To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

FundingSecure Lenders Suffer First Losses

Until recently, FundingSecure has been bragging that no lenders have lost any of their starting money.

But it had to happen eventually. Now, a small number of lenders have collectively lost £512 of their starting money.

Presumably all those lenders are up overall, because FundingSecure has matched over £4.4 million of lenders' money since July 2013 in 191 loans. So that's a staggering loss of 0.04%.

I'm grateful to FundingSecure for also revealing the amount of lost interest too. It amounts to a grand total of just £358. So that's total lender losses of £870.

FundingSecure has paid an interest rate after fees and bad debts of around 12.5%. Before bad debts the total earnings would have been just one-tenth of a percentage point higher.

Recovery rates have been very high

FundingSecure has classed just shy of £40,000 as bad debt (“in default”).

However, it has recovered 98% of the bad debt.

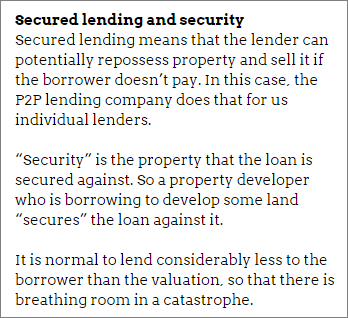

This very high recovery rate is supported by security . FundingSecure only does secured loans. (See sidebox for a definition of secured loans and security.)

. FundingSecure only does secured loans. (See sidebox for a definition of secured loans and security.)

In addition, it will only lend a maximum of 70% of the valuation of any property or high-value items that it takes as security on the behalf of us individual lenders.

Taxes are a bummer

Since FundingSecure has no bad-debt provision fund, we lenders are not able to offset any losses we make against interest we have earned elsewhere for tax purposes.

This tax rule is clearly a flaw so it will likely be changed in the near future, or you'll be able to dodge it by investing in a P2P ISA or P2P pension.

Read more in How is Peer-to-Peer Lending Taxed?

Our service is free to you. All P2P lending companies will be included in our fair and accurate comparison tables once we have finished adding them all. We don't receive compensation from FundingSecure, but we do from some of the other P2P lending companies, for providing you with the 4thWay® Risk Ratings and 4thWay® Insight Reports for free. We’re paid when you click through from us and open accounts with them. This doesn't affect our editorial independence. Learn How we earn money fairly with your help.