See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

How To Check The Financial Services Register For Monsters

Peer-to-peer lending websites and IFISA providers that do not appear to have the correct permission from the financial regulator are the ones that are most likely to turn out to be the real monsters that cause panic, fear and financial loss to individuals.

Below, you will see the most basic way to use the Financial Conduct Authority’s register of authorised businesses.

Checking this register doesn’t guarantee your safety by any means, but even for beginners it is a useful tool to help you cross off any peer-to-peer lending websites and IFISA providers with the most obvious issues.

4thWay sometimes checks that the businesses listed in its P2P lending and IFISA comparison tables still appear to have the right permission, although it is not always possible to know if the types of permission listed are exactly the right ones, since it varies based on the legal structure of the P2P lending business.

How to use the register

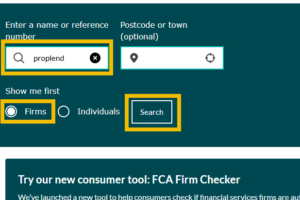

1. Go to https://register.fca.org.uk/

2. Scroll down to where it says: “Enter a name or reference number”.

2. Scroll down to where it says: “Enter a name or reference number”.

3. Type in the name of the peer-to-peer lending website or IFISA provider.

4. Click/tap “Firms” and then click “Search”. You will be given a list of likely matches.

5. From the list of likely matches, click on a match. The full name of the business, the post code and the FCA reference number should match those shown on the P2P lending website.

6. At or near the top of the entry, there should be a sentence that begins “This firm is authorised…” That's the first clue.

But there are exceptions. Somo, for example, is not regulated for lending purposes, so you won't see the same text there, nor will you see many of the details shown in the next steps. (See Is Somo Truly P2P Lending?)

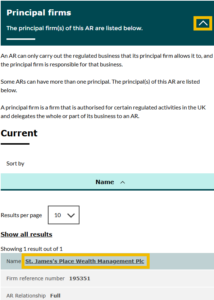

Furthermore, one of the very first opening sentences might instead begin: “This firm is an ‘Appointed Representative'.” In that case, it means that it is under the supervision of another regulated company, called a “principal firm”, and it is piggybacking off the principal firms' authorisations.

P2P lending companies that are appointed representatives usually are newer, smaller and less experienced. So just be a little more attentive to ensuring that you're very confident in the people, their processes and results before you sign up to them.

7. If the provider is an appointed representative, scroll down to “Principal firms” and click on the link to its principal.

7. If the provider is an appointed representative, scroll down to “Principal firms” and click on the link to its principal.

You might have to click the down arrow to open this section up, before you can see the link to the principal.

8. Scroll down to the section “What can this firm do in the UK?” and its first subsection, “Restrictions”. If necessary, click on the down arrows in that section one by one to open up all the details for each sub-section.

You should normally see in this section that it has permission to hold and control client money.

Sometimes, though, it can just hold client money, or just control it – or neither.

In those cases, look into why. For example, it might be able to control movements of your money but not hold it in its own client account, because it leaves that part to a partnering company. That's usually a so-called e-wallet provider or an e-money issuer regulated in the UK or Europe.

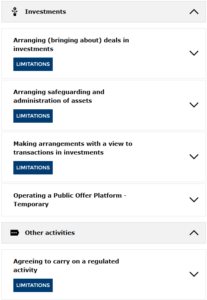

9. Next, scroll a bit further down to “Activities and services”. Use the arrow to open the details, if necessary.

Possibly under “Consumer credit”, it will state “Operating an electronic system in relation to lending“. This is the clearest signal that it is a peer-to-peer lending provider that likely has the right permissions.

However, not all P2P lending sites have that permission, because they might have a different legal structure which requires other permissions.

However, not all P2P lending sites have that permission, because they might have a different legal structure which requires other permissions.

For example, the most important activities for you in CapitalRise's list are “Arranging (bringing about) deals in investments” and “Arranging safeguarding and administration of assets”.

As you become more knowledgeable, you'll want to learn more about the other information in the financial register and combine this search with others, such as a search of the Companies House register. But doing the above is a fantastic start, and already more than most investors do in any kind of investment.