See why 4thWay now accepts ethical ads.

How Lenders Can Pick The Best Loans at HNW Lending

HNW Lending offers many loans with exceptionally high-quality security to protect you against losses. This means that the borrower owns properties or possessions that are easy to value and that are worth much more than the loan amount.

For a good proportion of these loans, lenders are also first in line if the borrower has to sell up to pay off the debt – ahead of the borrower's own bank.

Finding and choosing these loans are pretty easy, with not too many catches to beware of, but there are a few fiddly bits. So I shall help you to figure out what to look for and how to find it in the list of available loans on the HNW Lending website.

For most people, the simple checks below should be sufficient to build a low-risk selection of loans that you should, as usual, run alongside many other loans from other P2P lending sites, so that your overall portfolio is prepared for almost any shock.

You can also use the same skills to improve your loan selection on many other P2P lending sites.

HNW Lending allows individual lenders to lend to wealthy individual borrowers who might be low on cash but are high on property, valuable cars, fine wine collections, private yachts and other assets. Lenders earn 6% to 10% interest rates.

HNW Lending's focus is on lending to borrowers that have far more property and possessions than the loan amount, and it looks to press borrowers for payment as soon as there are any signs of delay.

This type of lending often leads to a lot of loans falling late or going bad, but with a high recovery rate on bad debt.

HNW Lending does bullet loans, meaning that lenders only get their initial loan back and all the interest due to them at the end of the loan.

Choose property loans

The simplest thing you can do first to narrow your shortlist of loans is focus on real property loans – real estate loans. It's just easier, because valuing real property is far easier to do, naturally easier for lenders to understand, and it can't go wrong as easily.

Property also usually goes up in value while other things can go down. You would need to dig deeper to find out whether that classic-car collection the borrower is using as security is the sort that will gain value, lose value or tread water…

RICS is best

…And do you know what kind of professional is the right one for valuing such cars? No? Whereas I bet you do know that independent surveyors of property are accredited by an umbrella organisation called RICS.

Except where the value of the property is seriously low, say below 30%, you could simply exclude any loans from your shortlist that do not have a RICS survey attached. To be more cautious still, exclude all of them.

Look for a recent valuation

HNW Lending is what we at 4thWay call a bit of a “swinger” in that it can be a little bit loose about such things as valuations when it is comfortable that the borrower is swimming in houses, luxury fleets and so on – it's typical kind of borrower.

Older valuations might be missing important factors – such as Japanese knotweed or a new flood event. So to be on the safe side you want to see the valuation has taken place recently. Alternatively, give Ben Shaw at HNW Lending a call and ask for more details about the security and why the valuation is older.

If you're willing to go up the risk scale to vehicles, make sure the vehicles are valued far higher than the loan amount. Dealers and auction goers do not find any one source to be a good guide for a vehicle's value. They might try eBay prices, AutoTrader, Glass' Guide and CAP – all different ways to make a judgement. But you might want to go down this investigative route yourself if you're a big car fan.

Is the loan below 50% or 60% of the valuation?

60% is excellent. Below 50% is incredible.

HNW Lending averages just 44% on its senior loans. (See the next section to find out what senior loans are.)

Here we are talking about the “loan-to-value” or LTV. That means if the loan is for £10,000 and the property is valued at £200,000, the loan-to-value is 50%. This gives you a lot of protection in the event the valuation is a bit wrong or prices fall or the cost of trying to recover a bad debt is high.

HNW Lending offers loans up to 70% LTV, an eminently sensible maximum, and for which you might earn higher interest. Make sure you do get that extra interest if you want to lend in some of those loans.

Establish the loan is genuinely senior

You usually want to lend in senior loans, which means that you are repaid first before everyone else if a loan goes bad.

In this case, if the borrower has borrowed money a second time or third time from a bank or elsewhere, you still get repaid first.

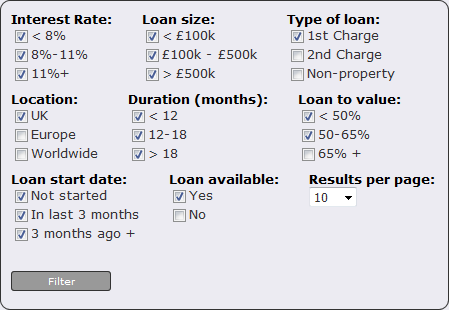

You can filter your options quite easily through the HNW Lending site to show just senior property loans – and to select other criteria I'm suggesting to you on this page. To do that, under “Type of loan”, check the box “1st Charge” and uncheck “2nd Charge” and “Non-property”:

In the above screenshot, I've selected boxes to isolate what should be a shortlist of loans that are lower risk than average. The filters selected closely match many of the points in this article.

However, your efforts don't stop there, because HNW Lending is a bit of a swinger – a bit loose – in how it presents loans to you too. Specifically: even if you select the above criteria, you might still see the odd loan that is not completely senior.

If you are doing your homework properly – and I hope you do – you will dig into the details of the loan. The first thing you might do is hover over or tap the ellipsis (three dots like this …) in the description column to see a bit more information pop up.

If you see any of the following, this is not completely senior:

- If it states that that the loan is “junior” to another HNW loan.

- If it states that there is a second charge on any of the properties used as security.

By the same token, you will also see in the description if the security is not entirely made up of real property. It could also include vehicles, a pension or other things. Depending on how large that proportion of the loan is, you might decide it is too complicated for you.

Joint senior loans

If the popup description states that there is an “existing loan”, this might be junior or it might not. It should state if it is junior or senior. If it doesn't, it still matters.

If it is neither junior or senior, t means that there is another loan ranked equally to yours. So if there are two loans of £50,000 to the same borrower totalling £100,000 and the borrower repays just £80,000, £40,000 will be repaid from each loan. You'll get back four-fifths of your money and so will those in the other loan.

This also means that you need to double check the stated loan-to-value and in some cases it might make sense to do your own calculation:

- Add all the loans together.

- Add all the security valuations (the valuations of every property, since there are often multiple properties put up as security for a single loan.)

- Type in your calculator the total loan amount divided by the total security valuations.

- Multiply by 100 to get the LTV.

Check the loans-to-value are accurate

Again, in the swinging style, HNW Lending appears to be a bit loose in its quickly typed descriptions or in entering its figures on the site, so that 4thWay's experts can't always understand how it has calculated the loan-to-value on the main list of loans. They simply appear to be incorrect at times from the information in the main list of loans.

You therefore need to double check this critical piece of information by taking the amount lent and dividing by the combined security value, as described above…

Read the loan documentation

…And you should double check the loan and security amounts by looking into the documentation provided, such as specialist valuation reports.

While you're at it, you should familiarise yourself with all the details in the supporting documents. The more of these valuation and auxiliary reports you read, the better you will get at assessing lending opportunities.

That said, please don't make the mistake that many lenders make when they are transitioning from complete novices to experienced lenders: never assume that you can pick loans so well that you don't need to spread your money widely across lots of loans and peer-to-peer lending sites. That is not how good lending has ever worked and it is not realistic to have a crystal ball that good.

To get access to the loan documentation on the HNW Lending website, you need to add loans you're interested in to your shortlist.

How important are directors' holdings?

All else being equal, and given a choice, you would go for the loans where directors have direct skin in the game. The directors often lend between £3,000 and £30,000 in the loans, and this is shown through the website.

However, so far there have been no losses on any loans, with lenders always getting their money back even after a loan falls late or goes bad. Therefore, lending in loans with loan parts held by directors has not been noticeably safer, even though they take first loss in those loans.

It's worth it in the end

This is relatively little work for what has so far been a very successful P2P lending site for lenders, with a lot of great loans to choose from.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.