To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

CapitalStackers: High Property Returns With Lower Risk

I interviewed CapitalStackers‘* Steve Robson, Director, who filled me in on some interesting aspects about the property P2P lending website.

Firstly, I should note that CapitalStackers' minimum lending amount is £5,000. The service is generally only available to people classed as sophisticated investors or high-net worth, or those who self-certify that you understand development and rental property lending.

Types of deals on CapitalStackers

CapitalStackers is new, so there have been just a handful of projects so far with one fully paid off, but you can already choose to be notified of any particular types of projects that would interest you from a long list.

You can choose either loans to property developers or to property owners getting a rental income from their residential or commercial properties.

You can then drill down by sector (e.g. residential, office, shops, hotels…), region of the UK, and more.

Some – but certainly not all – of the deals are complicated, which is why you're expected to know what you're doing.

Steve said that development loans sometimes lead into loans on income-producing properties once the development has finished so lenders through CapitalStackers can sometimes expect to lend to a developer and then be offered to keep lending when a development is complete and getting rental customers.

Moving up the risk ladder

Steve went on to explain some interesting aspects about what individual lenders are funding and how the interest rates are attractive.

At CapitalStackers, unlike most other property P2P lending websites, you are usually a junior lender. This means that other lenders have priority if the borrower can't repay. The property would likely be repossessed and sold, with earlier lenders (“senior lenders”) getting repaid first:

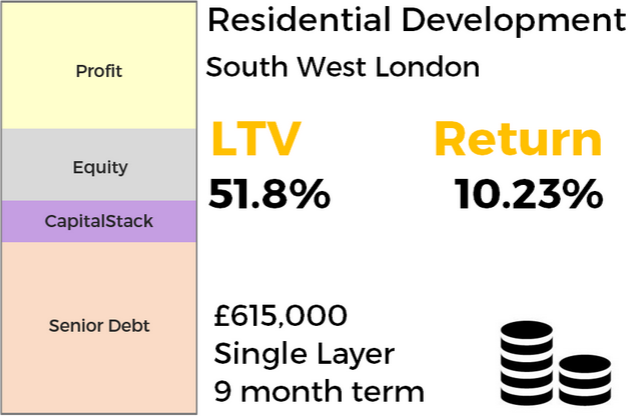

Example of where junior debt fits

In the above example, you see that CapitalStackers lenders come above the senior lenders in the stack, which means they come after them – the risks are higher.

(And, above CapitalStackers lenders, the borrower is even more junior in the event of a default. The borrower's share is the “equity”, which is the borrower's deposit, and the “profit”, which is the amount of money the borrower is expected to make on selling this development deal.)

Even though you as an individual lender come second, the “LTV” (see sidebox, right) is still less than 52% of the final estimated value of the development.

an individual lender come second, the “LTV” (see sidebox, right) is still less than 52% of the final estimated value of the development.

This means that so long as the property can be repossessed and sold for somewhat over half its valuation, plus a bit more for admin, legal and other expenses, individuals lending in this loan through CapitalStackers can expect to get their money back.

Sometimes CapitalStackers splits loans into several layers. Those investing in a higher layer get a higher interest rate to reflect the higher risks.

CapitalStackers will theoretically go up to 80%, but the LTV varies widely depending on the deal.

Investing at higher rates without higher risk

What's interesting about this kind of property lending is that the LTVs have in recent years got very low for junior debt, meaning the risks have come down, but the interest rates have not really come down to match the lower risks.

Steve explained that since the financial crisis, banks no longer lend at higher LTVs due to a tighter regime. He also believes that new managers appointed after the crisis are not sympathetic to real estate, since it's perceived to be behind the problem.

Plus, banks are now required to keep more in reserve, which means less lending – in particular, less higher up the stack.

As a result, senior debt LTVs have shrunk from 75% to around 50%. Junior debt LTVs have also come down from a typical 85%-90% to a maximum of about 75%.

This means your risks have come down dramatically.

The really exciting bit is that interest rates have not come down to match the lower risks. In the above example, you can see that you can still earn above 10% interest.

Steve sees CapitalStackers' interest rates as stable, rather than a temporary result of being a new service. New P2P lending companies often start with higher rates, since cautious lenders demand more interest to compensate for the additional uncertainty.

CapitalStackers' expected losses

CapitalStackers is not doing forecasts on lenders' expected returns or losses – at least not yet – because the P2P lending website is still pretty new.

However, Steve did write to us that “We do not anticipate losses” and that “Our lending is secured on real estate at conservative risk ratios with experienced borrowers.”

Steve added: “We do expect borrowers to encounter certain problems from time to time (such as the loss of a tenant resulting in a temporary interest cover shortfall on an investment loan, or a cost/time overrun on a development). Hence the need for close monitoring. However, the safety margins for such eventualities are considered in the due diligence and built into the deal which is why we are confident [about] loan performance.”

Dual auction process

CapitalStackers can run bidding processes as first-come, first served, with a fixed rate of interest.

It can also run them as reverse auctions, whereby the individual lenders bidding the lowest interest rates are able to take part in the loan at the rates they bid.

It is also able to offer both bidding methods alongside each other.

If you're outbid, you'll get an email informing you, so you have a chance to bid lower. If you bid lower than the fixed rate on offer, you'll get a warning to remind you that you might as well just take the fixed rate.

When a loan goes bad

Imagine if it gets to the stage where serious debt recovery procedures need to be put in place.

CapitalStackers will inform all the individual lenders of the options and then it'll be up to the lenders to decide how to go about debt recovery.

The vote is weighted in favour of those lenders higher up the stack. The rationality is that those higher up are more likely to get hurt, so they get a bigger say. Higher layers are generally thinner, which will also impact voting power.

I'm sure you have even more questions than answers after this short article. You can see CapitalStackers' full details are now in the 4thWay® comparison tables. Plus, Steve had a whole lot more to say about such things as making a profit when you sell loans back to other lenders. I'll write that up in another piece next week.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from CapitalStackers and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.