See why 4thWay now accepts ethical ads.

First Great National Steams into P2P

It sounds like a train service, but it's the latest P2P lending company to offer you the opportunity to do property loans.

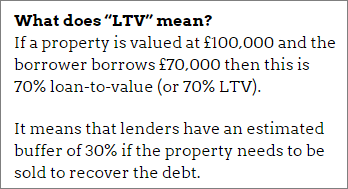

First Great National is a new peer-to-p eer lending company focuses on developer loans with a maximum loan-to-value of between 70% and 80%.

eer lending company focuses on developer loans with a maximum loan-to-value of between 70% and 80%.

First Great national is very heavy on the marketing but low on the details, especially about risks. I think we can put this down to its newness for the moment, but lenders will need more details before they can see if it's a good investment or not.

Currently it's putting an emphasis on making its service look as attractive as possible over cautioning potential lenders of any risks. There is no risk disclosure on its website, but it says:

“We are also the first peer to peer lender that offers savers security of assets. Because we hold the development sites and assets as security much like a mortgage on a personal property we ensure savers and investors achieve market leading returns with guaranteed security.”

“Guaranteed security” is not an industry phrase, so it's not clear what it means. What it doesn't mean is that it is risk free. Perhaps it means that your loans are guaranteed to be secured against property.

Contrary to its marketing words, First Great National is also far from the first P2P lending company to do property loans. There's Wellesley, LendInvest, Proplend and Landbay all entirely focused on property. Then there is Assetz Capital, Funding Circle, Funding Knight, eMoneyUnion, Funding Secure and others doing property loans as part of their loan mix and you can specifically choose to invest in just the property loans.

So we're not sure what First Great National is claiming to be the “first peer-to-peer lender” of.

This is not the first time that a P2P lending company has used heavy-handed marketing techniques, although many of them, particularly those in the P2P Finance Association, seem to try to encourage each other to do better and with success. But it pays to look beyond the pitch to the actual details.

I'm sure that First Great National will give more details sooner rather than later. As a start-up ourselves, we at 4thWay no how difficult it is to do everything at once. But until it adds more details to its website, or responds to our requests for more information, we must keep away from it for the time being.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.