To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Personal Peer-To-Peer Lending: It’s Underrated!

Before you start to assess a P2P lending website or IFISA provider that does personal loans, it really helps to understand the characteristics and features of personal peer-to-peer lending.

In other words: what are you getting into when you lend your money in these loans, what features of personal peer-to-peer lending make it different to other kinds of lending, and what broadly are the advantages and disadvantages?

I'll start with the basics about personal lending, then I'll highlight the variety of strong points they have for lenders, and finally I'll work my way up to what really sticks in my craw about it, to build the suspense…

What features distinguish personal peer-to-peer lending?

Personal loans are loans to individuals that are typically for £500 to £35,000. In peer-to-peer lending, you can also find smaller loans for specific purposes, such as paying for mobile-phone deals. The size of the loans makes it easy to spread your money widely.

Borrowers mostly take out loans that they'll pay off gradually over six months to five years. Lenders will receive some interest and some of their loan back each month. A batch of loans lasting up to five years is typically more than half-paid off within just 18 months. That's in part because of overpayments and early full repayments.

This means that lenders need to constantly re-lend their money in order to keep earning interest on it. On the flip side, the same factor helps you when you suffer issues trying to sell your loans early. Because you'll still get a lot back rapidly due to normal borrower repayments. And you earn interest while you wait.

Most of the time, it's liquid (quick) to lend your money to borrowers. It's the same when you sell your loans to get your money back early. It's not always the case – but most of the time.

What are the borrowers like?

Personal loans are usually to creditworthy borrowers and therefore distinct from heavy-risk lending to individuals, such as payday loans.

These loans are usually unsecured. That means bone of the borrowers' property or possessions have been earmarked in advance, for sale in the event the borrower becomes unable to repay the debt.

That said, some personal loans are secured on specific items of property. The most common example is car loans.

You do get lending to individuals that are secured against other valuable items they possess. But these are called asset-backed loans and are distinct from personal loans.

Homeowner loans and lending to individual landlords are also outside the scope here. (There is precious little opportunity to lend to homeowners through peer-to-peer lending platforms or IFISAs. The closest alternative is lending to landlords. Read about that in 5 Reasons Why Lending to Residential Landlords Is The Lowest Risk.)

What are the interest rates on personal loans?

In this kind of lending, usually the peer-to-peer lending website itself sets the interest rates. This is most logical, since you would expect them to have more skills and knowledge than you at pricing interest rates correctly.

Rates charged to borrowers can range from 4% to 50%. That includes any platform fees, which are usually incorporated into the interest rate. The maximum rate depends mostly on how high up the risk scale the P2P lending platform goes.

Banks tend to weight their loan books towards healthier borrowers. Peer-to-peer lending platforms have so far emulated that.

In practice, the average rate paid by the borrower is usually somewhere between 10% and 20%. At the same time, P2P lending sites include a lot of sub-10% loans.

Pricing interest rates correctly is always important in any form of lending, But the large range of quality that you get, even among creditworthy borrowers, makes the pricing of interest rates a particularly critical function for peer-to-peer personal lending.

What interest rates are paid to lenders doing peer-to-peer personal lending?

Lenders don't get everything the borrower pays. A slice of each loan goes to the peer-to-peer lending company in the middle. And lenders take all the risk in the event loans go bad.

So far, interest rates earned by lenders after fees and bad debts have typically been around 5% to 6.5% per year.

If you lend through lending accounts with shorter loans or with cheaper or quicker early access, you're paid less money.

In my view, lenders so far have got badly short-changed in return for “free” early access. That access isn't guaranteed and isn't worth the cut in lending rates. It's better to earn higher rates and hold onto your loans, or pay a small exit fee.

How stable are the returns on personal lending over the years?

In peer-to-peer lending, virtually all investors who have lent their money across personal peer-to-peer lending platforms have made money. And, indeed, they have made satisfactory returns.

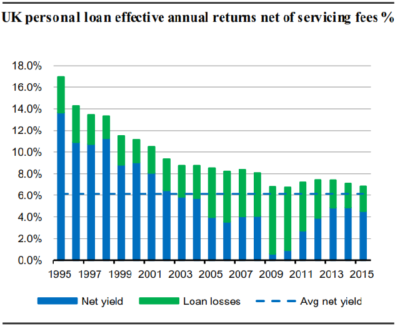

In banking, we can see that this is quite normal. Research from Liberum shows that banks made money every year on personal loans in the two decades from 1995 to 2015:

Source: Liberum.

Indeed, peer-to-peer lending has offered even more stable returns than that. Combine all the notable peer-to-peer lending websites that primarily do personal peer-to-peer lending. They have offered over 7,000 lenders average returns in the range of 4% to 7% every single year. The first of them started in 2005.

I don't expect this outperformance of the banks to continue. As peer-to-peer lending websites grow to be mainstream lenders, returns will equalise with banks. But, as you can see, that still means satisfactory results with far more stability than the stock market.

Bad-debt profile of personal loans

Bad debts in personal loans can occur at any point in the life of a loan, although most occur in the first 18 months.

There are a lot of ways to cut and slice a peer-to-peer lending website's bad-debt figures to learn about how risky the loans are.

I'm just covering one way here that gives you an idea of debts that go bad in a year. I'll show you the first way that we look at bad debts at 4thWay. If we've been given enough data. It's pretty similar to the way many banks approach one of their own key assessments, called Basel pillar 3 disclosures.

One of those banks, HSBC UK, has a massive dataset based on over one million historical personal loans. It's therefore very experienced at managing risk in loans like these. It's a good model to compare peer-to-peer lending platforms to.

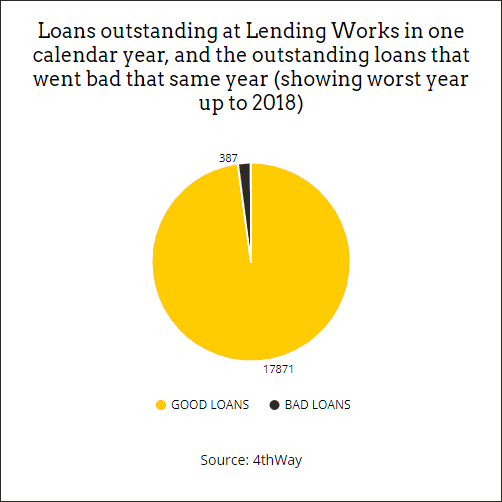

In the six years between 2013 and 2018, HSBC UK suffered no higher than 24 out of 1,000 outstanding loans going bad (2.35%) in any annual period.

A loan that didn't go bad in a given annual period could go bad in a later one. Or it could have gone bad in an earlier one, with recovery action underway. But, since interest is also paid annually, it makes sense in the first instance to compare bad debts on the same basis.

I'm taking personal loans peer-to-peer lending site Lending Works* as an example. The equivalent figure over the same period (excluding 2013, since it started in 2014) was practically the same. It was 22 bad debts out of 1,000 (2.17%) loans.

Bad debts in a recession on personal loans P2P lending

There were no recessionary years in 2013-2018. In a severe recession, you might find that the bad debts go up by two to four percentage points. More for higher-risk personal loans.

Therefore, at HSBC, 2.35% could in a very extreme case turn into 6.35% of outstanding loans turning bad in a single year. At Lending Works, it could be about the same.

In the year before and afterwards, the proportion of loans that turn bad might also be several percentage points higher.

How much you lose when a loan turns bad

We can say that, typically, you might expect to lose 75%-80% of the outstanding amount on any individual loan that goes bad. Therefore, if one of your loans goes bad as soon as it's taken out, and you're lending in 200 loans, you might then lose 0.4% of your money.1

HSBC hits around an 80% loss of the outstanding debt as a matter of routine, recovering around 20%. Personal loans peer-to-peer lending websites as a whole still need more practice to recover that much.

Probability: it's a numbers game

One of the main features of regular, unsecured personal loans is that you're playing a numbers game. You expect this game to be highly stacked in your favour.

You can't possibly select a mere handful of loans of this type and contain the risks. The chance of suffering losses through bad luck are too high.

Instead, you rely on probability. To make it probable that you'll get a satisfactory rate of return and not lose money, you lend to a lot of lenders. For creditworthy borrowers, this usually means in the region of 200 or more. The more, the better.

The probability of good results considerably improves the longer you lend and the more regularly you lend, or re-lend, the repayments and interest you receive.

Automated decision-making: computer says Yes or No

In personal loans peer-to-peer lending, hundreds or thousands of applications are processed every day.

While some manual checks are inevitable for some loans, staff at the peer-to-peer lending platform can't possibly review every borrower's application with a fine-tooth comb or arrange interviews with all the applicants. Not to the extent that property lenders do on their much larger, much rarer loans.

That's why decisions are often made instantly by a computer, especially for smaller loans. Failing that, the manual part is made as quick and easy as possible for the staff through technology.

Without trying to get too much into personal peer-to-peer lending “underwriting”, which is a topic for another day, the computer will typically check credit-reference agencies for the borrowers' records and scores. It will also check, or make it easy for staff to check, bank statements, the electoral roll, fraud databases, and other records.

Some peer-to-peer lending websites are pioneering more modern automated checks, such as searching social-media accounts.

Lots of data is the key

Banks and peer-to-peer lending platforms turn that high volume of loans into an advantage: the more applications there are, and the more loans, the more data they build over time in order to improve their borrower assessments. The corollary to that is that, when a P2P lending platform has just begun, it will usually have no data set at all.

There are other advantages to high volume lending that is decided automatically: computers can't make mistakes as easily as people when it comes to reading the data correctly. And they can't be charmed or humbugged into providing a more generous assessment of the borrower.

It's not just that a computer says Yes or No. It also automatically generates the interest rate that the borrower is offered.

Predictability of personal loans peer-to-peer lending

In personal lending, everything used in the decision has to be measurable against everything else. This is so that you can look back over the full history of lending to people to see what the likely results are.

In short, if you don't mind some jargon, it's about quantitative factors, not qualitative factors. Fewer mistakes are possible by those that set the automated criteria if they have a strong set of data. “Strong” means that it can show how similar borrowers have done previously.

If done well, it leads to a smooth system with few shocks and surprises.

Reserve funds

The interest you earn on personal peer-to-peer lending is not just how you make money. It is also your main defence against losses. The more you earn, the more losses you can offset, especially during an economic downturn.

Anything that adds to your main defence against losses from bad debts is called a credit enhancement. The most common one is a reserve fund.

A reserve fund, or “bad-debt provision fund”, is a pot of money that some peer-to-peer lending companies set aside to pay expected bad debts. They use this to pay you your money back when a borrower fails to do so. The provision fund also usually pays you the interest you're owed.

Some UK peer-to-peer lending platforms that do personal loans have a reserve fund. They all pay out no later than four months after the first missed payment by the borrower.

Other protections in personal peer-to-peer lending

Some peer-to-peer lending platforms and IFISA providers offer lenders other protections – other credit enhancements.

Other protections are rare in personal lending and most do not offer anything more than a reserve fund. However, you can see the following:

Insurance against cyber attacks and borrower fraud

Before the policy is granted, the insurer must already be satisfied that the P2P site has strong systems in place to counter these rare cases. And therefore the insurance won't be used often, if at all. Still, it might prevent some so-called “long-tail risk” such as when a very powerful and clever hacking group finds a way in. But that's unproven.

Life insurance

This covers the outstanding debt in the event that the borrower dies. In practice, so far, life insurance has seen the most use of any insurance policy in personal peer-to-peer lending. But even that has been sporadic.

Insurance for when the borrower is unable to pay due to being made redundant

This insurance, which tends to have a lot of small print and exclusions, might show its worth during a recession, when redundancies are high. It could knock down the overall bad debt level by a modest amount.

Insurance if the borrower can't pay due to sickness, accident or injury

Small print restricting claims probably makes this insurance a lot less valuable than you might think. Unless you have taken out your own payment protection insurance in the past. Then you know it's got a lot of exclusions.

Insurance to cover borrowers near bankruptcy

Perhaps half of any outstanding loan might be covered by insurance if a borrower gets an IVA or enters into a debt management plan. These are two alternative routes to going bankrupt and could have more value in a recession. But that hasn't been tested or proven.

Overall, the value of all these insurance policies is limited. It makes sense for lenders to assume they will have little or no impact.

Some European peer-to-peer lending platforms, such as Mintos, offer a loan buyback guarantee. This means they, or partner companies, will buy back any loans that go bad and stay bad for several months. In some cases, the parent company of one of the partners will repay the debt if the partner is unable to do so.

While other credit enhancements do exist in peer-to-peer lending, they are used in other types of lending at the moment.

Money spread across lots of loans (automatic diversification)

An extremely powerful feature of peer-to-peer lending to individuals in ordinary personal loans is that you don't usually choose hundreds of borrowers for yourself. Instead, your money is spread across lots of loans.

This level of diversification is more important than a reserve fund. I can't emphasise enough how critical it is to good lending that your money is widely spread around.

For these sorts of loans, with the variety of results they might achieve, a good minimum spread to aim for would be around 200 loans. Not all providers automatically spread your money across as many loans as that from day one. But you could increase your diversification by staggering your lending over several months, or by lending regularly.

Your money spread across all live loans (full diversification)

Some personal loans peer-to-peer lending platforms and IFISA providers enable you to spread your risk across the entire outstanding book of loans, which can be tens of thousands of loans.

Sometimes, this diversification doesn't take place until until its reserve fund is just about to be overwhelmed by unforeseen bad debts.

If a reserve fund is going to be used up, the lending platform effectively spreads excess bad debts across all lenders. In other words, you can't suffer losses due to being very unlucky with your batch of borrowers.

The interest earned on all the loans might also then be shared out equally between all lenders. Prior to that, lenders will have been earning different rates. The rate they earned depends on when they lent and which lending account they opened.

Personal peer-to-peer lending companies have great tech ability

One more feature of personal peer-to-peer lending platforms is their geekiness. That, I assure you, I mean as a compliment.

These businesses conduct thousands of transactions a day. They automatically spread lenders' money and they automatically check out potential borrowers. They need good technical skills in order to make this all work smoothly. And they need precision to defend their systems from cyber crime.

If a platform works on learning from all the data and loans they've arranged, it can also reduce human error through tech.

Experience in personal lending is not replaced by tech geekery

One thing to watch is that sometimes tech geeks in peer-to-peer lending think that their talents are directly transferable to assessing risk and underwriting loans. They are mostly right in that there can be a lot of overlap in how they think. And in their interests in manipulating data.

But programming and a love of spreadsheets are not a substitute for training and experience in lending itself. Nor does that cover the whole skill set needed in a lending operation. When this happens, it's a case of not knowing what they do not know.

So you also need to see people with all the right skills in personal peer-to-peer lending. But that's an article for another time.

Personal peer-to-peer lending: your options

In the UK, the big-three are Zopa, Lending Works* and RateSetter. But RateSetter is far from pure. It does a very large number of business and property loans too. And you can't choose to just lend in its personal loans.

All three currently have at least one lending account with the highest 4thWay PLUS Rating, which is “Exceptional”, or 3/3. You can read about them in the Lending Works Review, Zopa Review and RateSetter Review.

Less well known are Madiston LendLoanInvest and JustUs, neither of which have provided enough information, or access for interviews, in order for 4thWay to assess them. JustUs does relatively few personal loans.

Lendable might also be legally structured as peer-to-peer lending, but it has not provided enough information for 4thWay to confirm it. It's only available to high-net worth and sophisticated investors.

In mainland Europe, personal lending options are always somewhat different. And you're lending in euros, which adds a large dollop of currency risk, albeit with much higher interest rates. Mintos does personal loans secured against vehicles. Bondora and SAVY are two other leading options. Each of these does a wide variety of loans, not just personal loans.

Lending costs in personal peer-to-peer lending

In the investment world, the one thing that always sticks in the craw is the lack of transparency about the investing costs. Many of the biggest costs are so well hidden that some investors don't even know to ask for them. You won't even see them in your contracts!

This is not just limited to traditional, old, dusty investment funds and pension plans. I'm afraid it applies just as aptly to peer-to-peer lending too.

Specifically in peer-to-peer lending, the total cost of lending is the amount of money the borrower pays in fees and interest to the peer-to-peer lending platform, minus the amount that the platform passes on to lenders at the other end, but before bad debt is deducted.

For personal peer-to-peer lending sites that offer reserve funds, it's fair to make a small allowance for the fact that some of those costs go towards a pot of money that is adding to your protection.

The reason that it is difficult to pin down the costs is that peer-to-peer lending websites are loathe to reveal the average amount paid by borrowers. The most common reason is that it might lead to a personal loans price war. If the platform tells us what the full cost is, we can easily add that onto the amount earned by lenders to work out what the average borrower is paying.

Potentially, other reasons for the lack of disclosure are more dirty. Perhaps some peer-to-peer lending sites don't want lenders to work out how much they're holding back. That is something they will never say.

But many of them don't help themselves by claiming that lending is free to lenders. (Read There's No Such Thing As “No Lender Fee”.)

Best estimate of lending costs

Nevertheless, 4thWay takes bits of data here and bits of data there to estimate lending costs. It appears that lending costs are typically around 3%-5% if you're not offered a reserve fund. If there is a reserve fund, costs are probably more along the lines of 5%-7%.

These are quite reasonable and easily in line with banking. So, at present, it appears that lenders are roughly in the same boat. So the majority of the money kept back by the peer-to-peer lending companies go towards their essential costs.

Those costs include getting new borrowers, assessing them and looking after the loans. All the things you're paying them to do for you.

More:

Lending Works Review. | Visit Lending Works*.

RateSetter Review. | Visit RateSetter.

Articles and guides that were linked to above:

5 Reasons Why Lending to Residential Landlords Is The Lowest Risk.

There's No Such Thing As “No Lender Fee”.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Lending Works and RateSetter, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

1In 4thWay's experience, it's very difficult to predict how much money might be lost on any batch of loans that go bad, since, despite all the data collected to approve the loans, not enough is generally known about the borrower and why trouble has struck. It's not just us who say that. Lyn C. Thomas (who died in 2016) and others of the University of Southampton found the same in “Modelling LGD For Unsecured Personal Loans: Decision Tree Approach”; Lyn C. Thomas, Christophe Mues, Anna Matuszyk.