See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

Which P2P Lending Sites Lend In Their Own Loans?

In this article today, I'm looking at P2P lending company money: which P2P lending sites put a lot of their business cash on the line?

This is to follow up on the recent 4thWay article about P2P lending site founders who lend their own money through their own sites.

It's got trickier for P2P lending companies to lend their own money in loans listed on their own websites. This is since the Financial Conduct Authority, the UK's regulator, decided it didn't like them doing that very much.

However, some P2P lending sites have found legitimate ways to get around this without offending the FCA. And, to me, so long as this is transparent and clear, I see it as a good thing if a P2P site is willing to lend its own money. And it's even better if it promises to take the first loss on any loans that go bad or if it promises to buy back loans that have late payments for a few months in a row.

The following list contains all the P2P lending sites that have told us they lend extensively in their own loans. I'll warn you now, the list is disappointingly short, as well as short on details. Don't blame the messenger.

P2P lending sites that take first loss

4thWay knows of two P2P lending sites that take first loss with their own money:

Kuflink

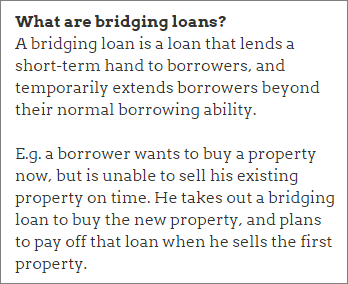

Kuflink does property bridging loans and development loans. It's completed over £100 million-worth of them.

It pays in the region of 7%, on average.

Kuflink lends 5% in every loan and takes the first loss of 5% if you lend in its manual lending account.

It doesn't commit to taking the first loss for its auto-lend account, as it expects your risks to be reduced by spreading your money across lots of loans.

It has, however, nevertheless taken the hit for auto-lenders on the couple of loans that suffered some losses. (Which wasn't necessary, as overall lending results would have been resoundingly positive without this gesture.)

HNW Lending, which has also completed around £100 million in loans, does bridging and development lending as well as lending against other assets. It too takes the first loss, typically of at least 10%. Auto-lend lenders also benefit from a modest reserve fund on top.

P2P sites that lend in their loans and buy back late loans

Mintos

Mintos has done nearly €400 million in loans. It is a P2P lending site with borrowers mostly in Poland, Sweden, Georgia and the Czech Republic, but also other countries. Most loans are in euros with borrowers in euroland countries, but some are in other foreign currencies. People living in the UK may lend through Mintos.

It mostly does personal loans, with over half being car loans, but it also does some business loans and mortgages.

It is not regulated by the UK's financial regulator.

After losses, lenders have been making just under 12% interest, on average, with high interest rates apparently driven by a lack of banking competition in many of these countries. Its record on bad debts has been very good so far.

Mintos doesn't actually lend its own money in its loans. Instead, Mintos' partners do. Mintos is passed loans by partner businesses, and all but one of those partners is required to keep 5% to 15% of the loan themselves.

In addition, if those loans fall late by a couple of months ,most of those partner businesses are required to buy the loans back from individual lenders who are using Mintos. This is arguably even better than Mintos taking first loss – if you are confident that those partner businesses can afford to buy back the loans. Mintos appears to be very confident that they can do so.

Note that at least some partner businesses (such as Lendo and Hipcredit) do not offer P2P loans, whereby you lend directly to the final borrower. Instead, through the Mintos website, you lend to the partner business, and the partner business then lends the money on to other borrowers. This adds an additional layer of risk for individual lenders.

We will do a full report on Mintos soon after we have conducted more extensive research.

Viventor

Viventor is another P2P lending site with borrowers in Spain as well as some smaller countries in Europe, doing loans in euros. It has done around €30 million in loans.

It is not regulated by the UK's financial regulator. It does a variety of short-term loans to businesses and individuals, some of which are secured against real property, but I have little further information about the types of loans. People living in the UK may lend through Viventor.

Viventor pays in the region of 8% or more and claims that no-one has lost a cent.

Viventor, like Mintos, doesn't actually lend its own money in its loans, but partner businesses are required to keep 5% of the loan themselves.

Like Mintos, most of those partner businesses are required to buy the loans back from individual lenders using Viventor if those loans turn bad.

P2P lending sites that lend on equal terms

Orchard Lending Club

Orchard Lending Club has a lending niche that encompasses lending to insurance brokers, solicitors and accountants, as well as their clients, and also lending to cover school fees.

It pays in the region of 4%.

Businesses operating under Orchard Funding Group had already been lending money for years, before it founded its P2P lending spin-off, Orchard Lending Club. As a result, the majority of the money in the P2P loans on its website came from Orchard Lending Club itself.

That's why, back in late 2016, Orchard Lending Club told 4thWay it “always” lends in its loans and that it was doing 90% of the lending, but it said that this would fall as more new individual lenders come on board.

That is not to say that it was planning to lend less of its own money. Just that more money from individuals using its P2P site would shift the balance.

Orchard Lending Club also told us in 2016 that it takes the first loss on loans. However, for now, it is important to realise that that information is quite out-of-date and nowhere in Orchard Lending Club's terms and conditions does it state it will take first loss. Therefore, lenders would be wise to assume that it will not do so.

We reached out to Orchard Lending Club to confirm what proportion of the loans it now holds itself and whether it still takes first loss, but we have not received an answer. I'll do an update here if it responds.

Its worth noting that Orchard Lending Club also hasn't updated 4thWay or its own website on important facts and statistics in any meaningful way for the whole of 2017.

Read more:

Our service is free to you. We don't receive commission or fees from the above-mentioned companies. We receive compensation from some other P2P lending companies when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. This doesn't affect our editorial independence. Read How we earn money fairly with your help.