See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

Saving Stream Provision Fund Looks Solid

Saving Stream is a secured loans P2P lending company that has been paying around 12% to lenders, with no losses to its 2,000 lenders. Now, in addition, it has launched the Saving Stream Provision Fund.

Saving Stream Provision Fund

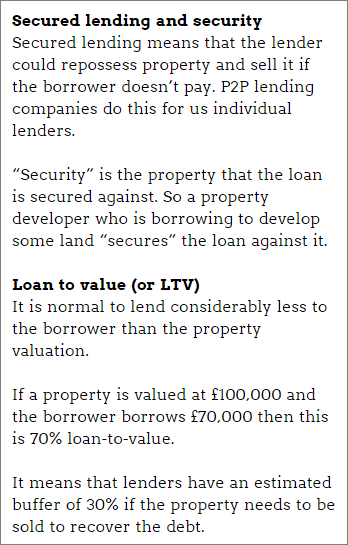

Not only does Saving Stream lend  to a maximum of 70% LTV (see sidebox for definition), but lenders can expect the Saving Stream Provision Fund to cover even more losses.

to a maximum of 70% LTV (see sidebox for definition), but lenders can expect the Saving Stream Provision Fund to cover even more losses.

This fund is set aside to pay lenders back if a borrower can't repay and if selling the security doesn't cover the outstanding debt.

Saving Stream says it will maintain a fund of at least 2% of outstanding debts, which is a very solid bad-debt provision fund, especially when combined with good-quality secured loans.

Currently, the fund is at the minimum of 2% of the outstanding loans, or just under £260,000.

As of now, lenders have their money in £13m-worth of loans on Saving Stream.

How the Saving Stream Provision Fund works

The Saving Stream provision fund is held in a separate company, so that if Saving Stream goes under, the fund will survive to keep on helping lenders.

Initially it has been set up using money belonging to Saving Stream's own shareholders, but it will top up the fund with each new loan on Saving Stream.

Saving Stream estimates that, for a very large loan – more than £2 million – the bad-debt provision fund is effectively like an extra 7%-9% reduction in the loan-to-value. For more ordinary-sized loans, the cover is far better, unless many of them go bad at the same time.

Bad-debt provision funds are always labelled as “discretionary” for legal reasons, but the directors of the separate companies running the fund are expected to use the money to help lenders recover losses.

None of us at 4thWay® consider the discretionary structure of the fund to be a noteworthy risk factor. Some of us have discretionary trusts through our life insurance companies, which we also expect will pay our loved ones when we die.

But I expect and hope that each of you will satisfy yourselves before rushing in on any lending, or investment, opportunity.

Bad-debt provision funds are no guarantee against loss, but between good security and such a fund, the likelihood of loss at Saving Stream is low, particularly if you spread your money across many loans.

Our service is free to you. We don't receive commission or fees from the above-mentioned companies. We receive compensation from some other P2P lending companies when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. This doesn't affect our editorial independence. Read How we earn money fairly with your help.