See why 4thWay now accepts ethical ads.

What We Learn From Loan Acceptance Rates

The loan acceptance rate can be incredibly useful for lenders like you and me, since it can be a strong indication that a P2P lending opportunity has strict borrower selection standards.

If a P2P lending website accepts no more than around 20% of applicants, rejecting the rest, that's generally a good sign. If it's more like 10%, that's excellent.

What if the loan acceptance rate changes?

If the loan acceptance rate worsens by 10 percentage points, that's probably something to think about. Is this P2P lending opportunity the same one that attracted you in the first place?

It's quite a big drop, so is the P2P lending company's explanation that it has learned from its history and improved borrower selection the complete answer?

If the drop is higher, say, 15% to 20%, this is very significant. When there are large drops, you need to consider that the company's past record of bad debts now has little meaning until it proves itself in future.

If you're no longer confident you understand the risks involved, you must remove your money until you understand them again.

It's clear that this is an incredibly useful indicator for people lending their money through P2P lending websites.

But only if you can find it

The problem is, it's also highly elusive.

To begin with, a large minority of P2P lending companies won't share this information at all, not even as an estimate or a range.

There can be two reasons for keeping it secret.

The first is that they believe the negatives of showing it outweigh the positives.

Some P2P lending websites might believe that the information will be used by their competition to their own detriment, and they might also believe that it is more important to hide it from competitors than to be open with their customers who are lending through them.

A more sinister reason is that they might not want to reveal loan acceptance rates because they don't think they're good enough or they don't know if they're good enough.

“It's about, approximately 10%…ish”

Secondly, there is no record of this rate. P2P lending companies never give 4thWay® an exact figure. And they never publish an official figure on their own websites, if they publish one at all. Which is rare.

So if a P2P lending website tells 4thWay® its acceptance rate is as low as 5%, it can always say in its defence later that it was just an estimate off the cuff. And that's if it ever got official, by which point it'd be too late for individual lenders anyway.

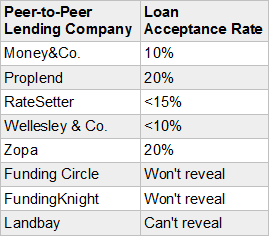

Loan acceptance rates

Figures are all approximate. Most are from late 2014. (We can't update these figures daily like we do interest rates!) Except for Money&Co. and Proplend which are early 2015 figures. Landbay can't tell us its acceptance rates because it uses its mortgage brokers to do the initial vetting of its borrowers.

How to use the loan acceptance rate

Due to the figures being quite sketchy, we're unable to use the loan acceptance rate as much as we'd like. However, there are some circumstances where it will still be useful.

If we get an update from a P2P lending company that shows its acceptance rate has significantly worsened, that's obviously of great use.

What we're more likely to get is more subtle: the P2P lending company previously told us its acceptance rate but has decided to stop giving us updates. It could have just decided to stop revealing it because it's become concerned about the competition, but it could have also worsened its standards.

At the very least, it needs a closer eye kept on it.

If a company stops reporting its loan acceptance rate, or never gave it to us to begin with, we perhaps need to give an extra once-over on the other indicators we use to see how sound it is, such as:

- Check the history of the key people: do they really have the ability they need?

- Are the bad-debt rates really good?

- To see if the situation is worsening, a close eye out for rising late payments is one option.

If you subscribe to 4thWay® below, we'll always keep you up-to-date on any indicators that change, so that you can keep making informed decisions.

Read more: How To Use The Bad-Debt Rate.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.