To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

What is Peer-to-Peer Lending?

Here’s an overview of how you can earn an income and make money by helping others escape the banks through peer-to-peer lending.

Peer-to-peer lending allows you to earn an income and make money by helping other people or businesses to get out from the grasp of the banks.What is peer-to-peer lending?

You open an online account with one or more peer-to-peer lending companies, and then you can lend money to people or businesses, including property owners.

By cutting out the banks in this way, you receive more interest than you’ll get in savings accounts and borrowers pay lower interest rates than the banks will charge them.

This is a social form of investment. That’s why it’s also called “social lending”, “democratic finance” and “crowdlending”.

There are tax breaks to keep down the amount of tax you pay and you can also open a type of lending account called an IFISA, which is completely tax free. Sometimes you can also lend through pensions called SIPPs or SSASs.

Confused yet? Check out the image on this page, because that might help you understand better.

Every year since peer-to-peer lending started in 2005, the amount of money being lent through P2P has been growing rapidly. £21 billion has been lent so far by hundreds of thousands of people. In terms of results, lenders have had positive results every year and they have beaten inflation every single year except for 2022.

Since peer-to-peer lending, including P2P IFISAs, is usually far less risky than investing in start-up companies (so-called “crowdfunding”) and less volatile than the stock market, it's emerged as the 4thWay to save and invest, alongside savings accounts, buying your own home and the stock market.

Who is peer-to-peer lending for?

You might consider peer-to-peer lending and IFISAs:

- If you want to earn much more money than with savings account, but with noticeably less risk than the stock market.

- If you want to invest some or all of your money outside the stock market in order to spread your risks or to reduce the risks.

- If you want a good chance of growing a pot of money faster than inflation or to supplement your income by earning interest on loans.

- At the more “exciting” end, you might like looking for higher-interest, higher-risk peer-to-peer lending accounts and IFISAs, and some of the opportunities allow you to do horse trading to get much higher returns.

- Finally, a good proportion of people like the idea of earning money for helping out UK businesses, consumers and property borrowers, and you can sometimes choose specific people or businesses to help, after they have been screened by the peer-to-peer lending company.

How much can you earn?

In a typical year, after deducting fees and bad debts, you can do far better than savings accounts, with the range of results typically being between 6% and 9%.

If you lend £5,000 today and make an average of 7.5% (after accounting for all the costs and any losses), after five years, you could have made £1,900. This is not a rare result at any point over the past two decades that this type of investment has been available.

How does peer-to-peer lending work?

Each peer-to-peer lending company works differently, sometimes dramatically so. But here’s an example of how the basic model works when you want to choose your borrowers for yourself:

Let’s say your neighbour, Fred, wants to borrow  £15,000 for his building business.

£15,000 for his building business.

He applies for a loan through a peer-to-peer lending website, because he feels it offers less penal rates, and better terms and conditions, than an ordinary bank.

And probably because they won’t leave a mark on his credit record just because he asked if he’s allowed a loan.

He could get a one-year loan, but he decides to spread the cost over five years.

The peer-to-peer lending website will then check out Fred, much like the banks do.

Often they’ll do so even more thoroughly, using more modern technology on top of the usual credit checks.

If Fred is approved for the loan, you and I will then be able to lend to him. Perhaps he’ll have a profile on the peer-to-peer lending website (or perhaps not). We might read it. Either way, we decide we want to help him out. Maybe I’ll be willing to lend him £50 and you, £100.

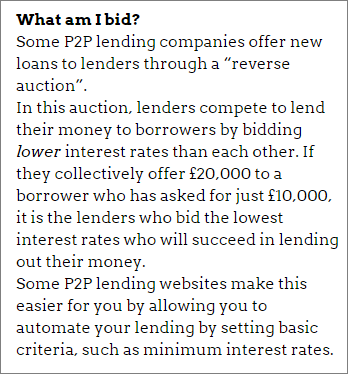

We, and other lenders like us, will offer our money at the interest rates that are usually set by the peer-to-peer lending website.

We’ll probably lend to lots and lots of different borrowers to spread out our risks. As we receive our repayments, we’ll also probably decide to re-lend our money, plus the interest we’ve earned, so that we can earn even more interest. Or we might choose to re-lend our money but keep the interest so that we have an extra monthly income from our loans.

We might even decide to sell our loans to someone else to get out early, if there are currently any willing buyers. Or we could buy existing loans off other people if they’re at more attractive interest rates.

Do you have to make all these decisions yourself?

If you don’t want to choose borrowers or set your own interest rates for each loan, most P2P lending companies will do all of this for you. They spread your money out across many such borrowers and even re-lend your money automatically as you receive repayments and interest.

Who can you lend to?

You can lend to both individuals and businesses, sometimes backed by the borrowers' property to give you extra security. Indeed, most P2P lending is property backed.

You can lend to prime, low-risk borrowers, or high-risk borrowers for the potential of earning higher interest rates, and anything in between.

With many dozens of peer-to-peer lending companies to choose from, the types of loans are expanding rapidly, which makes it easier to spread your risks even further by lending to different types of borrowers:

- Personal loans.

- Small business loans.

- Mortgages to buy-to-let landlords.

- Loans to office and retail property owners who are renting out their properties to businesses and shops.

- Loans to property developers.

- Short-term (bridging) property loans.

- Infrastructure loans (such as lending against energy projects).

- Loans against personal property (such as pawnbroking or taking rich people’s yachts as security).

- Loans against business invoices (where you pay businesses who are owed by their customers, and they pay you back plus interest when the customer repays.

- Payday loans.

How much can you lend?

Some P2P lending companies and IFISA providers will let you lend as little as £10 and they will share and spread your risk along with all other lenders across borrowers, hugely reducing the risk that you lose money due to having just one or two unlucky borrowers.

Most allow lending around the £20 to £100 mark.

But a small number of peer-to-peer lending companies require you to invest £1,000 or £5,000, or even as much as £10,000 or £25,000, in each loan you want to take part in.

Theoretically, you can lend as much as you want, provided there are enough quality borrowers available.

What happens if a borrower doesn't pay?

Peer-to-peer lending companies are responsible for collecting payments on your behalf as well as chasing any bad debts.

Like the banks – although often in a nicer way – they will send letters to the borrowers when they are late on payments, discuss with the borrower how they can help them through their difficult times and, if necessary, take the borrowers to court.

With secured loans – loans that have real property or personal property involved – the peer-to-peer lending company can look to repossess and sell such property. Sometimes expertise at the P2P lending company helps prevent this from happening, such as when they step in with their property development experience to ensure a development completes and sells.

With unsecured loans, the peer-to-peer lending company can still sometimes turn those into secured loans as a last resort through the courts, but the first resort with these loans is to have excellent processes to select better borrowers that aren't likely to go bad.

The interest rates should also be set high enough to cover the risk level of each different borrower.

Is peer-to-peer lending safe?

Peer-to-peer lending is a form of investment and so there are risks, although it is, on average, relatively low risk.

When thinking about safety, the phrase on average is important. The risks of peer-to-peer lending are varied and you need to understand them. That's why we have separate guides dedicated to covering the risks in detail.

Those who learn what they're doing can dramatically lower the risks using some very simple steps.

Take a look at our Learn page to find these different guides that help you get started on learning the risks and how to minimise them.

This was part one of our ten-page P2P lending guide

Read part two: Is Peer-to-Peer Lending Safe?

See the contents of the whole 10-part guide.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.