See why 4thWay now accepts ethical ads.

Funding Circle Goes Higher Risk

Funding Circle* has just added an extra borrower grade: grade E. It has also renamed C- to D.

So you can now lend in six categories of borrower: A+, A, B, C, D and E. You do not have to lend at the higher-risk grades if you don't want to.

If you're using autobid, E-grade loans will not automatically be switched on; you need to select them yourself if you're willing to go that high up the risk scale.

How risky is this new E category?

Funding Circle is now accepting more borrowers than it would have done before, and is placing them in this new E category.

The P2P lending website has tracked the performance of business borrowers that it has rejected for the past two years, so that it already has an idea of the bad debts you can expect from them.

These borrowers are riskier and more volatile, according to Funding Circle.

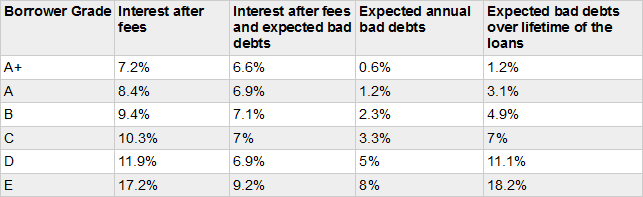

That's why it is forecasting 8% annual bad debts, or 18.2% bad debts over the lifetime of the loans. (I'll explain that in a minute.)

It has set a very narrow interest rate band at which you can bid for the E loans. You can bid no lower than 18.2% and no higher than 20%, before the 1% fee.

It's important to note that Funding Circle still describes these new borrowers as “creditworthy businesses”, so it has not started approving all-and-sundry with this new category.

Forecast bad debts

There are two key ways to forecast bad debts.

You can say how many bad debts you expect in a year, which in the case of the new E band is a very hefty 8%. Hence why interest rates are set to a minimum of 18.2%.

You can also forecast bad debts by year of loan issue.

So, for example, take all the loans that started in the year 2015. Most of them will probably run for several years. By the time they're all paid off, what was the total bad debt in all those loans? So we're not talking the average annual bad debt, because some of the loans will go bad in different years.

Expected lifetime bad debts for the new E loans is 18.2%, whereas currently the interest rate after fees is just 17.2%. You might think, then, that you're sure to make a loss.

Not so.

You will earn your 17.2% on a large part of the money you've lent every year for several years, i.e. you won't just earn 17.2% once. Yet you will suffer the 18.2% loss of your investment only once.

Still, these high-risk loans are not for the faint hearted. Funding Circle probably has to add riskier loans in order to be able to cope with demand to lend from more and more lenders. But that doesn't mean you have to go up the risk scale too.

And the average interest rates after expected losses for the other higher-risk loans – say, grades B to D – currently don't look particularly attractive, since they're barely higher than the A+ loans.

The A+ loans, in contrast, look incredibly good, with barely a dozen loans going bad out of thousands since Funding Circle started five years ago. And the interest rates still look reasonable too, especially if you plan to re-lend your money regularly, which dramatically lowers the risks even further.

Read more about investing in A+ loans in Funding Circle Lending Strategy.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Funding Circle, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.