See why 4thWay now accepts ethical ads.

Your P2P Investing Strategy in 2015 and Beyond

Everyone's always trying to beat the FTSE. I've seen several articles in the past few weeks touting shares that will do just that in 2015.

The mere existence of the FTSE benchmarks seems to inspire competition for competition's sake.

4thWay has its own benchmark of P2P lending returns for individual investors too: the 4thWay P2P Forecast Returns Index. You can see where it's at in the sidebar on the right.

But I don't think you should take that very seriously either.

What are your needs and plans?

Your money is about you, your needs, your plans. That's why I think competing to do better than average is not a good goal.

Does it matter how your neighbour's savings and investments are doing? I mean really? Whether it's better or worse, that won't help pay for your next holiday or feed your family.

I think what you need and want to achieve is more important. Do you want to comfortably beat inflation? Then P2P lending is the right place.

Do you want to get 10%+ returns? Then you can get it in P2P or the stock market, but you can usually expect higher risks.

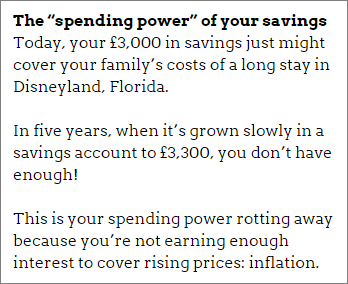

Do you want to ensure that you can't be  shocked by a sudden loss, and you're perfectly ready for your savings to lose spending power to do so? Then savings accounts and cash ISAs backed by government guarantees are the place for you.

shocked by a sudden loss, and you're perfectly ready for your savings to lose spending power to do so? Then savings accounts and cash ISAs backed by government guarantees are the place for you.

(See sidebox for definition of “spending power”.)

And you don't have to focus on one investment of course. Your P2P investing strategy could be blended by investments in shares, savings accounts, your own property, and more exotic investments.

What's your benchmark?

Not only should your strategy be about you, but how you measure your success or failure, and learn from it, is about you too.

A benchmark index like the one produced by 4thWay might give you a rough picture of where P2P lending sits compared to other investments and compared to inflation.

But your own benchmark should be tailored to your plans, whether it's a 10% target or increasing your spending power by beating rising prices, or something even more personal, like building a deposit for a house safely.

Read another opinion: 2015: Great Returns on Peer-to-Peer Lending.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.