See why 4thWay now accepts ethical ads.

Lenders On Crash Course to Get Burned!

This is the story of whacky individual lenders and their high-risk loans. The problem is that this doesn't seem to be a rare event!

I see this happen on numerous P2P lending websites. But I'm going to take FundingKnight as my example today. I only use them because I've just been poring over data that it has sent over today for 4thWay® to plug into its comparison tables. I could have chosen just about any P2P lending company that lets you lend at different loan grades.

FundingKnight's loan grading system

Before I show you how maybe even you are being a bit whacky, you need a little background on FundingKnight's business loans. (It also does property loans, but I'm ignoring those for simplicity.)

FundingKnight grades its different business loans. Its “5 Shield” loans are the ones that its experts think are the safest.

The loans it rates as the least safe it calls “2 Shield” loans.

Only one loan has received a 5 Shield loan so far. It's good to see FundingKnight is not frivolously throwing that grade around.

How much interest you could earn

But one loan doesn't give us much to work with, let's put 5 Shield loans to one side and look at FundingKnight's next best loans, its 4 Shield loans. Because it's done 40 of those.

On average, before bad debts, FundingKnight's 4 Shield loans have made lenders 10.01% interest.

Now let's skip 3 and look at 2 Shield loans for the biggest contrast. These loans have made lenders 12.52% before bad debts.

This difference of 2.5 percentage points might not seem like a lot to you. But in investing terms it is massive, particularly if you re-lend your interest and repayments for years.

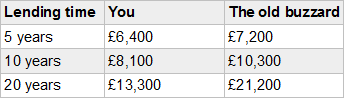

Say after bad debts and taxes you make 5%. (I'm not saying you will – I just plucked that figure out from behind your ear.) Your dad, wise old bast-, er, buzzard, makes 2.5 percentage points more, so 7.5%.

Here's what happens:

You vs The Old Buzzard

As you can see, the difference even over just five years is nearly £1,000, it accelerates, and in two decades he's laughing through his mush at you when he's multiplied his pot over four times compared to your less than three times.

Bad debts at 4 Shield and 2 Shield

But your dad is taking huge chances – like many other lenders.

FundingKnight hasn't completed nearly enough business loans to get a reliable idea of its actual bad debts at different grades.

However, for this simple exercise we just need to use FundingKnight's forecasts. They'll turn out wrong, for better or worse, like all forecasts do, but it's a neat way to demonstrate the point.

FundingKnight estimates 0.5% bad debts per year for 4 Shield loans. This means that while you make £100 interest on your £1,000, you'll lose £5 on average due to bad debts, plus a little more in lost interest from the borrowers who went bad.

You also get taxed on those losses, so that ticks your losses up a fraction more. (Read about taxes on losses and how you can dodge them in How is Peer-to-Peer Lending Taxed?)

In contrast, for 2 Shield loans, FundingKnight forecasts 3.25% bad debts per year, or £32.50 on each £1,000 lent. Plus lost interest and extra taxes on top.

Taking higher risks for less money!

Doing some rough numbers, here's how you might expect to do if you happen to lend through an average year at either 4 or 2 Shields:

Your earnings on £1,000 after one year*

![]()

*After losses, lost interest and taxes, assuming you're a basic-rate taxpayer.

I hope you can see from the above table that we have this extraordinary situation where investors lending at lower risk are expected to earn more than those lending at higher risk!

Those of you lending at higher risk are doing so at such low interest rates that, after losses and taxes, you can expect to earn less money than those who apparently took far less risk!

This isn't FundingKnight's fault. This is lenders' fault for lending at lower rates than they should for higher-risk borrowers.

It gets much, much worse!

You could invert this and say that lower-risk lenders are earning more interest than they deserve. But I propose a simple test to see if that's true.

Let's continue to assume FundingKnight's forecasts turn out to be fairly accurate on average. There will still be tough years when losses are much higher, i.e. years that are far from average.

What if you lend prior to a recession, for example? It's vital that lenders realise that higher-risk borrowers that go bust tend to multiply much more during recessions and other tough times than safe borrowers.

So borrowers who are safe might only get worse by, say five times, taking 0.5% bad debts to 3.5%. That would mean bad debts for safer borrowers in a bad year were just slightly higher than higher-risk loans in an average year.

Whereas, in the same recession year, the riskier borrowers might get worse by seven times, taking bad debts from 3.25% to 22.75%!

After losses, lost interest and taxes, that'll turn your £1,000 into around £850, despite the interest you earn on your good loans.

It just goes to show that if you're going to lend at higher risk, you better be getting extremely attractive interest rates to compensate you and give you a massive buffer in case another financial crisis is around the corner.

Lenders are clearly not doing this at the moment. I don't get it. I don't get it at all!

Key lessons

- The best investors in the world focus, above all else, on controlling the risks. If you're lured by higher rates without ensuring you have built in some kind of huge margin of safety, you should expect to be disappointed by your results.

- Don't go up the risk-scale without an extraordinarily large margin of safety. If there's a recession, bad debts from the safest borrowers won't rise all that much, but bad debts from the already riskier borrowers will multiply many, many fold.

- Remember that P2P lending's natural place for both risk and reward is between savings accounts and the stock market. If you're looking for high returns, the stock market's natural place is further up, so you should consider putting money set aside for higher risks there. I recommend my colleague Neil's article on Why I Prefer Shares to Higher-Risk Lending.

Our service is free to you. All P2P lending companies will be included in our fair and accurate comparison tables once we have finished adding them all. We don't receive compensation from FundingKnight, but we do from some of the other P2P lending companies for providing you with the 4thWay® Risk Ratings and 4thWay® Insight Reports for free. We’re paid when you click through from us and open accounts with them. This doesn't affect our editorial independence. Learn How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.