To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

24 Peer-To-Peer Property Lending Websites

You have dozens of choices when it comes to peer-to-peer property lending. As far as we know, we're listing every single one of your choices on this page that we call “P2P”.

See our definition of peer-to-peer lending.

A small number of P2P property lending websites offer lending that is usually intrinsically low risk. Typically, this means lending to borrowers against properties that are receiving rent.

This can mean homeowner mortgages and loans (although those are very rare in P2P), mortgages to buy-to-let landlords, and also mortgages to owners of commercial properties, such as tenanted shops or care homes.

Just three P2P property lending providers in the UK in the focus largely on those kinds of lending: Proplend, Assetz Exchange and LandlordInvest. Skip to Proplend's entry, below. | Skip to Assetz Exchange's entry. | Skip to LandlordInvest's entry.

You can also look for higher interest rates with potentially, relatively higher intrinsic risks – at least to the borrowers.

Here, you're typically looking at development lending and bridging lending, which is what you normally get when doing property peer-to-peer. Borrowers are not receiving rent against these properties and you can be less confident about getting all your money back.

Even so, the defences that lenders can have against losses can be immense, even for these development lending.

Regardless of the type of lending, a good proportion of peer-to-peer property lending companies contain the risks using top-quality loan approval processes, by requiring valuable property security from the borrowers, through reserve funds set aside to cover expected losses and by reacting rapidly and appropriately to borrowers in difficulty.

What the peer-to-peer property lending platforms have in common

Normally you're first in the queue to get your money back if a borrower is unable to repay, and the P2P lending company needs to repossess and sell the property. In the list below, we will always make it clear when this is not the case.

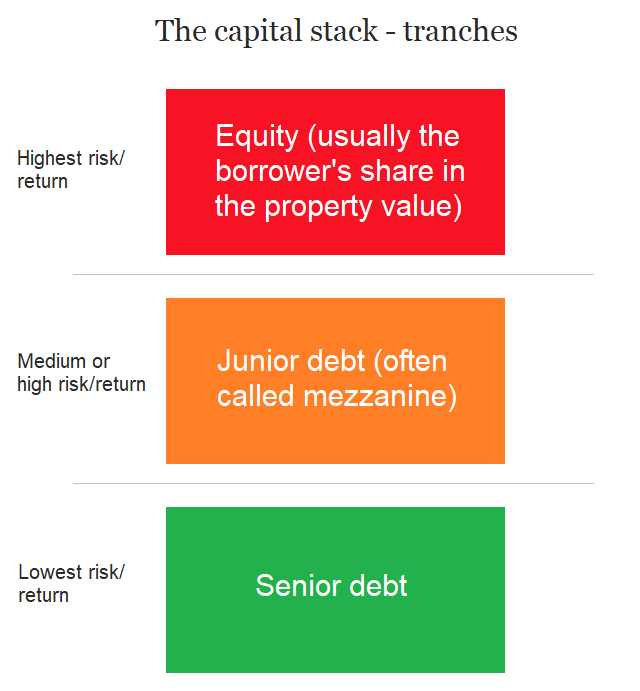

(Sometimes you don't want to be at the front of the queue, because being second or third means that you can earn much higher interest rates.)

Almost all property peer-to-peer lending platforms do either a) interest-only loans, where lenders get monthly interest paid to them by their borrowers and the money you lent is repaid to you at the end, or b) “bullet loans”, whereby you receive all the interest and your original loan at the end, with no payments in between.

Both of those types of loans – where you don't receive steady repayments of the money you have lent – can potentially increase your risks, but it also makes it easier for you to keep your money out on loan and earning interest. And these risks are sometimes more than offset by fantastic property security, reserve funds and other aspects.

Not all peer-to-peer property lending companies are listed in 4thWay's comparison tables with a review from one of our specialists, but we're working on it.

Largely it depends on the companies providing over 100 facts, then answering our Q&As, then having gruelling interviews with us, then another Q&A with detailed data submissions from them, and finally background checks and other checks on our side. Not until then do they make it into our detailed comparison pages.

So here, on this page, we tell you about all of them, including the ones that haven't provided enough information for us to assess their risks and strengths.

The platforms that have passed our strict tests based on international banking standards – and therefore have been awarded 4thWay PLUS Ratings – are on top of the list. The rest are listed in order of size:

Proplend

Size, history and types of loans: Roughly £210 million of mortgages against rented residential and commercial properties since 2014. It has also occasionally does bridging loans.

Proplend's 4thWay PLUS Rating:

Based on Proplend's tranche A loans where the properties are receiving rent.

Lender losses: Just one loan at tranche B has lost a little money through Proplend*, so that lenders have easily made massive profits overall.

Most similar to: like the peer-to-peer property lending company LandlordInvest, the majority of loans are secured against property that is receiving rent, and like CapitalStackers and Relendex in terms of stacked tranches that you can select for yourself:

Average loan-to-value: Proplend splits its loans into tranches for lenders. If you lend in tranche A of a loan then you have a maximum loan-to-value of 50%, which is incredibly low.

If you lend through tranche B then you sit above tranche A lenders in the stack, where the loan-to-value is a maximum 65%.

(Therefore, for tranche B, if the property is repossessed and sold for a loss of 40%, you could expect to lose around 33% of your loan, since you own the 15% between 50% LTV and 65% LTV. And 100%-40% is 60%. 65% minus 60% is 5% and your holding was 15%…Think about it.)

If you lend through tranche C then you take the slice above B's 65%, but still have a maximum of 75% LTV. Still highly respectable for rental properties, but as you would guess, “junior” debt like this significantly adds to your risks.

If you want, you can blend your property loan by lending in more than one tranche, with the lowest-risk tranche being a maximum loan-to-value of 50%, or you can take a riskier slice of the same loan higher up – up to 75% loan-to-value. So you'd lose your money first, but you also get higher interest rates.

Average rents: Proplend typically ensures landlords' rent will cover the mortgage payments with an additional 10% cover or more. Although less common, Proplend also does brownfield loans and bridging loans, which don't earn the borrower rent.

Other protections: Proplend takes three to six months' interest in advance, effectively reducing the risk of losing money overall by a modest few percentage points.

Place in the queue: Your tranche tells you your place in the queue.

Transparency: Proplend is among the most transparent opportunities you'll find when peer-to-peer lending in property in the UK. It shares most facts about its people, processes and data with 4thWay.

Interest rates: You're look at an average of 7.80%. These interest rates are after fees and expected losses.

Available in an IFISA.

Who chooses loans? You can choose your own loans and tranches.

Minimum you can lend: £1,000 per loan.

Early exit: You can exit early provided other lenders have the money to buy you out.

See more of Proplend* in our comparison tables, where you can also read one of our specialist's Quick Expert Review on Proplend.

Somo (formerly BridgeCrowd)

Size, history and types of loans: At least £326 million in property bridging loans completed since 2014.

Somo's 4thWay PLUS Rating:

Lender losses: Up to March of last year, 2023, lenders had only suffered a negligible loss of interest to bad debts, but no losses to their loans. The team's experience at Somo and prior stretches over two decades. They have never lost any money on a loan, not even through the 2008-9 recession.

Most similar to: CapitalRise, CrowdProperty, Downing Crowd, Folk2Folk, Invest & Fund and Kuflink, in that it does bridging and development lending, and you can choose your own loans with no reserve fund. (Somo has no option to auto-lend.)

Average loan-to-value: 57.94%, although for developments, the figure is probably based on the hoped-for sale value of the property after the development is completed. The maximum is usually 70% on bridging loans, although we do not know the maximum on development loans.

Other protections: None.

Place in the queue: First, second or third (a mix).

Transparency: Somo currrently provides 4thWay substantial data, information and access to key people.

Interest rates: 10.41% before bad debts. No IFISA.

Who chooses loans? You choose which loans to lend in yourself.

Early exit: You can exit early provided other lenders have the money to buy you out.

Minimum you can lend: £5,000.

See more of Somo in our comparison tables, where you can also read one of our specialist's Quick Expert Review on Somo.

Assetz Exchange

Size, history and types of loans: Assetz Exchange has completed total lending of £25 million. That's since it started in 2019.

This is certainly an odd one out in P2P lending in property in the UK, in that Assetz Exchange effectively sets up multiple, bankruptcy-remote borrower companies itself and lets out the properties.

Each separate company houses one loan. Thus Assetz Exchange is not one borrower, with the risk of bad debts of one loan contaminating the other, but instead becomes multiple borrowers, with segregated risks.

You also benefit or take the hit of property-price changes, even though you're legally a lender not a property owner. Technically, this whole arrangement scrapes into our current definition of P2P lending.

Assetz Exchange's 4thWay PLUS Rating:

Lender losses: There have been no lender losses.

Most similar to: no other P2P lending company does loans like this. In addition, when lending, you decide whether to pay the asking price or bid at a different price, which is also unusual. As with BLEND Network, CapitalRise, Kuflink, Invest & Fund, Somo and Sourced Capital, you can choose your own loans. As with all the mentioned competitors, there's no reserve fund.

Other protections: None.

Place in the queue: You're always first in the queue to recover your money if a loan goes bad and the property has to be repossessed and sold.

Transparency: Assetz Exchange has provided a huge amount of data and access to 4thWay. Information on its public website is good, although it should say more about its key people. Signed-in lenders get a lot of useful information.

Interest rates: Assetz Exchange typically pays around 5% to 6%, with the possibility of a capital gain when the property is sold. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: No.

Minimum you can lend: £1

Visit Assetz Exchange*.

Kuflink

Size, history and types of loans: £322 million since 2016 in peer-to-peer property bridge lending and property development lending.

Kuflink’s 4thWay PLUS Rating:

Lender losses: Lenders have not lost money. A very small number of loans have lost approximately 10% or less, but Kuflink has taken on those losses for itself.

Most similar to: As with BLEND Network, CapitalRise, CrowdProperty, Invest & Fund and Somo – which all offer bridging and development only – you can choose your own loans. But, as with BLEND Network, CapitalRise, CrowdProperty and Loanpad, you can also spread your money across more than one bridging and development loan automatically. It's also similar to HNW Lending in that Kuflink takes a first loss of 5% when you use one of its auto-lend accounts. As with all the mentioned competitors, there's no reserve fund.

Average loan-to-value: 64.83%.

Average rents: Not applicable.

Other protections: None.

Place in the queue: First, second or third.

Transparency: Kuflink provides a large amount of information and access to 4thWay, including regular detailed data on the history and performance of its loans. It's one of the most transparent peer-to-peer property lending companies.

Interest rates: Around 8.00% after bad debts. Available in an IFISA.

Who chooses loans? You choose which loans to lend in or you can lend automatically.

Early exit: You can exit early provided other lenders want to buy you out and agree the price: you could sell your loan parts to them for more or less than you paid.

Minimum you can lend: £100.

Visit Kuflink* and see it in our comparison tables, where you can also read one of our specialists‘ Quick Expert Review on Kuflink.

CrowdProperty

Size, history and types of loans: £385 million exclusively on peer-to-peer property lending, specifically property development and bridging loans, since 2014.

CrowdProperty's 4thWay PLUS Rating:

Lender losses: CrowdProperty confirmed its first small lender losses in 2023, although it hardly made a dent in lenders' results.

Most similar to: BLEND Network and Loanpad in that it just does senior bridging and development loans. “Senior” means no other lenders (such as banks) can get their money back before you do if the borrower is unable to repay, and the property needs to be repossessed and sold. As with BLEND Network, CapitalRise, Kuflink, Invest & Fund and Somo – which all offer bridging and development only – you can choose your own loans. But, as with BLEND Network, CapitalRise, Kuflink and Loanpad, you can also spread your money across more than one bridging and development loan automatically. As with all the mentioned competitors, there's no reserve fund.

Average loan-to-value: 60.90% – or 57.70% based on the hoped-for sale price of the completed development.

Other protections: None.

Place in the queue: You're always first in the queue to recover your money if a loan goes bad, the developer has other debts to pay, and the property has to be repossessed and sold.

Transparency: CrowdProperty is now one of the most transparent and accessible peer-to-peer property lending sites, providing 4thWay with all the information and data we ask for.

Interest rates: 10.19% before losses. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: No.

Minimum you can lend: £500

Visit CrowdProperty and see more of it in our comparison tables, where you can also read one of our specialist's Quick Expert Review on CrowdProperty.

CapitalRise

Size, history and types of loans: £239million since it started in 2016. It offers bridging loans and development loans. It used to also offer some non-loan products for developers, which it has discontinued.

Restrictions: Only for investors earning £100,000 or with £250,000 in assets (excluding own home), or for professional investors, or investors who have recently invested in one unlisted company (e.g. through crowdfunding websites).

CapitalRise's 4thWay PLUS Rating:

Lender losses: No losses at CapitalRise* and loans rarely repay later than six months after the planned repayment date.

Most similar to: As with BLEND Network, CrowdProperty, Kuflink, Invest & Fund and Somo – which all offer bridging and development only – you can choose your own loans. (CapitalRise has no option to auto-lend.) As with all the mentioned competitors, there's no reserve fund.

Average loan-to-value: 63% on non-development property loans. For development loans, the average amount lent against the starting property price is around 75%, but against the future hoped-for sale price the average is 65%.

Other protections: None.

Place in the queue: You can be first in the queue or later, depending on the individual lending opportunity.

Transparency: CapitalRise has provided a huge amount of information about itself to 4thWay and provides regular data feeds, showing the results of its entire loan book. It's one of the most transparent peer-to-peer property lending companies.

Interest rates: 7%-10%, before losses. These have come down just slightly since CapitalRise's launch, from 7.75%-11.5%. Available in an IFISA.

Who chooses loans? You choose your own loans.

Minimum you can lend: £1,000.

Early exit: You can exit early provided other lenders want to buy you out for the value of the loan. The charge for leaving is 1.5%.

See more of CapitalRise* in our comparison tables, where you can also read one of our specialist's Quick Expert Review on CapitalRise.

HNW Lending

Size, history and types of loans: Around £138 million, mostly in peer-to-peer property lending property, especially bridging loans, since 2014. It's also one of the rare P2P lending sites to do loans to homeowners – albeit rarely. It also does some loans secured against other assets, such as performance cars.

HNW Lending's 4thWay PLUS Rating:

Lender losses: Less than 1% of the total lent has ever been written off through HNW Lending*. Total losses are also very low compared to interest earned.

Most similar to: Somo and Invest & Fund, in that it does peer-to-peer property bridging loans with no reserve fund, although you can instead choose to auto-spread your money with a reserve fund. Also similar to Kuflink in that HNW Lending takes a first loss of 5% when you use one of its auto-lend accounts.

Average loan-to-value: Senior loans have an incredibly low 47.22% average LTV. The maximum is sensible for these loans at 70%.

The low LTV is necessary to recover bad debts, because, while hardly any loans have been written off, quite a lot of loans go late or classed as having gone bad. This is normal for these kinds of loans, but special to HNW Lending is that it can also be trickier to recover the full loan amount on some of its loans.

Other protections: HNW Lending's directors take the first loss of 10% on most loans, in the event that repossessing and selling the property doesn't recover all the money. In some loans, the first loss is lower, although this is increasingly rare.

In the broader scheme of things, the first loss will have little impact on lenders' average returns. However, that directors have lent six and even seven figures in the same loans as individual lenders is highly reassuring.

Those using auto-lend also have a fund with a cash surplus to protect them. While 4thWay only gets information and data on that surplus irregularly, the recent update shows it is more than sufficient to cover any and all likely write-offs in the near future.

Place in the queue: You can be first, second or third in the queue to recover your money if a loan goes bad and the landlord has other debts.

Transparency: HNW Lending is transparent with 4thWay, sharing facts about its people and processes, and lots of data and access to people.

Interest rates: 6%-12% after fees. Available in an IFISA.

Who chooses loans? If you want, HNW Lending will auto-spread your money with the aim of at least 15 loans (and the spread was considerably more last time we asked). Or you choose your own loans. HNW Lending quite often has extraordinary deals, paying close to 10% interest on less than 40% LTV.

Minimum you can lend: £10,000 per loan when choosing your own loans – that's one of the highest bars to lending among all of the peer-to-peer property lending companies. So you need to be wealthy. This falls to £5,000 per loan if you register with HNW Lending*, open an HNW Lending IFISA, and then pay in (or transfer in from others ISA) at least £15,000. In auto-lend, your money is split between loans.

Early exit: Yes, you can sell your loans online through the HNW Lending website, provided other lenders want to buy you out.

See more of HNW Lending*, in our comparison tables, where you can also read one of our specialist's Quick Expert Review on HNW Lending.

Invest & Fund

Size, history and types of loans: Invest & Fund* has done £314 million in bridging and development loans since 2015.

Invest & Fund’s 4thWay PLUS Rating:

Lender losses: No losses to lenders.

Most similar to: As with BLEND Network, CapitalRise, CrowdProperty, Kuflink and Somo – which all offer bridging and development only – you can choose your own loans – although only if you're a wealthy or sophisticated investor. As with BLEND Network, CrowdProperty, HNW Lending, Kuflink and Loanpad, you can also spread your money across more than one loan automatically. As with most of those competitors, there's no reserve fund.

Average loan-to-value: 68.68% on bridging loans. Development loans are for an average of 64.27% of the hoped-for sale price. The highest loan-to-value approved for a bridging loan was 86%. On its (mostly senior) development lending, it has hit 75% versus the expected sales price on a development.

Other protections: None.

Place in the queue: Always first, except Invest & Fund occasionally offers second or third charge if lenders already have the first-charge loan.

Transparency: Invest & Fund opened up its transparency for 4thWay completely, and it's become one of the most accessible and transparent peer-to-peer property lending companies with us and it provides access to its key people, and regular detailed data and information.

However, public information on its website for individual lenders can get out-of-date.

Interest rates: 8.32% after fees and bad debts after fees in the regular P2P lending account. It pays 7.82% in the IFISA, due to slightly higher fees.

Borrowing and lending rates have come down a few percentage points over the past few years, which is normal and expected when a P2P lending company proves its ability and grows in size.

Who chooses loans? You choose your own loans.

Early exit: You can exit early provided other lenders want to buy you out. You can't lower the price when selling loan parts to speed up a sale or increase the price to sell for an additional profit. You're charged 0.25% of the loan value when you sell.

Minimum you can lend: The minimum initial contribution is £2,500. The minimum you can lend in a single loan is £250 (or £25 when buying existing loan parts off other lenders).

Visit Invest & Fund* and see it in our comparison tables, where you can also read one of our specialists‘ Quick Expert Review on Invest & Fund.

Loanpad

Size, history and types of loans: just £223 million lent so far, exclusively on peer-to-peer property lending, specifically property development and bridging loans, since 2018.

Loanpad's 4thWay PLUS Rating:

Lender losses: No lender losses and no losses are likely.

Most similar to: BLEND Network and CrowdProperty, in that it just does senior bridging and development loans. “Senior” means no other lenders (such as banks) can get their money back before you do if the borrower is unable to repay, and the property needs to be repossessed and sold.

As with BLEND Network, CapitalRise, CrowdProperty and Kuflink, you can also spread your money across more than one bridging and development loan automatically.

Indeed, at Loanpad, your money is automatically spread across all live peer-to-peer property loans and redistributes on a daily basis. This is unique across all P2P property lending sites.

As with all the mentioned competitors, there's no reserve fund. It's similar to Proplend's tranche A loans in that the most you ever lend is half the property valuation.

Average loan-to-value: 40.3% as of August 2023 and 32.5% based on the hoped-for sale price of the completed development. (Those aren't mis-prints. The ratios really are that good.)

Other protections: None, but partner lending businesses lend in a separate loan to all the same borrowers. Their loan is about 33% of the size of the Loanpad loan. Their lending is in a junior position, so they will lose their money before you do.

Place in the queue: You're always first in the queue to recover your money if a loan goes bad, ahead of other lenders.

Transparency: Loanpad is one of the most transparent and accessible peer-to-peer property lending sites, providing 4thWay with all the information and data we ask for.

Interest rates: 5.5%-6.5% before losses, with zero or negligible expected losses. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: You can exit early provided other lenders want to buy you out and agree the price: you could sell your loan parts to them for more or less than you paid.

Minimum you can lend: £10

Visit Loanpad* and see more of it in our comparison tables, where you can also read one of our specialist's Reviews on Loanpad.

CapitalStackers

Size, history and types of loans: £41 million since it started in 2014. It offers P2P lending in property secured against residential or commercial developments.

CapitalStackers' 4thWay PLUS Rating: Unrated, due to the depth of its history being insufficient. However, CapitalStackers does have 2/3 4thWay ALT Ratings:

These are the Secured Property Loans and Hidden Gem Ratings. More here.

Lender losses: No losses at CapitalStackers* and none expected on outstanding loans.

Most similar to: Downing Crowd in terms of its mix of property loan types. CP Capital and Crowdstacker in that it does junior lending where banks or others lend a lot more money first that is due to be repaid before you in the event the debt turns bad. Proplend and Relendex in terms of stacked tranches that you can select for yourself:

Average loan-to-value: 64.90% is the average. When it comes to CapitalStackers' development lending, this is calculated using the hoped-for sale price rather than the starting price.

Average rents: No rent, as loans are developments.

Other protections: None, although the directors and close family do around 1/4 of the lending through the same online lending platform as everyone else.

Place in the queue: Usually second or third in the queue. Your tranche – your place in the “stack” generally tells you your place in the queue.

Transparency: CapitalStackers has provided huge amount of information about itself to 4thWay, and provides highly detailed data on a regular basis. It's one of the most transparent peer-to-peer property lending companies.

Interest rates: The average return has been 13.27%. The range of results has been 6.87%–30.60%, after losses. Last year, in 2023, this became available in an IFISA.

Who chooses loans? You choose your own loans and tranches.

Minimum you can lend: £2,500.

Early exit: You can exit early provided other lenders want to buy you out and agree the price: you could sell your loan parts to them for more or less than you paid. Indeed, you can make massive profits selling loans for more than you paid. (Read The Safest 20% Returns In P2P Lending.)

See more of CapitalStackers* in our comparison tables, where you can also read one of our specialist's Quick Expert Review on CapitalStackers.

Folk2Folk

Size, history and types of loans: £676 million to borrowers that can be any businesses with real property (real estate or land) to back the loans. Its peer-to-peer property lending also includes loans specifically about the properties itself, such as property developments and bridging loans.

Folk2Folk's 4thWay PLUS Rating: Unrated. Folk2Folk is not awarded a PLUS Rating because it does not provide enough information to assess the riskiness of its loans.

Lender losses: Folk2Folk lenders have suffered no losses. Typically around 1-2% of the outstanding loan book turns bad in a given year, but so far Folk2Folk has recovered all bad debts.

Most similar to: Like CrowdProperty, CapitalRise, Somo and Kuflink, it also does bridging and development lending, and you can choose your own loans. (Folk2Folk has no option to auto-lend.)

Average loan-to-value: No information. However, the maximum loan-to-value – at least on non-development loans, is usually 60%, which is excellent.

Other protections: None.

Place in the queue: First, except in exceptional circumstances.

Transparency: While Folk2Folk is now one of the largest investment opportunities focused on peer-to-peer lending in property in the UK, it provides too little information for us to fully assess the risks.

Interest rates: 6.5%, typically. Available in an IFISA.

Who chooses loans? You choose which loans to lend in.

Early exit: You can sell loans for the same price you paid, provided there are lenders who want to buy the loan parts from you. You're charged 0.5% of the loan value or £250, whichever is higher. You have to pay the first £250 of that just to list your loan on the secondary market, i.e. regardless of whether you successfully sell.

Minimum you can lend: £20,000 per loan!

Visit Folk2Folk. We currently do not have enough information to add Folk2Folk to our comparison tables.

Downing Crowd

Size, history and types of loans: £210 million in loans completed since 2016. Downing Crowd does peer-to-peer property lending to trading businesses, such as pubs and care homes, typically for renovation and expansion, and also for more substantial development. Some of the business borrowers are making an element of rent on the properties.

Aside from real-property loans, Downing Crowd also does loans on renewable energy projects.

Downing Crowd's 4thWay PLUS Rating: Unrated. Downing Crowd is not awarded a PLUS Rating because it does not provide enough information to assess the riskiness of its loans.

Lender losses: There have been no lender losses, although we have no information about how many loans are in trouble.

Most similar to: Downing Crowd is currently unique in that it's both related to another lending business with a good track record (Downing LLP), and it takes the lowest-risk loans from that other lending business to offer them to individual lenders on its P2P site.

It's quite similar to CapitalStackers, Folk2Folk and Relendex, in that they offer nearly all the same types of loans. It's also similar to Somo, in that it does bridging and development loans and you can choose your own loans, there's no option to auto-lend and there's no reserve fund.

Average loan-to-value: We have no recent figures, although the maximum is 75%. This is based on Downing Crowd's own valuation, not an independent one. Some of the properties are probably difficult to value.

Average rents: a lot of the businesses are renting out properties. We don't have the typical or average rents and expect that these loans can be more stretched than you find with typical, high-street commercial property, although, on average, any rent is better than none in property lending.

Other protections: None.

Place in the queue: Almost always first.

Transparency: Downing Crowd did initially give 4thWay a large amount of information about its results, as well as the results of its other lending business, but it has not provided any updates since. We don't know the scale of any late loans or loans that have gone bad and are currently in recovery.

Interest rates: Usually between 4% and 7% in loans before bad debts, with no more details provided. Available in an IFISA.

Who chooses loans? You choose which loans to lend in yourself.

Early exit: No.

Minimum you can lend: £100.

See more of Downing Crowd in our comparison tables, where you can also read one of our specialist's Quick Expert Review on Downing Crowd.

Relendex

Size, history and types of loans: £126 million exclusively on property peer-to-peer lending, specifically in residential buy-to-let, rented commercial properties and property development loans, since late 2013.

Relendex's 4thWay PLUS Rating: Unrated. Relendex doesn't provide enough information for a rating.

Lender losses: There have been some very minor confirmed losses for lenders.

Most similar to: It's similar to CapitalStackers and Downing Crowd for the variety of property loan types that it does. It's also similar to CapitalStackers and Relendex in terms of stacked tranches that you can select for yourself:

Average loan-to-value: the LTV on non-development loans is around 54.55%, which is fantastic. On development sites, the loan size compared to the initial property site valuation, or against the hoped-for future sale price, is unknown.

Average rents: No information supplied.

Other protections: None.

Place in the queue: You are usually first in the queue, sometimes second, and sometimes a mix.

Transparency: Relendex initially provided huge amount of information about itself to 4thWay, although it does not provide a detailed, monthly breakdown showing the history of all its loans, and has not updated us for many years.

Its web statistics and information for lenders has some use, but is not complete enough. Relendex is therefore substantially below average on transparency compared to other peer-to-peer property lending companies.

Interest rates: 7.36%, including an estimated deduction by 4thWay based on losses so far, but this estimate is very rough due to limited data. Available in an IFISA.

Who chooses loans? You choose which loans to lend in yourself.

Early exit: Yes, if you can find another lender to buy your loan parts for the same price you paid.

Minimum you can lend: £500.

Visit Relendex*.

Crowdstacker

Size, history and types of loans: Since 2021, Crowdstacker splits lending between property development lending and business loans that were backed by property. Prior to that, it wasn't offering the development lending.

It's completed about £4 million in development lending and about £66 million in business lending.

Crowdstacker's 4thWay PLUS Rating: Unrated. Crowdstacker doesn't provide sufficient information.

Lender losses: In its first five years it had a couple of years of absolutely horrendous overall results, and another of those years is still in the negative, pending any possible remaining recoveries. Since its development lending is so new, its record there is currently untested.

Most similar to: CP Capital and CapitalStackers in that it does junior development lending where banks or others lend a lot more money first that is due to be repaid before you in the event the debt turns bad.

Average loan-to-value: We don't have any figures.

Other protections: None.

Place in the queue: On projects I've seen, you and your fellow P2P lenders are not usually first in the queue to recover your money if a loan goes bad, the developer has other debts to pay, and the property has to be repossessed and sold. At least one other lender, such as a bank, takes priority.

Transparency: Crowdstacker has started to produce a little bit more information on its public website recently, but it's not sufficient. It doesn't engage with 4thWay to provide detailed data, information and interviews of key people.

Interest rates: The earnings for lenders after bad debts have varied from about -40% to +14%. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: No.

Minimum you can lend: Typically £100, but it varies with each loan.

Visit Crowdstacker.

BLEND Network

Size, history and types of loans: £63 million since 2017 in peer-to-peer property lending. Its focus is entirely on development loans and short-term (bridging) loans.

BLEND Network’s 4thWay PLUS Rating: Unrated. BLEND doesn't provide sufficient information to be rated.

Lender losses: There have been no confirmed lender losses so far.

Most similar to: CrowdProperty and Loanpad, in that it just does senior bridging and development loans. “Senior” means no other lenders (such as banks) can get their money back before you do if the borrower is unable to repay, and the property needs to be repossessed and sold.

As with CapitalRise, CrowdProperty, Kuflink, Invest & Fund and Somo – which all offer bridging and development only – you can choose your own loans. But, as with CapitalRise, CrowdProperty, Kuflink and Loanpad, you can also spread your money across more than one bridging and development loan automatically. As with all the mentioned competitors, there's no reserve fund.

Average loan-to-value: BLEND Network does very few bridging loans, but it allows up to 75% LTV. We have no up-to-date information on average LTVs, as we receive no data from it. The maximum it accepts is 75% of the expected development sale price.

Average rents: Not applicable.

Other protections: None.

Place in the queue: Always first.

Transparency: BLEND initially provided a lot amount of information about itself to 4thWay, but it's not kept up with regular data submissions.

Interest rates: Estimated 8.09% after allowing for potential losses in normal times of about 1% of loans.

Who chooses loans? You choose which loans to lend in or you can lend automatically.

Early exit: You can exit early provided other lenders want to buy you out and agree the price: you could sell your loan parts to them for more or less than you paid. The cost is 0.6% of the loan parts you sell.

Minimum you can lend: £1,000.

Visit BLEND Network and see it in our comparison tables, where you can also read one of our specialist's Quick Expert Review on BLEND Network.

Sourced Capital

Size, history and types of loans: Sourced Capital last updated its publicly available data on 19th March, 2024, showing total lent of £50 million since it started in 2019. It's the only UK-based P2P property lending company to focus exclusively on development lending with no bridging or other lending thrown in.

Sourced Capital's 4thWay PLUS Rating: Unrated. Sourced Capital is too new for a rating and doesn't provide sufficient information.

Lender losses: There have been no lender losses so far.

Most similar to: BLEND Network, CrowdProperty and Loanpad in that it just does senior loans. Sourced Capital is unique in that it exclusively does development loans. As with BLEND Network, CapitalRise, Kuflink, Invest & Fund and Somo (which all offer bridging and development) you can choose your own loans. As with all the mentioned competitors, there's no reserve fund.

Average loan-to-value: We don't have the latest figures on the average loan sizes. The maximum borrowers can borrow to begin with is 70% of the starting value of the property. The maximum borrowers can borrow altogether to complete the development is 70% of the hoped-for sale price.

Other protections: None.

Place in the queue: You're always first in the queue to recover your money if a loan goes bad, the developer has other debts to pay, and the property has to be repossessed and sold.

Transparency: Sourced Capital initially provided a lot of information to 4thWay, but has not updated us or provided a full breakdown of the performance of each loan. It has, however, kept its key people open to be interviewed by 4thWay's specialists.

Sourced Capital has improved its public information for prospective lenders recently, although not all questions are answered.

Interest rates: Sourced Capital typically pays lenders 10% to 12% before losses. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: No.

Minimum you can lend: £250

Visit Sourced Capital and see more of it in our comparison tables, where you can also read one of our specialist's Quick Expert Review on Sourced Capital.

easyMoney

Size, history and types of loans: we have no figures at all on how much money has been lent through easyMoney by ordinary lenders since it started offering development loans and short-term (bridging) loans in 2018. I guess its total peer-to-peer property lending through its website has reached seven or eight figures.

easyMoney’s 4thWay PLUS Rating: Unrated. easyMoney doesn't provide sufficient information for a rating.

Lender losses: There have been no confirmed lender losses so far.

Most similar to: It's like Kuflink, Invest & Fund and Somo, in that it exclusively does bridging and development lending in both senior loans or junior loans. As with Invest & Fund, lending is automated as standard with no reserve fund, while certain classes of lender can self-select loans. In easyMoney's case, that means professional investors.

easyMoney is unique (not in a good way) in that, when you auto-lend, you might initially have all your money lent into a single loan, although it tries to diversify you after that.

Average loan-to-value: The average LTV is just 58.10% on bridging loans, and 58.50% of the hoped-for sale price on development loans. However, we have no information about how this differs across each of easyMoney's lending accounts.

The maximum loan-to-value is 75% for non-development loans, which is the very most we would want to see. It has a maximum of 70% of the hoped-for sale value on development loans.

Average rents: Not applicable.

Other protections: None.

Place in the queue: First or later.

Transparency: easyMoney provides nothing like enough information either publicly or to 4thWay for lenders to assess the risks. For example (one example among dozens), easyMoney statistics have claimed no loans are late or are bad, while providing no information about how many loans have been extended, and for how long. That information is necessary to see if bad debts are being kicked down the road to cause problems later.

There's insufficient information to assess whether lenders for its various accounts are getting a good deal, i.e. a sensible, fair interest rate.

Interest rates: easyMoney is advertising 5.53% to 7.51% target lending rates. Available in an IFISA.

Who chooses loans? You lend automatically, although professional investors lending £1 million can choose their own loans. It's not clear whether, or how much, they can cherry pick the best loans.

Early exit: You can exit early provided other lenders want to buy you out. You'll receive less back if the latest interest rates are higher than the ones that you agreed to lend at, in order to compensate the new lender.

Minimum you can lend: £100.

Visit easyMoney. We currently do not have enough information to add easyMoney to our comparison tables and it has not gone through our lengthy assessment for listing.

JustUs

Size, history and types of loans: £32 million since 2013, the vast majority of which is peer-to-peer property lending.

JustUs does all sorts of loans, including personal loans, but its property loans include bridging loans and development loans. It has also done buy-to-let mortgages, but it seems that these are now very few and far between.

Unlike most P2P lending in property, you sometimes receive some of your actual loan money back in the monthly repayments (as opposed to getting your money back at the end).

JustUs' 4thWay PLUS Rating: Unrated. JustUs is not awarded a PLUS Rating because it has not provided enough information to be listed.

Lender losses: None on JustUs' property loans.

Most similar to: JustUs is like BLEND Network, CapitalRise, CrowdProperty, Kuflink and Loanpad, in that you can spread your money across more than one bridging and development loan automatically. But, as with BLEND Network, CapitalRise, CrowdProperty, Kuflink, Invest & Fund and Somo – which all offer bridging and development only – you can also choose your own loans. As with all the mentioned competitors, there's no reserve fund on its property lending (although there is one for your unsecured lending).

JustUs keeps probing and testing different ways to re-enter rental-property lending and even homeowner mortgages. We await developments.

JustUs has some auto-lending options. Those options enable a set up rather like BLEND Network, CrowdProperty and Loanpad, in that you can limit your property lending to senior bridging and development loans. “Senior” means no other lenders (such as banks) can get their money back before you do if the borrower is unable to repay, and the property needs to be repossessed and sold.

Average loan-to-value: Unknown, although most loans appear to be under 60%, we have seen one loan for nearly 90% LTV. Buy-to-let lending can be as much as 80%.

Other protections: None on property lending.

Place in the queue: First or second.

Transparency: JustUs provides 4thWay with insufficient information to assess its risks, so it's below average on transparency compared to other peer-to-peer property lending companies. Its own website information and statistics for its website users are sort of reasonable.

Interest rates: 8.17% after losses on all loans, not just property.

Who chooses loans? You choose your own loans or you can lend automatically.

Minimum you can lend: £10, or £100 initial contribution for the JustUs IFISA.

Early exit: You can exit early provided other lenders want to buy you out and agree the price: you could sell your loan parts to them for more or less than you paid. At present, this market to sell your loan parts is being redeveloped, so you need to get in touch with JustUs to try to sell your loans.

Visit JustUs. We currently do not have enough information to add JustUs to our comparison tables.

LandlordInvest

Size, history and types of loans: £18 million lent since 2017 in a combination of loans to residential property landlords and some short-term (bridging) loans against residential property.

LandlordInvest's 4thWay PLUS Rating: Unrated, due to insufficient information.

Lender losses: It's unclear whether there have been any lender losses. All we know is that at least one loan has turned bad, but it could be more. (Note that since lenders are allowed to sell their loans for a 20% discount, some lenders might have given themselves a loss by selling in a hurry for up to 20% less than they paid. That loss is down to the lenders' own actions and not the quality of the loans.)

Most similar to: Proplend in that the majority of loans are secured against property that is receiving rent.

Like CapitalRise, CrowdProperty, Downing Crowd, Folk2Folk, Invest & Fund, Kuflink and Somo, it also does bridging and development lending, and you can choose your own loans, with no reserve fund.

Average loan-to-value: 63.45%. The maximum LTV is around 80% for both buy-to-let loans and bridging. For the latter, this is on the high side.

Other protections: None.

Place in the queue: Lenders are first or second in the queue to recover money if a loan goes bad.

Transparency: LandlordInvest is highly transparent with lenders directly, but it doesn't update 4thWay.

Interest rates: averaging 10.46% after bad debts. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: You can exit early by selling to other lenders. You can sell for a discount of up to 20% if you want, e.g. if you need your money back quickly and discounting encourages other lenders to buy.

Minimum you can lend: £100.

Visit LandlordInvest and see it in our comparison tables, where you can also read one of our specialist's Quick Expert Review on LandlordInvest.

FutureBricks

Size, history and types of loans: FutureBricks had put £3 million (based on money actually lent through FutureBricks' online lending platform) through its online lending platform as of 11th February 2021, which is the latest point in time for which we have some limited data.

It first started lending in 2018. You lend to developers of residential properties or those converting buildings to residential use, as well as bridging loans.

FutureBricks lending is not regulated by the FCA or any other regulator. It's unknown to us whether FutureBricks is genuinely peer-to-peer property lending by 4thWay's definition.

FutureBricks 4thWay PLUS Rating: Unrated. FutureBricks doesn't provide sufficient information for a rating and likely doesn't have sufficient history.

Lender losses: We aren't aware of any lender losses, but we simply don't have enough information.

Most similar to: BLEND Network, CrowdProperty and Loanpad, in that it just does senior bridging and development loans. “Senior” means no other lenders (such as banks) can get their money back before you do if the borrower is unable to repay, and the property needs to be repossessed and sold.

As with BLEND Network, CapitalRise, Kuflink, Invest & Fund, Somo and Sourced Capital, you can choose your own loans. As with all the mentioned competitors, there's no reserve fund.

Average loan-to-value: We don't have a loan-to-value for developments. (The loan-to-value on bridging loans combined with the loan value against the hoped-for sale price of developments is 56.71%.)

The maximum is 80% loan-to-value on bridging loans and 80% of the hoped-for sale price on developments.

Other protections: None.

Place in the queue: You're first in the queue to recover your money if a loan goes bad, the developer has other debts to pay, and the property has to be repossessed and sold.

Transparency: FutureBricks hasn't gone through an intensive 4thWay assessment and doesn't provide us with data. Its website has some useful statistics for the public, but they can get more than two years out-of-date. It's not among the most transparent peer-to-peer property lending companies.

Interest rates: It's not possible to put faith in the statistics on lending rates on the website, as they conflict in a way that can't possibly make any sense. Nevertheless, lending rates appear to be somewhere in the region of 8%-10%.

Who chooses loans? You choose your own loans.

Early exit: No.

Minimum you can lend: £5,000 per loan.

Visit FutureBricks.

CP Capital

Size, history and types of loans: CP Capital started in 2022. We have no up-to-date figures on total amounts lent.

You're lending in junior loans to property developers that always sit behind a senior loan funded by CrowdProperty, another P2P lending company in its group.

CP Capitals' 4thWay PLUS Rating: Unrated, due to the depth of its history being insufficient and no data.

Lender losses: No losses, although it is brand new.

Most similar to: CapitalStackers in that it does junior lending where banks or others lend a lot more money first that is due to be repaid before you in the event the debt turns bad.

Average loan-to-value: It's too early to know what the average will look like, but generally speaking the most that you'll lend is 85%. The senior debt is typically going to be around 70%, so this is high-risk lending.

Other protections: None, but CrowdProperty directors will always lend an unspecified amount in each loan to show commitment and confidence.

Place in the queue: Usually second in the queue if a loan turns bad, with another lender taking first place in getting money back from recovered bad debt.

Transparency: CP Capital has no real history upon which to provide data yet. It's not yet been assessed by 4thWay or provided any data or access to key people to us. However, it's part of the CrowdProperty group, which is one of the most transparent P2P lending company's out there. It's probably just a matter of time before we get the information we need.

Interest rates: Unknown

Who chooses loans? You choose your own loans.

Minimum you can lend: £1,000 per loan. Available in an IFISA.

Early exit: You can't exit early. You wait until the borrowers repay naturally.

Visit CP Capital.

CARLTON Bonds (formerly MAVEN)

Size, history and types of loans: CARLTON Bonds started in 2019, but it doesn't provide any information to 4thWay or the public on how much lending has gone through it.

When you lend through CARLTON Bonds, you lend to property developers to develop properties for sale. The properties could be residential or commercial.

It's not certain at this stage whether CARLTON Bonds is genuinely peer-to-peer property lending, due to lack of information.

Restrictions: Only for a) investors earning £100,000 or with £250,000 in assets (excluding own home), or b) for professional investors, or c) investors who have recently invested in one unlisted company (e.g. through crowdfunding websites). A few others can invest too, e.g. if you've been the director of a company with revenue of £1 million or more in the past two years.

CARLTON Bonds' 4thWay PLUS Rating: Unrated. CARLTON Bonds doesn't provide sufficient information for a rating and might not have sufficient history.

Lender losses: We aren't aware of any lender losses, but we simply don't have enough information.

Most similar to: Kuflink, in that it mostly does senior loans. As with BLEND Network, CapitalRise, Kuflink, Invest & Fund, Somo and Sourced Capital (which all offer bridging and development) you can choose your own loans. As with all the mentioned competitors, there's no reserve fund. CapitalRise, in that who is allowed to invest is quite limited.

Average loan-to-value: We don't have any figures.

Other protections: None.

Place in the queue: You're usually first in the queue to recover your money if a loan goes bad, the developer has other debts to pay, and the property has to be repossessed and sold.

Transparency: CARLTON Bonds hasn't gone through an intensive 4thWay assessment and doesn't provide us with data. CARLTON Bonds' website doesn't contain any useful data for the public.

Interest rates: 5.25%-9.25% before losses. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: No.

Minimum you can lend: £1,000 per loan.

Visit CARLTON Bonds.

Simple Crowdfunding

Size, history and types of loans: Simple Crowdfunding has historically offered other investments rather than lending through its website. Up to around 2022, it had completed over £10 million in non-lending projects. However, as of January 2024 it has also now funded over £2 million in P2P loans that were mostly for property development. It will consider lending against any type of property.

Simple Crowdfunding's 4thWay PLUS Rating: Unrated. Simple Crowdfunding is too new for a rating and doesn't provide sufficient information.

Lender losses: We aren't aware of any lender losses yet, but we have no data.

Most similar to: BLEND Network, CrowdProperty and Loanpad in that it just does senior loans. Sourced Capital is unique in that it exclusively does development loans. As with BLEND Network, CapitalRise, Kuflink, Invest & Fund and Somo (which all offer bridging and development) you can choose your own loans. As with all the mentioned competitors, there's no reserve fund.

Average loan-to-value: We don't have any figures.

Other protections: None.

Place in the queue: Unusually, not all loans appear to be secured against the properties. Where you do benefit from secured lending, I've only seen projects so far where you're first in the queue to recover your money if a loan goes bad, the developer has other debts to pay, and the property has to be repossessed and sold.

Transparency: Simple Crowdfunding currently provides 4thWay with no access or data and the information on the public section of its website is extremely thin. It's one of the least transparent peer-to-peer property lending companies.

Interest rates: Most interest rates appear to be in the 8% to 10% range, before losses. Available in an IFISA.

Who chooses loans? You choose your own loans.

Early exit: No.

Minimum you can lend: £250

Visit Simple Crowdfunding.

Crowdestates

Don't get confused! This Mayfair-based business is not to be confused with the Estonia-based Crowdestate (with no “s”).

Size, history and types of loans: Crowdestates, Mayfair, was apparently founded in 2014, although we don't know when its first loan was approved. It provides so little information to lenders or 4thWay that there's no point covering it here.

Removed from the list

Assetz Capital is winding down its P2P operations starting in December 2022, because it's shifted how it raises funds for loans to a new model.

crowdahouse closed down, relaunched and apparently closed down again. It now accepts lending again, but only if the lender is a business, not an individual. Last we checked (November 2021), Crowdahouse did not have a secure website, include at the point of logging in. This is extremely concerning.

CrowdLords is winding down gently, giving the tighter regulations as the reason.

fruitful soft-closed its doors to P2P lending in autumn 2015 to shift to more ordinary, non-P2P mortgage lending, so the company was removed from this list. As of end November 2015, lenders had already received 75%-85% of their money back and were still earning interest on the remainder.

Funding Circle announced in April 2017 that it will no longer be doing peer-to-peer property lending. (It later then closed all its P2P operations to focus on funding small business loans another way in March 2022.)

FundingKnight has not offered new loans for a long time.

FundingSecure is a peer-to-peer property lending company that went into administration in October 2019.

houseFundr was due to open in 2015, but never did. It was going to focus on property development loans in London.

Landbay stopped doing peer-to-peer property lending on 5th December 2019. It now only allows financial institutions to fund loans through it.

LendInvest has stopped allowing small individual lenders to lend through it, and there was always a question mark anyway about whether it was truly “P2P” lending.

Lendy has gone out of business.

MoneyThing closed and went into an orderly wind down in December 2019. (In December 2020, due to borrower litigation, MoneyThing could not afford to continue as it was, and it went into administration.)

Octopus Choice permanently stopped doing property peer-to-peer lending in February 2021 and is winding down gently.

PropertyCrowd stopped doing P2P lending during the COVID-19 outbreak and is no longer available to individual lenders.

RateSetter, which mostly did personal loans but did a lot of property peer-to-peer lending too, has been sold to Metro Bank and its operations will now be taken over for bank lending instead of P2P lending.

The House Crowd went into administration in February 2021.

ThinCats stopped doing peer-to-peer property lending in December 2019. It now only allows financial institutions to fund loans through it.

Wellesley & Co. stopped offering peer-to-peer lending in property in the UK three years after it offered its first P2P loan. (Some years after that, it went bust.)

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Assetz Exchange, CapitalRise, CapitalStackers, HNW Lending, Invest & Fund, Kuflink, Loanpad and Proplend, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.