Funding Circle Loans with Cashback This Week

A+, commercial property mortgage for 35 months in Kent

- 8.5% fixed interest, which is an estimated 6.9% after Funding Circle fees

- Cashback of 1.5% on top.

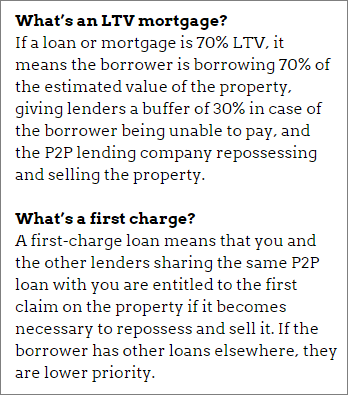

- 80% LTV mortgage with a first charge.

The auction finishes at 10.30am on Tuesday 16 December at the latest.

This is a first-come, first-served loan. This means you can't keep bidding after the auction is fully funded, so you will not be able to bid lower to steal the loan part from another individual lender at the last minute.

Four-fifths of the £300,000 loan is already funded.

You will receive both interest payments and repayment of some of your original loan on a monthly basis, so you’ll need to re-lend both.

A+, residential property development loan for 16 months in Cheshire

- 8% fixed interest, which is an estimated 6.4% after Funding Circle Fees.

- Cashback of 1.5% on top.

- 52% LTV mortgage with a first charge.

The auction finishes at 12.43pm on Tuesday 16 December at the latest.

This is another first-come, first-served loan.

£88,000 of this £200,000 loan has already been funded.

This is an interest-only loan, which means you’ll receive interest payments monthly and your actual loan will be repaid at the end; since you don’t receive partial repayments for your actual loan each month, you will get interest on the full amount without having to re-lend it (although you will need to re-lend the interest).

A+, residential property development loan for 13 months in Cornwall

- 8% fixed interest, which is an estimated 6.4% after Funding Circle Fees.

- Cashback of 1.5% on top.

- 63% LTV mortgage with a first charge.

The auction finishes at 2.47pm on Wednesday 17 December at the latest.

This is another first-come, first-served loan.

Four-fifths of this £200,000 loan has already been funded.

This is an interest-only loan.

A+, residential property development loan for 16 months in Northampton

- 8% fixed interest, which is an estimated 6.4% after Funding Circle Fees.

- Cashback of 1.5% on top.

- 56% LTV mortgage with a first charge.

The auction finishes at 5.04pm on Thursday 18 December at the latest.

This is another first-come, first-served loan.

For-fifths of this £200,000 loan has already been funded.

This is an interest-only loan.

About cashback and the interest rates

Cashback can be lent out again swiftly and it is not taxed. Thus, it is more valuable than adding 1.5% to the interest rate for shorter loans. However, for loans over several years this can reverse, because cashback is a one-off and annual interest is not.

Average annual interest for lending to A+ loans without cashback is currently between 6.2% and 6.7%, depending on how much of your money is not on loan and earning interest in a year, which reduces the interest you get.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Funding Circle, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.