How To Get Your Money Lent Out More Quickly

If you invest by buying shares through the stock market, you can be confident that most of your money is working for you most of the time. And you can reinvest with ease in seconds. It's extremely rare when this becomes difficult.

Not so with P2P lending! It's one of the downsides of this kind of investment.

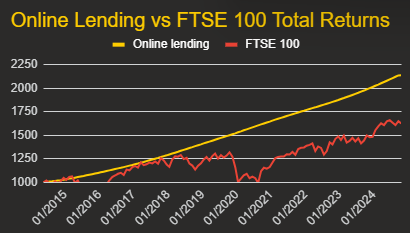

You can see P2P lending is a much less bumpy ride than shares in terms of results.**

You can see P2P lending is a much less bumpy ride than shares in terms of results.**

But you have a lot more work to do getting most of your money lent out – and keeping it that way.

You can make it easier to lend and re-lend by choosing from a few different strategies that I'll mention below.

Here are the full contents of this page:

Why it can take time to get lending and to re-lend.

The cost of delays in getting your money lent out.

The silver lining – lower risks.

10 steps you can take to lend, and re-lend, more swiftly.

Why it can take time to get lending and to re-lend

There are a variety of reasons why it can take time to lend or re-lend enough of your money. I'll give you several examples:

High minimum lending amount. In some cases, the minimum amount you're allowed to lend can be high: sometimes many thousands of pounds per loan. So, as your interest payments come in on loans, it can take a while before you're able to re-lend it.

Very short-term loans. With other lending accounts, loans can be very short term – sometimes as little as three months. This can leave you looking to re-lend on a regular basis.

The economy. Market conditions matter too. Fewer people may wish to borrow when there are problems such as high inflation or rising interest rates. When the economy holds back borrowing, some P2P lending accounts can see the supply of loans dry up for a time. Especially if they don't have a particularly large borrower pipeline to choose from to begin with.

Change of strategy. The providers of these accounts sometimes change their strategies and their whole business models. When that happens, what you wanted to lend in through their online lending platforms quickly becomes unavailable. This happened with Assetz Capital in 2020 and there are signs it's possibly beginning to happen with CrowdProperty today.

Others to change strategies and wind down P2P lending include RateSetter and Zopa.

Ambiguous reasons. Sometimes the providers pause lending with ambiguous reasons, as Crowd2Fund did in 2020-21. (Although the pandemic was probably at least partially the cause.)

Trouble balancing borrowers and lenders. Providers can find it difficult to balance both the borrowing and lending side. This can mean that there is much more cash available to be supplied by lenders than there is demand from borrowers.

For example, MarketFinance (which is no longer P2P lending and now called Kriya), would typically have one-third of lenders' money sitting in their MarketFinance accounts as cash at any one time – just waiting to be lent out. And Zopa at one point had a weeks-long waiting list to re-lend money; it ultimately put new lenders on a waiting list until the problems cleared up.

Too few loans. Sometimes there are just too few loans for you to lend in. Even when the size of the loans are large enough that lenders could theoretically put all their funds into them, you need to spread across lots of loans to contain the risks. So in these situations it's not sensible to go all in.

The cost of delays in getting your money lent out

The “cost” to you is loss of interest. Economists call this an “opportunity cost” and in finance it's called “cash drag”. You have simply not been lending every penny of your money the whole time, so you've not been earning money on every penny.

For example, if 10% of your money in a specific lending account is in cash (meaning not lent out), you could have earned a couple of percent on that in a savings account at least. Or more elsewhere.

If that situation remained the same for a few months, it might lower your returns by a quarter of a percent for the period. OK, it sounds small, but it adds up.

You should know that even popular share and bond investment funds tend to have at least a few percentage points of your money in cash, so it's not unique to money lending accounts.

Even so, cash drag can get more extreme in your P2P lending accounts if you don't keep an eye on them – and do something about it when the cash pile starts growing.

The silver lining – lower risks

Your risks actually come down due to delayed lending from cash drag.

I'm not saying it's great when you're unable to lend enough of your money, but I feel that is point is still worth making.

Because, a while back, one lending account was hit very badly with delays. A 4thWay subscriber estimated he was just earning about 5% per year on the money he had in the lending account, when it should have been closer to 8%. That's very large amount of cash drag he was facing.

His conclusion was that it wasn't enough interest to justify the risk.

But his money that was at risk – i.e. out on loan – was still earning around 8% as expected. The rest of the money was earning nothing, but it was sitting in a segregated client bank account set up by the P2P lending provider at Barclays Bank.

The money in that account was untouchable by the P2P lending site, unless it was to transfer it back to the lender's own individual bank account or to lend it out on his instructions.

Furthermore, as the cash was in a standard Barclays client account, it was protected by the government through the Financial Services Compensation Scheme, with all the usual rules and limits that apply to that scheme. This gave him protection in the event the bank itself fails. (To see where your unlent cash has this cover, read Which P2P Lending Sites Offer FSCS Protection?)

So the risk of losing any unlent money in such circumstances is very low.

The bottom line is that the amount of pounds paid out to you in interest will be less than expected if some of your money is unlent – but your risks also come down by the same or very similar proportions.

10 steps you can take to lend, and re-lend, more swiftly

Here are some strategies to keep more of your money working for you:

1. Use multiple accounts

This is to avoid a MarketFinance-like situation where a third of lenders' money was in cash at any one time.

If you're sensibly spread across 6-12 accounts, it's highly improbable that enough of your lending accounts will be hit that badly, and all at the same time.

2. Have lending accounts that focus on bullet loans or interest-only loans

Most P2P lending accounts these days do interest-only loans – where the borrower pays interest regularly and then the repays the whole loan at the end – or they do bullet loans – where the entire loan and all the interest are repaid at the end.

In many ways, this kind of lending has helped people to keep money lent out without the greater fuss of getting small pieces of loans lent out again as they're repaid each month.

I could give you a very long list, but companies such as Invest & Fund (read review) or Somo* (read review) do loans where you don't have to keep re-lending repayments.

3. Use P2P lending accounts that prefund loans

To reduce the risk of money being unlent in P2P lending accounts, go for sites that prefund loans.

Prefunding means that the borrower has already received the cash in advance, so all you have to do is buy part of the loan from the P2P site.

Since you buy immediately in this case, you're also lending immediately. Such sites include CapitalRise* (read review), Housemartin* (read review), Loanpad* (read review) and Unbolted (read review).

4. Use accounts that pay interest when you pledge

Kuflink (read review) pays interest from the point you pledge your money to a loan, if you have chosen to select loans for yourself. So, even if it takes days or weeks for the loan to be fully funded and go live, you don't miss out on interest earned.

5. Use accounts that don't require you to submit funds till the loan is agreed

Another way to stop money sitting around is to go for sites that don't ask you to send in any money until a loan is agreed.

You pledge how much you'll lend to a borrower before funding your account. You only send the money once the borrower has received enough pledges from lenders to fund the whole loan.

This includes CapitalStackers* (read review) and Sourced Capital (read Review).

7. Look for where you can buy existing loan parts from other lenders

Some sites have online secondary markets – where lenders can buy and sell loan parts to and from each other directly.

With these, you can see for yourself by looking at the market if there are loan parts available in advance, before you upload your money and lend straight away by buying those existing loan parts.

These include Lendwise (read Review), Proplend* (read Review), CapitalStackers* (read review) – and many, many more.

8. Use accounts with low minimum lending amounts

It can be a little hard to keep your money lent out if the minimum lending amounts are high, especially regarding the interest that is paid back to you.

Loanpad* (read review) allows you to lend 1 penny at a time. (Indeed it will re-lend for you just a fraction of a penny, if you have earned that much in interest.) Crowd2Fund (read review) allows lending from 10p per loan and Housemartin* (read review) from £1. Rebuildingsociety is from £10 per loan.

9. Have a holding account

Many lenders tell us they use a lending account as a holding accounts – invariably Loanpad* (read review) – when they have cash waiting to be lent or invested elsewhere. Any cash building up sits in the account earning some interest on loan while the lenders wait for it to grow sufficiently to lend again elsewhere at higher rates.

10. Earn interest on unlent money

You might occasionally find lending accounts which pay you interest on all the money you put in, regardless of whether it's being lent or not.

Kuflink (read review) does this with its auto-lend accounts. Loanpad* (read review) also currently pays interest on cash while it's waiting to be re-lent, so you earn interest on all the money you put in.

With both those accounts, your money is spread across a large pool of loans. This can lower your risks dramatically.

At the same time though, such systems can potentially put a lot of pressure on a P2P lending site to constantly find borrowers to lend your money to. After all, it can only really earn decent fees if borrowers are paying the cost***. This could lead to the P2P site approving loans that it previously wouldn't have done.

So be confident about the people running the P2P business, or that it is sufficiently profitable to make good on interest shortfalls, or look to see that it's backed by a bigger company with lots of money.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from CapitalRise, CapitalStackers, Housemartin, Invest & Fund, Loanpad, Proplend and Somo, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or when you make an investment, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

**Online lending returns data from the 4thWAY P2P And Direct Lending Index, which includes all lending costs, interest earned and bad debts. FTSE 100 returns data from curvo.eu with an estimated 1% all-in investing costs from the wrapper (share-dealing account, share ISA or pension), investment management costs and expenses, transaction costs and miscellaneous costs. For most people, this is low.

***That’s not to contradict our main message on lending costs: There’s No Such Thing as “No Lender Fee”.