want to understate the stark difference in quality between Funding Circle's A+ and C- loans. The risk levels are still dramatically different.)

While these descriptive labels are, by themselves, nearly as useless as the letters, I think they're reasonably accurate after analysing Funding Circle in some detail.

In Funding Circle terms, then, a start-up with inadequate security is, in the eye of that beholder, a “junk” loan or unratable.

This is all A-OK!

Lower standards are totally fine. Indeed, “lower standards” is a bit of an unfair term. Because you might not want higher standards. You might want higher interest rates and be prepared to take bigger chances.

What's important is that the standards are explained clearly and that you understand them – and demand an appropriate interest rate for them.

Personally, I can't think of a situation where I would lend to a start-up that has poor security without a) very high interest rates, b) an awful lot of information about the P2P lending company and c) at least as much information about the business borrower. Plus, I would put just a tiny fraction of my wealth into a loan to any one start-up business.

The bottom line is that you can't rely on the grade. You have to dig deeper.

Different standards elsewhere

The same can be said of other aspects in P2P lending.

What one P2P lending website calls a “responsible” or a “prime” borrower can mean something different when another P2P website uses it.

That can be the difference between one P2P website being so picky as to accept just 10% of applicants and another being looser and taking 20%. (20% is still a very low acceptance rate, but it is likely to mean you have more less-than-perfect borrowers in the mix.)

Then there are bad-debt provision funds. All very well, but how large is it?

And there are other “credit enhancements” (that's some industry jargon I picked up from our debt risk specialist), such as Wellesley & Co. paying the first 5% of losses before its bad-debt provision fund even gets touched.

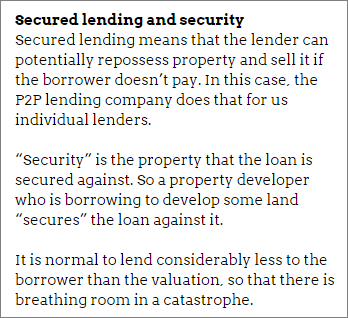

Then there's secured lending: are borrowers taken at their word on valuations or are physical inspections always carried out? And how much higher are the valuations compared to the loaned amount? Plus, do you and other lenders sharing this loan get first dibs when repossessing, or are you all second in the queue?

Ahem…

Bad-debt rates give an indication of many of these things, but not all of them. Sorry for this pitch, but I know of no better way to get a measure of all these risks at once than 4thWay's own Risk Ratings.

These risk scores are not works of art that can be adored by one and hated by another. They're calculated using the same mathematical formula. The formula probably won't always work (no risk-scoring system ever does) but it's a great basis to start you research from.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Funding Circle and Wellesley & Co. and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.